By Adam Pankratz and Jack Middleton

May 13, 2024

Dear Canadians, our long national nightmare is over. The Transmountain Pipeline Expansion (TMX) is now in operation (The Energy Year 2024).

The TMX saga began over a decade ago and has become a polarizing force in federal, provincial, and municipal politics. From protests, government acquisition, to playing a major part in rebuilding the Coquihalla Highway (Palmer 2021), the project has become a divisive national symbol.

It comes into operation at an important time as the Canadian economy languishes, deficits balloon, and British Columbia faces its third credit downgrade in a row (S&P Ratings 2024).

However, it’s important to look at this project not just as an oil pipeline, but as a metric of Canada’s ability to build big things. It turns out that we can – but it’s been expensive, late, and a bit painful. That needs to change for the future.

Within the TMX expansion is an important lesson for all Canadians, not just those who support oil and natural gas: it’s a warning that building the infrastructure required for an energy transition will face similar challenges. Critical minerals mines, transmission lines, and even communications networks must all travel through Indigenous territories to be built. Environmental permits must be obtained. If managed improperly, both add risk and cost.

It is imperative that businesses and government look at what went well for TMX, and what didn’t, if we are to move forward on building any linear infrastructure in Canada.

What we missed

The TMX pipeline expansion, first proposed to the National Energy Board (now know as the Canadian Energy Regulator) in 2013, was originally set for completion in 2019. The project was approved in 2016 but then beset by court challenges and blocked at every turn. At many times the future of the project was uncertain. One of its biggest opponents was the newly elected BC NDP government, which declared it would “use every tool in the tool box” to fight the project (Eagland 2020).

In August 2018 the Federal Court of Appeal overturned the NEB approval of the Trans Mountain Expansion Pipeline, citing insufficient consultation with First Nations groups and assessment of its environmental impact.

The main message to the investment community and the world during this period was simple: in Canada, it is virtually impossible to build large infrastructure projects. The project was essentially stalled until 2020, when its opponents’ court challenges had finally been exhausted.

Canada has missed out on billions since then. When the project was approved, the Conference Board of Canada estimated that during construction and the first 20 years of the project taxes and royalties paid would amount to $46.7 billion, with $19.7 billion going to Alberta, $5.7 billion going to BC, and the balance of $21.6 billion going to the rest of Canada. We are five years into the original 20-year operations timeline as things stand, so we can conservatively say we have missed out on 25 percent of that original estimate, or $11.6 billion. Imagine if that amount had gone towards funding healthcare, off-setting the expense of dealing with the COVID-19 outbreak or subsidizing the federal government’s “$10 a day” national daycare program.

We have missed out on a lot, but now that the TMX is complete Canada is well-positioned to take advantage of the opportunities it provides.

What we have

The TMX line fill is hitting full operational capacity just as the world is finally waking up to the incredible challenges and costs associated with transitioning away from fossil fuels – especially during a period of increasing global energy insecurity.

For nearly a decade, government rhetoric has claimed that fossil fuels’ days are numbered, and that Canada is leading the charge towards a new, idyllic, and greener future. Certainly, that’s a future worth striving for. But the timelines Canadians were promised are unrealistic at best and, at worst, a flat out lie. Let us consider where we are versus what was promised.

First, the cost. In 2023 the International Energy Agency (IEA) estimated that to limit global warming to 1.5 degrees by 2030, $4.5 trillion had to be invested in clean energy annually (Jaynes 2023). From 2010 to 2019 approximately $2.5 trillion was invested in renewable energy, per the UN Environment Programme (UNEP 2019). That’s a lot of money, so one would of course assume its effect had been proportionately large. It has not. While there is no question that renewable energy production is indeed increasing, fossil fuels still account for 80 percent of world energy production (IEA 2020). This is lower than the approximately 82–83 percent they accounted for 25 years ago, but not by much and they are not falling fast. The reality of oil (and gas) consumption is that it is going up. The highest year on record for oil consumption was 2023 and 2024 is set to break that record (Statista 2024).

