OTTAWA, ON (December 22, 2020): Canadian households have been largely shielded from the brunt of the economic woes wrought by COVID-19 lockdown measures. But for large sectors of the economy, nothing could be further from the truth.

OTTAWA, ON (December 22, 2020): Canadian households have been largely shielded from the brunt of the economic woes wrought by COVID-19 lockdown measures. But for large sectors of the economy, nothing could be further from the truth.

In the Macdonald-Laurier Institute’s latest quarterly economic report, titled “A tale of two outcomes: Pandemic relief has hit households and businesses unevenly,” MLI Munk Senior Fellow Philip Cross explores the divergent outcomes experienced through Q3 2020. While there are major differences between industries, Cross finds that the starkest disparities exist when comparing households and businesses.

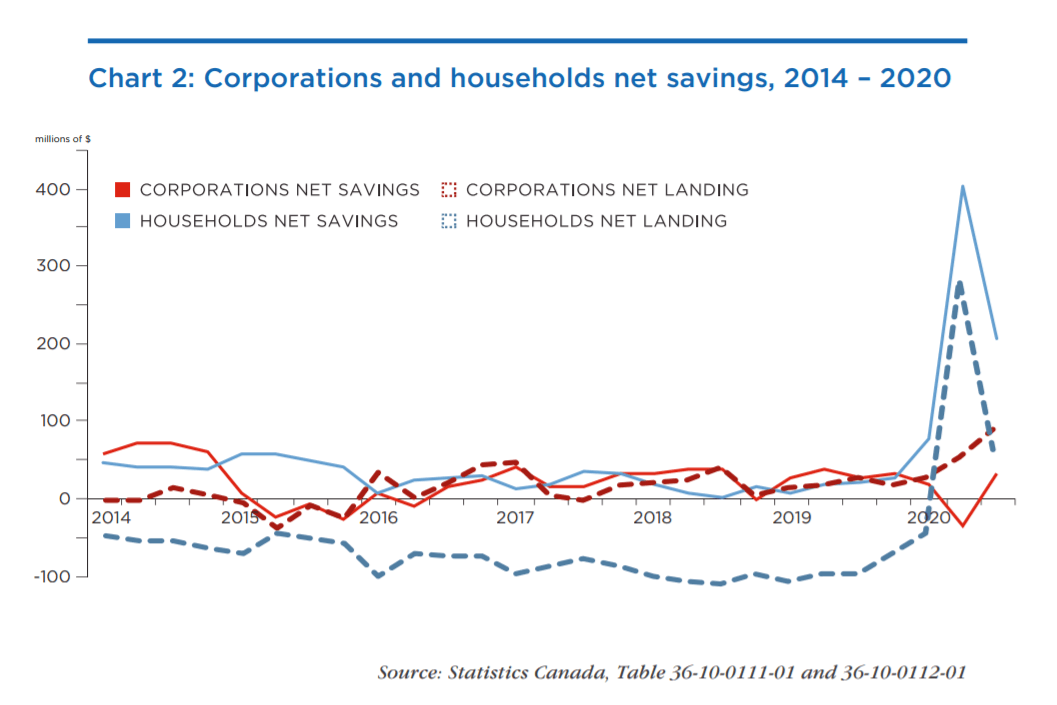

Savings for households “soared,” even with declines in earned incomes. Cross has noted that much of this trend is due to government transfers to individuals in the form of the CERB and other benefits. Indeed, savings for households increased at over twice the speed of savings growth for businesses, and even then, business savings have been remarkably narrowly based.

Savings for households “soared,” even with declines in earned incomes. Cross has noted that much of this trend is due to government transfers to individuals in the form of the CERB and other benefits. Indeed, savings for households increased at over twice the speed of savings growth for businesses, and even then, business savings have been remarkably narrowly based.

“Almost all corporate savings were in the financial sector, as nonfinancial corporations struggled to cope with plunging revenues and profits,” explains Cross. “This is consistent with the messaging from the federal government throughout its pandemic relief efforts of generosity in its approach to households [and suspicion] in dealing with businesses.”

