By Jon Hartley, April 19, 2023

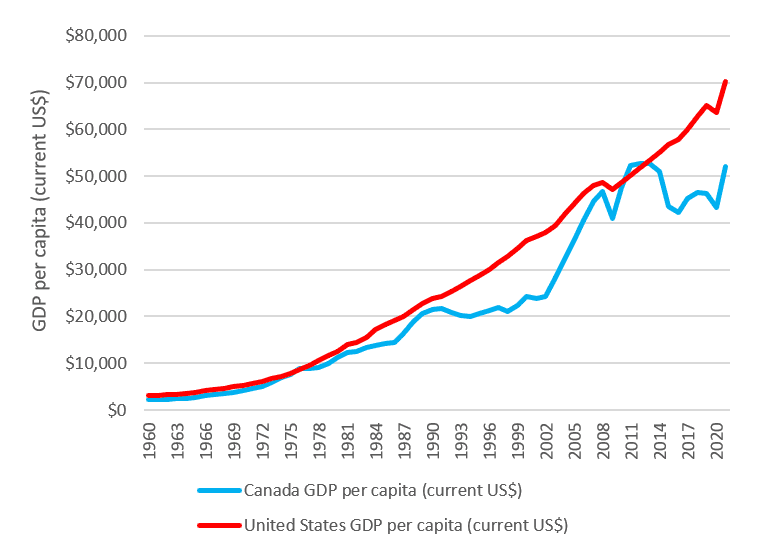

Slowing global economic growth has become one of the most important economic issues in the early 21st century. GDP per capita in advanced economies, amidst slowing productivity growth, has been growing at a much slower clip compared to growth rates in the 20th century. What’s worse: Canada and many Western European countries have been laggards with little to no GDP per capita growth over the past 10 years since the global financial crisis. Now, as of 2021, GDP per capital level in Canada (around US$50,000) is about 40 percent lower of what it is in the US (around US$70,000) (Figure 1).

Figure 1: Canada and U.S. GDP per capita (current US$)

What’s causing this slowdown in growth is not crystal clear, but there are several obvious barriers to Canadian growth, such as the federal government hindering Canada’s energy industry, zoning and land use regulations that don’t allow for the growth of new and affordable housing supply, occupational licensing that prevents skilled people from doing what they are trained to do, and an increasingly heavy tax burden on Canadians.

Reversing some of these areas where government is hindering economic activity could be the starting point for a new Canadian pro-growth policy plan.

Unshackling the Canadian energy industry

Killing or stalling oil and gas projects over the past decade has been a major factor in stalled Canadian energy production and, by harming one of Canada’s most important industries, this has posed a major hindrance to Canadian economic growth.

Canada already has a carbon price of $65 per tonne, which is only set to increase in future years. Indeed, Canadian carbon emissions have also started to plateau like many countries in the advanced economic world. Members of the global community looking for carbon emission reductions should look to China and India, which have become global leaders in carbon emissions.

Several pipelines have been stalled or cancelled since the Trudeau government took power. The Keystone XL pipeline was held up numerous times by Ottawa only to be cancelled by US President Joe Biden. There were over a dozen proposed liquefied natural gas (LNG) pipeline projects at the end of the Harper government in 2015 and none have since been built thanks to very lengthy environmental review processes and outright political opposition. Ironically, LNG is a much more environmentally-friendly energy solution compared to coal or other energy sources. Further enabling the expansion of natural gas would help further reduce carbon emissions.

Shackling the Canadian energy industry has been an overkill form of environmental policy, and allowing the construction of new pipelines would be a key first step to restoring Canadian economic growth.