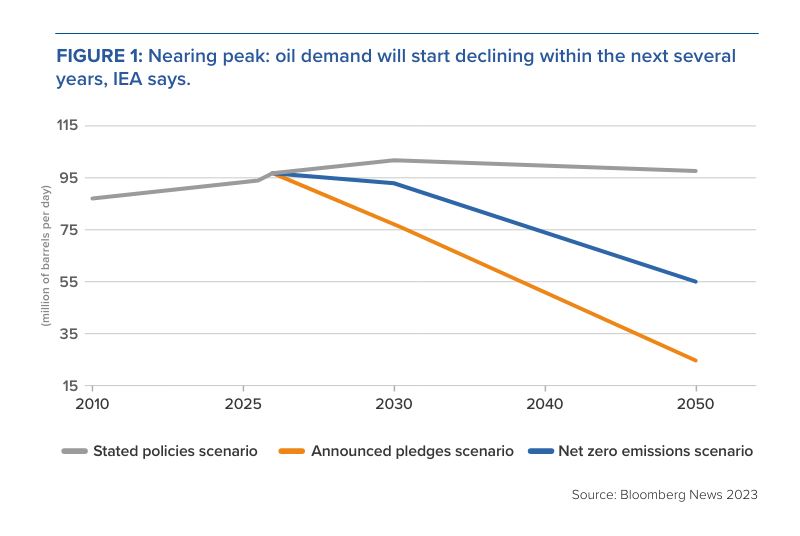

The Government of Canada is fond of pointing to the IEA’s forecast that shows either a steep or slow decline of oil demand in 2030, depending on the speed at which climate goals and policies advance globally. Will oil demand peak in the next 10 years? Possibly – if the trillions of dollars required for the green energy transition are in fact invested, as agencies now assume.

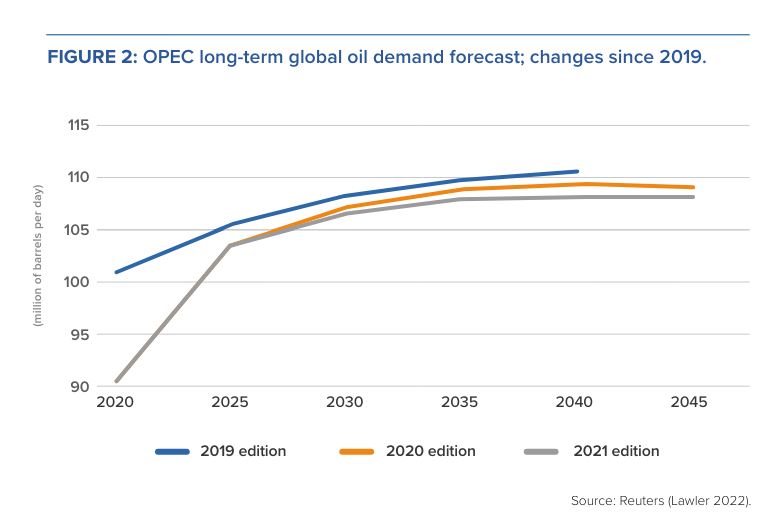

The challenge with this logic lies in the fact that no one can truly predict the future, let alone a government that contributes a mere 1.5 percent of global emissions (Government of Canada 2020). The future of fossil fuels will be shaped by larger economies, like China, India, Russia, the European Union, and the US. For example, the world’s largest oil exporter, OPEC, provides an outcome that shows steady growth until 2040.

Our government is correct that policy decisions at home may limit Canadian supply, but doing so under the assumption that demand won’t be there runs contrary to a free market and is dangerous logic for making a meaningful impact in reducing global emissions. During that time Canadian companies need to continue to play a role in getting Canadian resources to market. Last year, TC Energy announced it would spin off its oil business (TC Energy 2023). They did this not because Canadian oil is expected to decline, but because expanding the core pillar of North American energy is a huge opportunity.

The second issue that has never truly been addressed (or has been flat-out ignored) is time. The transition away from fossil fuels will take a long time. We have developed a society built on fossil fuels because they are energy dense, transportable, and cost effective to produce. Turning away from them overnight simply cannot happen no matter how much environmental ideologues may wish it (Financial Times 2024). Unless the price we are willing to pay is deindustrialization and a lower quality of life, the transition period will be measured not in years but in decades.

Finally, a third issue few contemplated until 2022 was the importance of energy security. Russia’s invasion of Ukraine in February of that year reminded the West that not everyone is our friend, and when our enemies have energy as leverage, we have a serious problem. Speak to any European if you doubt this.

Canada can offer the world safe and reliable energy exports produced with the highest environmental standards. Enhancing and expanding our export capacity should be a key economic priority. It may sound hyperbolic but Canadian energy exports support democracy around the globe.

