By Jerome Gessaroli, November 29, 2023

Teck Resources recently announced the sale of its Elk Valley Resources metallurgical coal operations valued at US $9 billion, completing the company’s transition to a base metals and critical minerals producer. Two fundamental questions arise from Teck’s sale. Was this deal the best for Teck and its shareholders? And did the deal advance international decarbonization efforts? While a cursory review of the fossil fuel sector and Teck’s overall strategy suggests the answer to both questions is “yes”, the reality is more complex when considering the current environmental narrative and the real-life dynamics within the global economy.

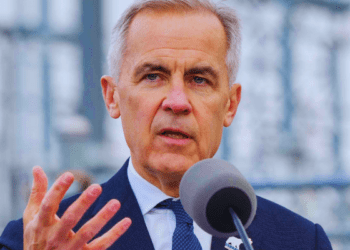

The need to reduce greenhouse gas emissions and mitigate climate changes have resulted in initiatives from the financial sector to reduce their investments in high emitting sectors. The movement towards prioritizing ESG (Environment, Social and Governance) metrics in investing has had material effects on the availability of funding for emissions-intense sectors such as oil & gas, coal, steel, cement and others. Efforts such as the Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of leading financial institutions committed to accelerating the decarbonization of the economy chaired by Michael R. Bloomberg and Mark Carney, exemplifies this trend.

While Teck’s metallurgical coal is separate from the thermal coal used in power generation, coal is still very carbon intense and has been shunned by investors, alongside fossil fuels in general. The International Energy Agency (IEA) forecasts a decline in the demand for fossil fuels expected before 2030. CEO Fatih Birol goes further, saying that, “fossil fuel projects not only carry major climate risks, but also business and financial risks for the companies and their investors.” Various non-government organizations (NGOs), including the Sierra Club and Carbon Tracker, likewise caution against investing in non-renewable energy companies because of various risks these companies may encounter. This constant messaging, coupled with pressure from institutional investors such as Blackrock, Vanguard and State Street to develop decarbonization plans, makes corporate strategy and planning much more complicated for resource extraction companies.

Unfortunately, the decarbonization goals set by the UN Climate Convention and reflected in IEA and NGO forecasts do not align with the current and projected demand for oil, gas and coal. Producers must navigate this competing pressure while operating in an environment where objective forecasted demand differs from desired demand based on UN climate agreement goals. Major energy companies, such as Suncor and BP, had previously announced corporate strategies to transition from coal, oil and gas extraction to cleaner energy initiatives.

For example, Suncor was relatively early in diversifying its energy portfolio through investments in solar and wind farms. In 2020, BP announced its transition from an international oil company to an integrated energy company – shifting capital expenditures over time from fossil fuel development to low-carbon energy alternatives. In step with these industry leaders, Teck Resources made several strategic decisions hedging against fossil fuels; the first, in 2020, to not move forward with its $20 billion Frontier oilsands project. In 2022, Teck announced a $1 billion sale of its ownership position in the Fort Hills oilsands project. Both decisions were consistent with the company’s stated move to concentrate on its metals business.

More recently, however, both Suncor and BP have slowed down their carbon transition plans. Suncor sold its solar and wind facilities in 2022 and, more recently, its CEO stated that there has been a “disproportionate emphasis on the longer-term energy transition,” adding that company intended to return to “creating value through [its] large integrated asset base underpinned by oilsands.” Similarly, BP scaled back its 2030 carbon emissions target in order to satisfy market demand for oil and gas.

Teck, however, has stuck with its transition strategy. On November 14, the company announced the sale of its coal operations, valued at US $9 billion, to Swiss conglomerate Glencore plc. This sale completes Teck’s transition away from high-carbon emitting commodities. The company’s leadership has indicated they will use part of the proceeds to grow Teck’s copper production, strengthen its balance sheet, and distribute remaining funds to shareholders.

Teck’s stated reasons for selling its steel-making coal assets look logical at first glance. The company believes that many investors are wary of buying Teck’s stock because of its coal mining operations, resulting in its stock trading at a lower value than it would otherwise. By selling these assets, Teck can invest in producing larger quantities of investor-friendly critical minerals – which are considered essential for building a low-carbon economy. Its focus would be on copper production, which is listed as a critical mineral, as well as zinc. Investors who shied away from Teck due to its coal mining would, by this logic, now be willing to buy its shares, potentially leading to a higher valuation.

Teck’s strategy also makes conventional businesses sense. The company’s balance sheet is viewed by analysts as more leveraged than it should be. The company accordingly intends to use some of the proceeds from the sale pay down some debt, helping to improve its overall value. Teck could also distribute some of the funds to investors through share buybacks or a special distribution. Finally, some of the money could also be used to invest in their metals business, specifically their multibillion-dollar Chilean Quebrada Blanca 2 copper project.

Assuming efficient markets (given Teck’s size, that assumption is a reasonably safe one to make), upon the announcement of the sale of Teck’s coal assets, investors quickly incorporated the financial implications, including all the above information, into the company’s share price. Those who thought the deal was good for Teck would either hold or buy shares, while those who disagreed with this assessment would sell their shares.

Assuming Teck’s transition into a critical minerals producer is indeed the correct course of action, its stock price should have risen on the day of or day after the announcement. However, comparing Teck’s closing price of $36.45 on November 13, the day before the announcement, to its November 14, closing price of $36.63, the stock barely moved. On the second day after the announcement, November 15, the stock closed at $35.60, down $0.85 or 2.3%. Investors did not see greater value in the totality of Teck’s corporate strategy – the sale of its coal assets, adopting a better capital structure, returning money to shareholders, and investing in its metals business. The stock may have declined even further if the company had not stated its intention to distribute some proceeds to shareholders and toward paying down its debt, measures investors often reward companies undertaking.

Glencore’s stock, on the other hand, closed up 4.5% on the London Stock Exchange on the day of the announcement. Investors across the pond expressed approval for the acquisition of coal assets, challenging arguments about stranded assets.

What insights can be gleaned from this transaction? Markets objectively value assets by considering all available information, positive and negative. This assessment is used to estimate the asset’s expected future cash flows. Markets are not distracted by the rhetoric or noise from governments or NGOs, suggesting that fossil fuels will have little value due to the growth in renewable energy and government commitments to decarbonize their economies. Contrary to claims of “short-termism,” the $9 billion price assigned to the coal assets reflects the present value of cash flows and the assets that are expected to accrue, not just in one or two years but, also over the longer term.

Company executives need to be objective regarding the future of their businesses and the potential adjustments they will have to make with decarbonization on the horizon. However, news reporting may often reflect the desires or expectations of governments or NGOs, rather than the harsh reality of current or expected events. This poses a more challenging environment for C-suite executives to navigate.

Was the asset sale in Teck’s best interest? It is hard to say. Although Teck divested itself of its remaining fossil fuel business, the deal itself did little to decarbonize the economy; the same coal production as before continues, just under different ownership. But based on Teck’s stock price movement after the announcement, the market appears ambivalent to mildly negative on the deal.

Boards and CEOs often face conflicting information that pulls them in different directions. The alignment of corporate decision-making with decarbonizing the economy is more likely when government commitments to reduce carbon emissions are realistic and credible. The energy forecasts published by NGOs must also accurately reflect real economic activity rather than mere pledges; that is, if such NGOs wish to be taken seriously. In essence, alignment occurs when, as the saying goes, governments not only talk the talk, but also walk the walk.

Jerome Gessaroli is a senior fellow at the Macdonald-Laurier Institute and leads The Sound Economic Policy Project at the British Columbia Institute of Technology.