Relaxing zoning and land use regulations in Canada

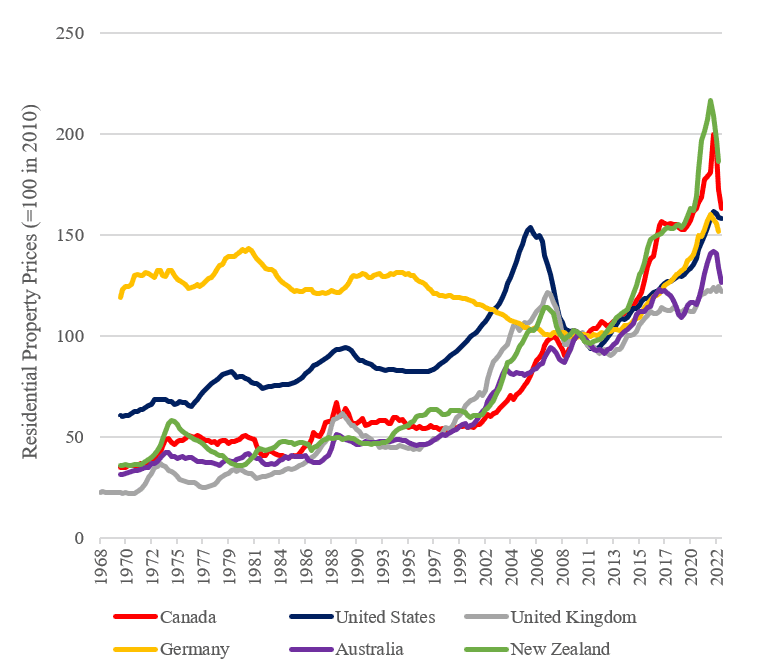

In recent decades, many Canadians have found it increasingly expensive to relocate to the most productive hubs in Canada like Toronto and Vancouver, where job openings abound but housing remains costly. Canada has experienced some of the fastest growing residential real estate prices among advanced economies (Figure 2). This is in large part because zoning and land use regulations prevent the new construction of housing supply in response to increased housing demand.

This doesn’t mean being against the preservation of historic buildings, which are essential to cultural preservation. What it does mean is being serious about increasing housing density in urban and suburban areas. Many single-family housing developments become zoned to the point where it becomes impossible to develop new multi-family housing as is the case in most metro suburban areas.

Figure 2: Residential real estate prices in the western world

Furthermore, well-intentioned environmental concerns are often at odds with pro-housing growth such as protected Greenbelt lands that surround urban areas and prevent further urban sprawl. Beyond Canada, environmental legislation like California Environmental Quality Act (CEQA) in 2022 had statutes that famously forced Berkeley to significantly reduce its incoming class sizes (the California state legislature ultimately amended CEQA to ultimately avoid cutting class sizes).

There has been some recent progress in relaxing zoning and land use regulation within Canada. The Ontario government’s recently passed More Homes Built Faster Act, “pro-sprawl” legislation that opens some previously protected Greenbelt land for housing construction, reduces development charges collected by municipalities and limits the ability of provincial conservation authorities to block or stall new housing projects, which are all necessary steps toward addressing the shortage of housing in the province. Ontario Municipal Affairs and Housing Minister Steve Clark has also announced new rules to allow municipalities to allot new land for housing as they choose, which has the potential to spur increased suburban development. Many other provinces can and should follow these trends to promote affordable housing development and economic growth.

Relaxing the occupational licensing burden in Canada

While occupational licensing can create consumer benefits by establishing minimum quality standards in what would otherwise be a world with imperfect information about the quality of professionals, it also can constrain economic growth by creating barriers to entry and restricting competition. In doing so, licensing limits the supply of workers in various fields, causing higher wages and prices for consumers.

Canadian licensing requirements are so stringent that they often prevent immigrants with skilled foreign training from performing the same labour tasks in Canada, limiting the economic potential of such individuals. Furthermore, licensing requirements vary from province to province, which often makes it taxing on professionals who move by requiring them to obtain a new license from their new destination province.

Occupational licensing has grown tremendously in both the US and Canada over the past century and in many respects has replaced unions as the largest labour institution by counting the sheer number of licensed workers versus the number of union members. This makes such barriers all the more taxing on economic growth.

In addition, occupational licensing regulations can often be haphazard and capricious, making it even more pernicious. For example, the College of Psychologists of Ontario, the body which regulates psychology licenses in Ontario, threatened to pull Canadian psychologists Jordan Peterson’s practising psychology license unless he completed social media re-education for comments he made both on Twitter and the Joe Rogan podcast.

There is a broad consensus across political party lines on the need for occupational licensing reform. There are generally three types of occupational licensing reform that need to be achieved.

First, occupational licensing needs to be relaxed across certain disciplines where stringent licensing is unnecessary (i.e., making licensing less burdensome in occupations like hair stylists, braiders, nail-technicians).

Second, licensing needs to be relaxed for foreign-trained professionals particularly when it comes to medical fields like doctors and nurses. The Ontario government has recently directed the colleges of nurses and physicians to streamline entrance requirements for foreign-trained professionals.

Third, there should be reciprocity of recognizing licenses across Canadian provinces, as licenses are regulated at the provincial level in Canada and provinces currently do not recognize licenses in other provinces. Having to unnecessarily repeat licensing exams, lengthy application processes, and pay high fees when moving to a new province that prevents someone from beginning a new job represent a huge economic cost. Some major initiatives include reforming the national medical licensing system to adopt national competency tests that would allow doctors and nurses to more easily work across provinces.

In the US, where licenses are similarly governed at the state level, over a dozen states have now adopted universal reciprocity. Hopefully Canada will follow suit in the near future with adopting universal reciprocity of licenses across provinces. Even cross US-Canada border license recognition would be a welcome step. The Nova Scotia provincial government recently announced it will accept US board certifications for doctors.

