OTTAWA, ON (January 29, 2020) As the economy continues to trudge along with persistently slow economic growth, there are worrying signs that Canada’s economy is vulnerable to a global downturn.

OTTAWA, ON (January 29, 2020) As the economy continues to trudge along with persistently slow economic growth, there are worrying signs that Canada’s economy is vulnerable to a global downturn.

MLI Munk Senior Fellow Philip Cross’s latest quarterly quarterly economic report, titled “Excessive debt leaves Canada vulnerable to global economic slowdown,” reflects on the state of the economy and how rising private and public debts are putting Canada’s economy at great risk.

“All sectors have gorged themselves on credit since interest rates were cut during and after the 2008-2009 Great Financial Crisis,” explains Cross. “Households, corporations, and governments each have raised their debt load to about 100 percent of GDP.

“High debt levels across households and governments mean Canada is quite vulnerable to a downturn in the global economy.”

Ever since 2008, the economy has been positioned in a stimulus mode with low interest rates and high government spending. This in turn has led to a radical increase in debt; when combined across households, governments, and corporations, Canada’s total debt-to-GDP ratio has soared beyond 300 percent – one of the highest levels in the world. All sectors of the economy have “gorged themselves on credit since interest rates were cut to historically low levels,” writes Cross.

Despite the fiscal and monetary levers of the economy being pushed toward stimulus mode, economic growth has been meagre. In the third quarter of 2019, Cross notes that growth returned to a lacklustre 0.3 percent. This has translated to a year-over-year GDP growth rate of just 1.7 percent, which is barely faster than Canada’s rate of population growth.

Despite the fiscal and monetary levers of the economy being pushed toward stimulus mode, economic growth has been meagre. In the third quarter of 2019, Cross notes that growth returned to a lacklustre 0.3 percent. This has translated to a year-over-year GDP growth rate of just 1.7 percent, which is barely faster than Canada’s rate of population growth.

In this climate of slow growth but rising debts, Cross warns that Canada could be propelled towards the fiscal cliff if the global economy falters. “Debt levels continue to grow faster than incomes, reflecting how household and government spending remain dependent on debt-financing… The result is that Canada is quite vulnerable to a downturn in the global economy.”

Worryingly, bankruptcies are on the rise in Canada with the largest increases occurring in Ontario and Alberta. This is despite low interest rates and a tight labour market. If households already are having trouble managing their record debt under present conditions, “these difficulties will multiply as the global economy continues to decelerate.”

While Cross notes that Canada is unlikely to experience a banking crisis as a result of high debt and slow growth, our economy nonetheless remains over exposed to risk relative to many of our peers.

“It is a testament to the vapidity of the recent federal election that Canada’s growing indebtedness was barely discussed,” Cross laments. “Completely ignored were the huge amount of debts accumulated in the corporate, household and provincial government sectors and the vulnerability this debt creates for a highly-cyclical economy like Canada’s.”

To learn more about the state of Canada’s economy and the risks posed by Canada’s overreliance on debt, check out the full quarterly economic report here.

***

Philip Cross is a Munk Senior Fellow at the Macdonald-Laurier Institute. Prior to joining MLI, Mr. Cross spent 36 years at Statistics Canada specializing in macroeconomics. He was appointed Chief Economic Analyst in 2008 and was responsible for ensuring quality and coherency of all major economic statistics.

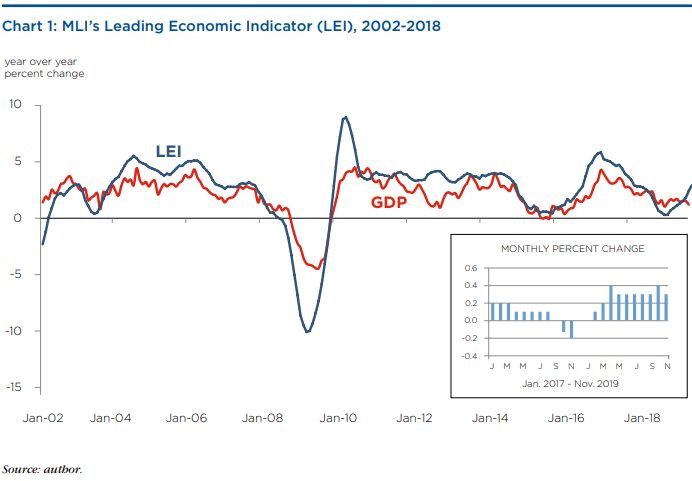

Cross’s Quarterly Economic Reports provide analysis of the latest economic data and results of the Macdonald-Laurier Institute’s Leading Economic Indicator, designed to signal an upcoming turn in the business cycle, either from growth to recession or from recession to recovery, six months in advance.

For more information please contact:

Brett Byers

Communications and Digital Media Manager

613-482-8327 x105

brett.byers-lane@macdonaldlaurier.ca