This is the environment into which TMX will become operational: energy becoming a priority for democratic nations as we begin a long transition to greener solutions and push back against hostile forces around the world. TMX provides revenues for government and society, acts as a hedge against energy transition timelines, and offers energy security for our allies.

What will be

As previously mentioned, fossil fuels will continue to be important for some time. This is good news for Canada in several different ways.

First, the economy. Canada is blessed with abundant oil and gas resources. The TMX will grant Canadian crude full access to the world market. This means Canadian oil will be less constrained by pipelines that flow to the United States, where they are beholden to American buyers. By breaking this quasimonopsony, we are finally addressing the discount price our Western Canadian Select oil gets when purchased by our southern neighbours. The differential has been falling as TMX neared completion (Alberta Energy Regulator 2022). Now, Canadian producers will get more revenue for their products – and more money will flow via taxes into government coffers to pay for services.

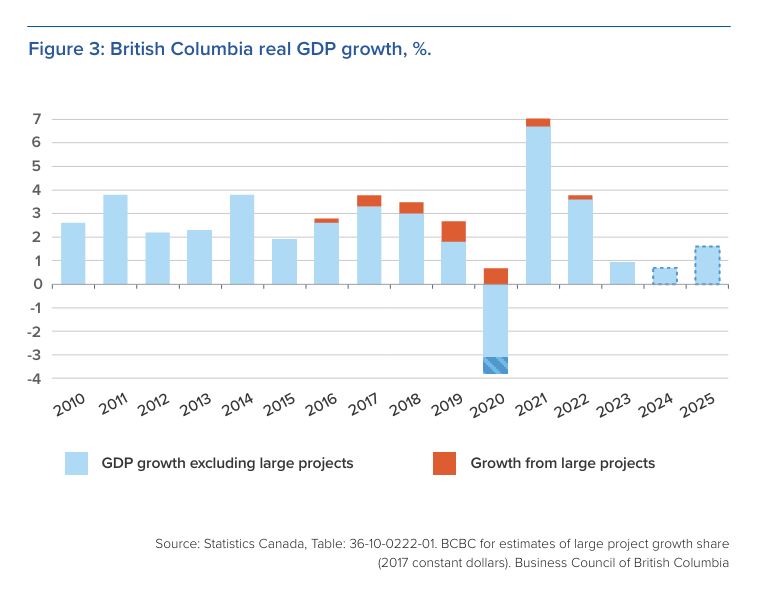

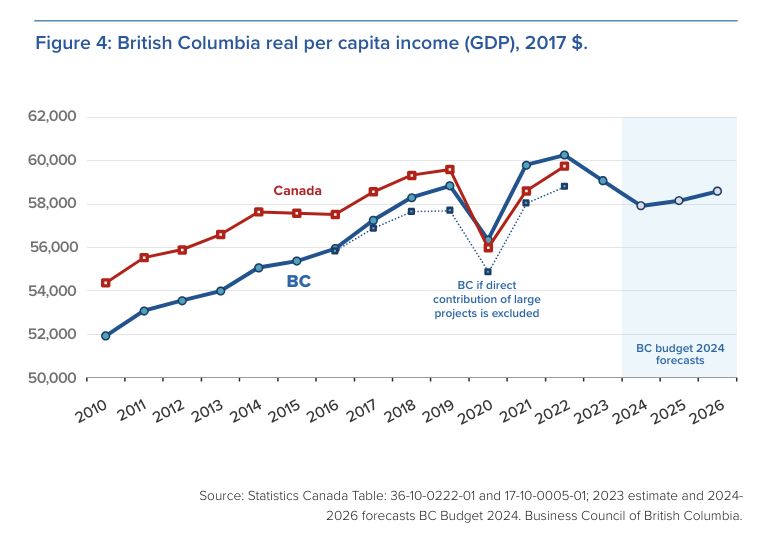

British Columbia has benefitted greatly from the investment made locally. The Business Council of BC (BCBC) has quantified the impact of major projects on the economy in simple terms: during the COVID-19 pandemic, when all provincial GDPs were declining, BC was buoyed by these major projects. This was due to the billions of dollars being spent and the tens of thousands of working people who were building TMX, LNG Canada, Coastal Gaslink, and Site C. In fact, these major projects helped BC rebound faster and overtake the Canadian average. This would be true in any province, so the real question now is what comes next?