Reducing the Canadian tax burden

In recent decades, the tax burden on the average Canadian has increased dramatically. The top federal marginal tax rate of 33 percent occurs only at $221,708, a fraction of where the top federal marginal tax rate of 37 percent begins in the US at around US$539,900 ($723,466 in Canadian dollars). Then layer on heavy provincial income taxes.

For Canadians living in Ontario, any income earned over $221,708 is taxed at a rate of 53.53 percent tax. Then add VAT taxes (HST in Ontario is 13 percent while GST in Alberta and British Columbia is 5 percent), which are regressive in nature. To say the least, Canadians are heavily taxed.

Such high taxation creates serious incentives to migrate to lower tax jurisdictions like the United States and to some degree reduces one’s willingness to work.

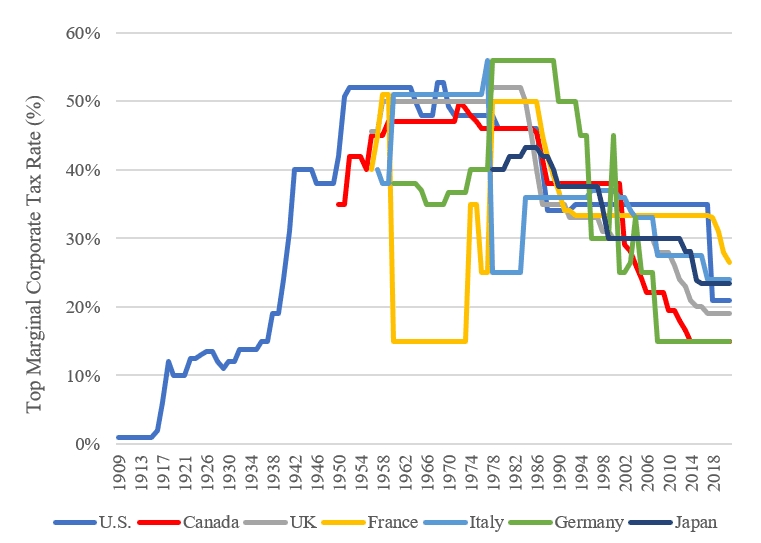

Comparatively, Canada has done much with lower corporate taxes in the past, but as other countries slash corporate tax rates rapidly, Canada becomes less competitive once again (Figure 3). Canada would be wise to remain competitive by continuing to reduce its corporate tax rate, and corporate taxes remain some of the least efficient ways of raising government revenue as corporations are highly mobile and can avoid taxes easily.

Figure 3: Top marginal corporate income tax rates (federal)

Despite significant immigration that ameliorates slowing population growth, without increased productivity and per capita economic growth, growth in the tax base will not be able to keep up with the growth in spending.

Canada’s federal debt grew enormously during the COVID-19 crisis, and it is now saddled with general gross debt levels around 100 percent (which includes federal, provincial and government debt) rivalling that of the 1990s.[1]

Economists Alberto Alesina, Carlo Favero, and Francesco Giavazzi find empirical evidence for the fiscal multipliers associated with tax changes to be larger than those associated with government spending. If true, it is possible that taxes could be reduced along with government spending dollar-for-dollar with enhanced economic growth.

A reduced tax burden with careful reductions in the growth of government spending (unlike the Trudeau government 2023 budget which is increasing government spending amid inflationary times) could be an important part of reigniting Canada’s economic growth.

Conclusion

This year marks the 300th birthday of Adam Smith, who taught us much about free market mechanisms, including the roles of competition, supply and demand, and limited government. These lessons can and should act as a starting point for the hard work that needs to be done to reignite Canada’s economic growth.

From allowing the Canadian energy industry to thrive, relaxing zoning and land use regulation barriers, relaxing occupational licensing, and applying traditional pro-growth policy strategies through lower taxation, these are some of the ideas that can underpin what needs to be a larger plan for restarting Canada’s economic growth engine.

We desperately need a new royal commission like the Macdonald Commission of the 1980s, which was created by then Prime Minister Pierre Trudeau in 1982 to address the economic growth concerns of that time. Ultimately the commission’s findings were presented to Prime Minister Brian Mulroney in 1984, which recommended a North American free trade agreement and significant reforms to the Canadian welfare system.

Today, the challenges and barriers to growth are different and so will its solutions. It’s clear we need a new Macdonald Commission to chart a plan for revived Canadian economic growth. Let the work begin.

Jon Hartley is a PhD student in economics at Stanford University and a research fellow at the Foundation for Research on Equal Opportunity.

[1] Note gross debt does not include net assets from CPP and QPP (net debt measures that the government often cites do include CPP and QPP net assets but do not include corresponding future pension obligations/liabilities associated with the assets).