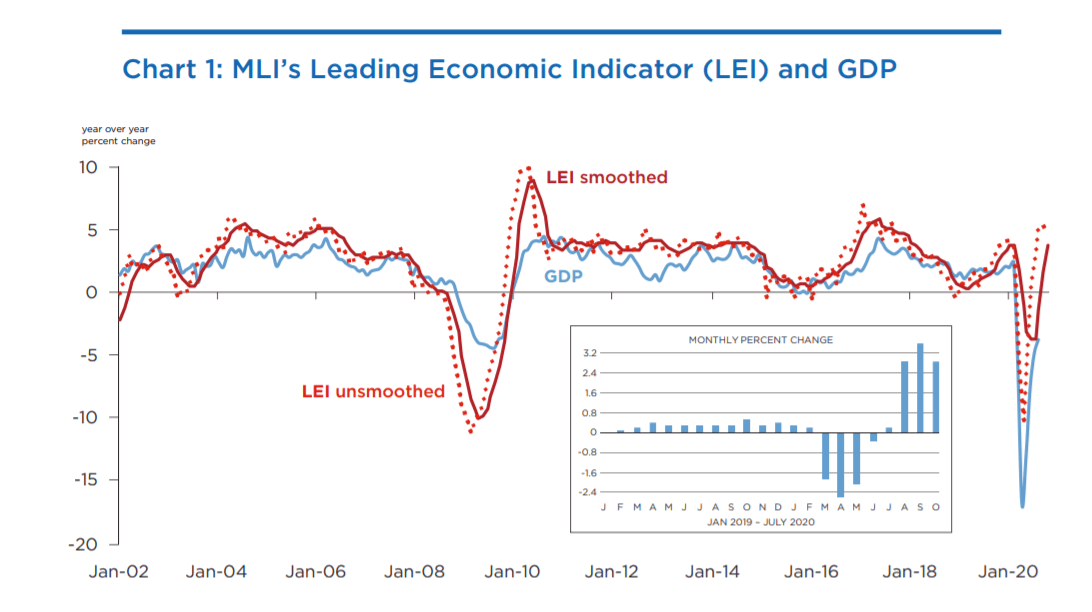

Though the economy has been recovering, experiencing an 8.9 percent jump in the third quarter, it still remains 5.3 percent below pre-lockdown levels. Industries like housing have boomed, whereas travel, hospitality, personal services, and more continue to languish. Furthermore, business investment remains sluggish, with a 13.5 percent decline in 2020 driven by uncertainty, volatility, and the oil price crash experienced in the spring.

However, this lacklustre economic performance might come as some surprise to Canadian households. While unemployment skyrocketed, incomes actually rose, as did savings, for most Canadians. Net savings for households increased by $686.4 billion dollars. By comparison, net savings for corporations eked out a meagre $14.1 billion. Excluding the financial sector, net savings by corporations actually fell by $90.4 billion.

However, this lacklustre economic performance might come as some surprise to Canadian households. While unemployment skyrocketed, incomes actually rose, as did savings, for most Canadians. Net savings for households increased by $686.4 billion dollars. By comparison, net savings for corporations eked out a meagre $14.1 billion. Excluding the financial sector, net savings by corporations actually fell by $90.4 billion.

“Both persons and firms began increasing their cash holdings at banks from the moment the pandemic began, presumably motivated by the massive uncertainty surrounding both the pandemic and how government would respond,” writes Cross. “These cash holdings rose even before governments began transferring record amounts of income support, especially to households.”

To learn more about the uneven economic recovery facing households and businesses, read the full report here.

***

Philip Cross is a Munk Senior Fellow at the Macdonald-Laurier Institute. Prior to joining MLI, Mr. Cross spent 36 years at Statistics Canada specializing in macroeconomics.

For more information, media are invited to contact:

Brett Byers

Communications and Digital Media Manager

613-482-8327 x105

brett.byers@macdonaldlaurier.ca