The second future benefit to be realized will be economic reconciliation with First Nations. It’s a simple fact that many natural resource industries operate on Indigenous traditional territories. Over 40 years of case law have established rights and title to the land that must be consulted on and accommodated. TMX is an example of where that consultation was originally not sufficient and how during the second consultation the Government of Canada returned to the table with decision makers and listened in a broader way to the concerns of First Nations. The discourse around consultation and consent still has a long way to go in our country and, while it may be easy to brush this complexity off as investment-limiting risk, the opposite appears to be true. Innovation and inclusion are now the name of the game across Canada.

This began with Impact Benefit Agreements led largely by industrial projects (Government of Canada 2024). Forward-looking nations have taken their future into their own hands, working with organizations like the First Nations Major Projects Coalition (FNMPC) to structure equity agreements and participation in projects from powerlines to pipelines. The recent federal and BC budgets have announced Indigenous loan guarantee programs that will help Indigenous nations access capital to participate in major projects (Passafiume 2024). This represents progress we should all cheer as it ought to facilitate more large projects like TMX going ahead.

Currently, the federal government is looking to sell the TMX pipeline and its associated infrastructure (Bakx 2024).

As they do so, Ottawa must balance accommodations to Indigenous communities with financially acceptable terms of sale. An accommodation could take the form of a royalty, or small percentage of the project. But Canada needs to sell the project for a fair market price. This does not mean the market will pay the $5 billion government originally paid for it, nor the ballooned cost of $34 billion it took to build it, but government needs to move out of the pipeline business.

One such potential buyer is Western Indigenous Pipeline Group (WIPG) in partnership with Canadian owned Pembina Pipeline. The group includes a business case for the project and the participation of nations across Western Canada. Chief David Jimmie, the Chief & CEO of Squiala First Nation and chair of the WIPG, has spoken about his original opposition to the project and the need to take an ownership stake: “If you can’t have [concerns] addressed through a regulatory process, then what other alternatives do you have? And that’s ownership. It’s not that I set out to pursue buying a pipeline. It’s that I think there’s opportunity – from an environmental stewardship perspective and how it’s operated. And, obviously, an opportunity for generating revenue for communities. So, it was tough, it was not an easy process” (Stueck 2023).

Some critics have questioned the environmental impacts of the TMX. However, the fact is, TMX will move existing production more safely than the oil-byrail option currently being used to export oil from Alberta. Pipelines are the most efficient and safe method of moving product and the TMX will reduce congestion on limited rail lines and with it, the risk of derailments. Further, Canadian oil adheres to the strictest of environmental standards – and rightly so. Our standards are also generally much higher, from an environmental standpoint, than the rest of the world’s (Tuttle 2024; Resource Works 2024).

Thus, the more efficiently our oil can access world markets, the more responsibly extracted oil there will be as a portion of world production. Even if oil demand and production is indeed set to flatten or peak, having Canadian barrels on the market is more environmentally beneficial than many alternatives.

Finally, an overlooked aspect of the TMX project is the coastal marine spill response. This voluntary effort is funded by the project. West Coast Marine Spill Response (WCMRC) doubled the spill response capacity by investing $170 million in new equipment and bases, and by increasing personnel from 30 in 2013 to 220 in 2024. This spill response network protects BC coasts not only from the rare chance of a TMX related spill, but also from the much more likely event of a sinking fishing boat, or marine bunker fuel spill. This is why in 2018, despite widespread opposition to TMX, the Association of Vancouver Island and Coastal Communities (AVICC) passed a motion calling for the program to be funded, whether TMX moved ahead or not (Quinn 2018).

What can be

We understand that the debate over fossil fuels can be at times heated, and that it’s important not to overstate your case. However, we believe that future prosperity for Canada runs through its resource sector, particularly energy. It’s also important to remember that the TMX is only a part of a potentially much larger puzzle.

Last March, Greek Prime Minister Kyriakos Mitsotakis visited Canada and expressed strong interest in purchasing Canadian LNG (Silcoff 2024). The federal government declined mainly because Canada has no export capability to the East. This followed on the heels of a similar request by German Chancellor Olaf Schultz, who was, and still is, desperately searching for an alternative to Russian gas (Tizhoosh and Zimonjic 2022). Since being turned away by Canada, Germany has signed agreements worth billions with Qatar. (Al Jazeera 2022). Despite the clear interest in Canadian LNG, the federal government still says there is little to no business case for enhancing our export capacity.

