By Aaron Wudrick and Jon Hartley, April 18, 2024

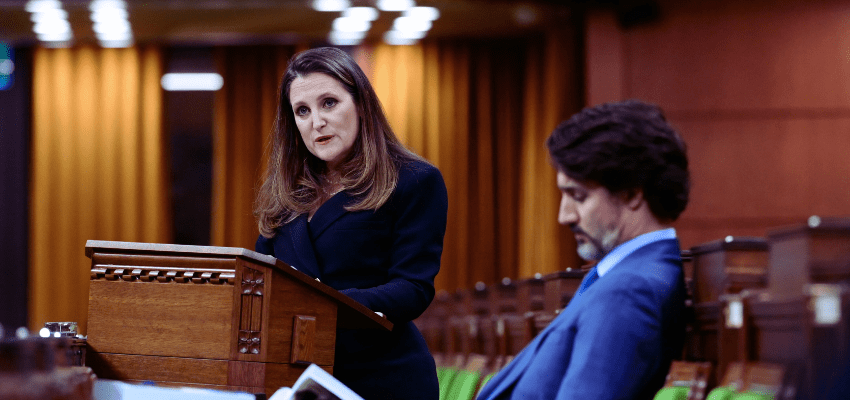

On Tuesday, Finance Minister Chrystia Freeland released the Trudeau government’s eighth federal budget – and once again Canadians were treated to a veritable spending spree. Indeed, endless deficits and debt have become fiscal hallmarks for a government that seems constitutionally incapable of spending restraint. What is even worse is the way this government undermines its efforts to spur innovation and economic growth, the possibility that higher taxes might do more harm than good is apparently lost on Minister Freeland.

The evidence for this is that this year, Freeland added an additional economic poke-in-the-eye, by raising the capital gains inclusion rate from 50% to 66%. The government and its defenders insist this is a simple matter of asking the richest to pay more, noting these measures will only affect “the top 0.13%” to pay for urgent new spending (since the possibility of simply reprioritizing spending from within the existing fiscal framework never seems to occur to our government.)

You can certainly argue it’s shrewd politics; you’ll find few politicians or pundits who are itching to stand up and defend the rich. But as policy, it’s a pretty clear own goal; the vilified 0.13% in question includes a lot of the same people that this government insists it is keen to incentivize to start, invest and build businesses in Canada. Hitting them with a tax hike while using them as a political punching bag is probably a bad idea.

And they’ve taken notice. As just one example Tobi Lutke, CEO of Shopify – possibly Canada’s most revered tech unicorn – reacted to the budget by tweeting “Message from a friend: Canada has heard rumors about innovation and is determined it will leave no stone unturned in deterring it.” Ouch.

Making Canada a less attractive place to do business and innovate is also a strange way to address Canada’s widely acknowledged productivity deficit – a problem so serious that earlier this month, Bank of Canada Deputy Governor Carolyn Rodgers referred to Canada’s weak productivity and GDP growth as an ’emergency’.

She’s right. Canadian GDP per capita has been nearly flat for the past ten years since the Trudeau government took office so much so that in 2022 per capita GDP in Canada has fallen to just 70 percent of the American figure. The latest Spring 2024 IMF World Economic Outlook projections suggest the trend is likely to continue: Canada put out a real GDP growth number of 1.1% in 2023, compared to 2.5% in the U.S, and the IMF projects an anemic 1.2% growth for Canada in 2024 compared to 2.7% in the U.S.

The Trudeau government will point to measures such as investment tax credits for electric vehicles and accelerated capital cost allowance for innovation and productivity-enhancing assets as positive moves. But it’s hard to see how these can attract individuals and companies when the big picture is so bleak: overall tax rates and housing prices are astronomically high – even higher than in California, which has gained a reputation for being among the most expensive places in America to live and do business. Importantly, the most punitive tax rates – including marginal tax rates which surpass 50% in most provinces – kick in at just under $250,000, whereas in the US, the highest federal rate only begins to apply on income over $820,000.

Escaping Canada’s economic tailspin requires a federal government that has a clear-eyed view of these challenges, and the political spine to pare back a bloated bureaucracy, focus on core government responsibilities, and take a buzzsaw to the thicket of suffocating and distortionary taxes, subsidies and regulations that are smothering Canadian entrepreneurs and businesses. The Trudeau government has demonstrated time and again that it either does not understand or is incapable of doing so, and in many cases is actively making all of these challenges worse.

There was once a time when the Liberal Party of Canada could credibly claim strong fiscal and economic stewardship of the country, based on a strong track record of wrestling down the deficit and keeping a lid on spending.

Today’s Liberal Party is effectively the polar opposite – and Canadians are suffering the consequences.

Aaron Wudrick is the domestic policy director at the Macdonald-Laurier Institute.

Jon Hartley is a senior fellow at the Macdonald-Laurier Institute and a research fellow at the Foundation For Research on Equal Opportunity.