By refusing to supply our allies with the energy they need, Canada is tossing economic, environmental, and reconciliation opportunities into the garbage. In addition, it is diminishing our role as an international leader. If we believe Canada can and should have clout in world affairs, then energy is an arena in which we could have real influence – if we so choose. As of now, the federal government seems entirely disinterested, but the opportunity is there for the taking.

TMX, LNG Canada, and the Coastal Gas Link pipeline (once online in 2025), are critical energy infrastructure that the world absolutely needs. We can and should build more. The next planned LNG projects are Indigenous owned. Haisla’s Cedar LNG and Nisga’a’s Ksi Lisms represent the best lessons of the 2010s. They include the free prior and informed consent of their nations, without government needing to enforce it. These projects will allow for more Canadian natural gas to reach global markets, while generating higher royalty revenue in the upstream that helps to fund domestic spending at home.

Now completed, TMX should not be viewed as existing in a historical bubble. Other industries like telecoms and renewables are also experiencing the challenges associated with linear infrastructure. Critical minerals mines and wind farms still require environmental permits. At a fundamental level, these industries must mitigate timeline risks and rising costs. Canadians need these sectors to grow, and they must take the lessons of major infrastructure projects to heart. TMX offers those lessons.

All players in this story have roles and responsibilities. Government leaders must champion big ideas – and then get out of the way of innovation. Industry must partner with the Indigenous Nations on whose land they plan to work, and we as Canadians, must keep demanding real results. Building big things may be hard, but it is the only way to secure our future prosperity, security, and influence in a changing world.

Adam Pankratz is a lecturer in the Strategy and Business Economics Division of the Sauder School of Business at UBC.

Jack Middleton is the Director of Policy at Sedgwick Strategies in Vancouver. He helps major projects in the mining and energy sector navigate risk and build partnerships with Indigenous nations, governments, and communities.

References

Alberta Energy Regulator. 2022. “Canadian oil price differentials.” Accessed May 2024. Available at https://www.aer.ca/providing-information/dataand-reports/statistical-reports/st98/prices-and-capital-expenditure/crudeoil-prices#:~:text=Price%20differentials%3A%20In%202022%2C%20 the,differential%20averaged%20US%2418.22%2Fbbl.

Al Jazeera. 2022. “QatarEnergy, ConocoPhillips sign LNG deal for Germany.” November 29, 2022. Available at https://www.aljazeera.com/ news/2022/11/29/qatarenergy-conocophillips-sign-lng-deal-for-germany.

Bakx, Kyle. 2024. “For its next trick, Ottawa must unload the $34B Trans Mountain pipeline. It won’t be easy.” CBC News, April 18, 2024. Available at https://www.cbc.ca/news/canada/calgary/ tmx-trans-mountain-sale-freeland-1.7176629.

Bloomberg News. 2023. “Global Oil Demand to Reach Its Peak This Decade, IEA Says.” October 24, 2023. https://www.bnnbloomberg.ca/ global-oil-demand-to-reach-its-peak-this-decade-iea-says-1.1988527.

Eagland, Nick. “B.C. NDP out of tools to stop Trans Mountain pipeline expansion 2020.” January 17, 2020. Available at https://vancouversun.com/ news/local-news/ndp-out-of-tools-to-stop-tmx.

Financial Times. 2024. “German industry unlikely to fully recover from energy crisis, warns RWE boss.” April 10, 2024. Available at https://www.ft.com/ content/5d98bcab-c8bc-49c8-83a0-88522194f64d

Government of Canada. 2020. “Global greenhouse gas emissions.” Accessed May 2024. Available at https://www.canada.ca/en/environment-climatechange/services/environmental-indicators/global-greenhouse-gas-emissions. html.

Government of Canada. 2024. “Centre of Expertise on Impact and Benefit Agreements: an important ally.” Accessed May 2024. Available at https://sacisc.gc.ca/eng/1645561183367/1645561204248.

International Energy Agency (IEA). 2020. “World Energy Balances: Overview.: Accessed May 2024. Available at https://www.iea.org/reports/ world-energy-balances-overview/world.

Jaynes, Cristen Hemingway. 2023. “IEA: Clean energy investment must reach $4.5 trillion per year by 2030 to limit warming to 1.5°C.” World Economic Forum, September 8, 2023. Available at https://www.weforum.org/ agenda/2023/09/iea-clean-energy-investment-global-warming/.

Lawler, Alex. 2022. “OPEC expected to stick to view of long-term oil demand rise.” Reuters, October 28, 2022. https://www.reuters.com/ markets/commodities/opec-expected-stick-view-long-term-oil-demandrise-2022-10-28/.

Palmer, Vaughn. 2021. “Vaughn Palmer: A nod to TMX expansion project for helping get Coquihalla repaired.” Vancouver Sun, December 15, 2021. Available at https://vancouversun.com/opinion/columnists/vaughn-palmera-nod-to-tmx-expansion-project-for-helping-get-coquihalla-repaired.

Passafiume, Alessia. 2024. “Budget 2024 commits $5B for Indigenous loan guarantees but falls short on infrastructure.” Canadian Press via Global News, April 16, 2024.Available at https://globalnews.ca/news/10427894/budget2024-indigenous-loan-guarantees-infrastructure-gap/#:~:text=The%20 federal%20government%20is%20providing,short%20more%20than%20 %24420%20billion.

Quinn, Susan. 2018. “Regional gov’t pressuring federal Liberals to fund west coast spill response bases.” Alberni Valley News, April 17, 2018. Available at https://www.albernivalleynews.com/news/regional-govt-pressuring-federalliberals-to-fund-west-coast-spill-response-bases-697684.

Resource Works 2024. “TMX pipeline will serve cleaner Canadian oil to ecoconscious California.” Available at https://www.resourceworks.com/eco-cal.

S&P Ratings. 2024. “Province of British Columbia Downgraded To ‘AA-’ From ‘AA’ On Continued Fiscal Weakening; Outlook Negative.” April 8, 2024. Available at bc-credit-rating-sp.pdf (gov.bc.ca).

Silcoff, Sean. 2024. “Greek PM fuels debate for expanding Canadian LNG as Ottawa promotes renewable energy industry.” Globe and Mail, March 24, 2024. Available at https://www.theglobeandmail.com/business/article-greekpm-fuels-debate-for-expanding-canadian-lng-as-ottawa-promotes/.

Statista. 2024. “Demand for crude oil worldwide from 2005 to 2023, with a forecast for 2024.” Accessed May 2024. Available at https://www.statista. com/statistics/271823/global-crude-oil-demand/.

Stueck, Wendy. 2023. “‘A true seat at the table’: Why an Indigenous group wants an ownership stake in the TMX pipeline.” Globe and Mail, November 21, 2023 [updated December 15]. Available at https://www.theglobeandmail. com/business/article-a-true-seat-at-the-table-why-an-indigenous-groupwants-an-ownership/.

TC Energy. 2023. “TC ENERGY TO UNLOCK VALUE BY CREATING TWO PREMIUM ENERGY INFRASTRUCTURE COMPANIES WITH INTENTION TO SPIN OFF LIQUIDS PIPELINES BUSINESS.” Press release, July 27, 2023. Available at https://www.tcenergy.com/ announcements/2023/2023-07-27-tc-energy-to-unlock-value-by-creatingtwo-premium-energy-infrastructure-companies-with-intention-to-spin-offliquids-pipelines-business/.

The Energy Year. 2024. “Canada’s $24.7-billion TMX oil pipeline begins operations.” April 30, 2024. Available at https://theenergyyear.com/news/ canadas-24-7-billion-tmx-oil-pipeline-begins-operations/

Tizhoosh, Nahayat, and Peter Zimonjic. 2022. “Scholz says Germany wants more natural gas from Canada but lacks infrastructure, business backing.” CBC News, August 23, 2022. Available at https://www.cbc.ca/news/politics/ scholz-vassy-kapelos-lng-russia-gas-1.6559814.

Tuttle, Robert. 2024. “Canadian oil flows to Los Angeles as Trans Mountain start nears.” Bloomberg News, March 24, 2024. https://www. bnnbloomberg.ca/canadian-oil-flows-to-los-angeles-as-trans-mountainstart-nears-1.2052487.

United Nations Environment Programme (UNEP) . 2019. “A decade of renewable energy investment, led by solar, tops USD 2.5 trillion.” Press Release, September 5, 2019. Available at https://www.unep.org/news-andstories/press-release/decade-renewable-energy-investment-led-solar-tops-usd25-trillion.