By Jeff Kucharski, February 20, 2024

Geopolitical strife is dominating the environment of international relations and injecting uncertainty into global markets.

In this unstable climate, businesses and governments are now laser-focused on security. There are two big risks to economic security that democratic countries like Canada and S. Korea are confronting. One is an over-reliance on suppliers of critical goods, including energy, from countries governed by authoritarian regimes; energy weaponization is a critical threat. The second big risk is the potential of losing public support for the energy transition because of affordability issues and the consequent loss in industrial competitiveness.

Within this turbulent context, the governments of Canada and the Republic of Korea are trying to advance their respective Indo-Pacific strategies. S. Korea’s National Security Strategy (NSS) released last year emphasizes S. Korea’s intent to “strengthen substantive cooperation with Canada,” with a focus on ensuring stable supply chains and promoting technological development, including energy security initiatives. A bright spot in the deepening bilateral relationship is the potential to build on the Canada-Korea comprehensive strategic partnership through enhanced energy cooperation.

More broadly, trilateral cooperation between S. Korea, Canada and Japan could strengthen our mutual economic and security position in the Indo-Pacific.

Energy is a key driver for trade and investment

Japan and South Korea, which respectively represent the third and the thirteenth largest economies in the world, are increasingly important to Canada. While China remains Canada’s largest export market in the Indo-Pacific, S. Korea and Japan share Canada’s democratic values, are close security partners, and represent opportunities for an increase in value-added trade and potential sources of foreign direct investment, particularly in the fast-evolving energy sector.

The Indo-Pacific region accounts for about 43% of global energy demand and will continue to lead global demand for the next several decades. By 2025, Asia will account for half of the world’s electricity consumption. By 2050, demand for natural gas is expected to rise 22%, and demand for nuclear power by 184%.

While climate change remains a major global concern and shaper of energy policy, the energy transition looks different in every country and is proceeding at different speeds. While some countries like Canada have access to multiple energy sources at relatively cheap prices and can rapidly decarbonize the electricity sector, others like S. Korea, with challenging geography and a lack of domestic resources, will remain highly dependent on traditional fossil fuel sources for many years even throughout a transition to cleaner forms of energy.

S. Korea is the world’s 8th largest energy consumer and relies on overseas suppliers for more than 90% of its energy imports. In 2021, 83% of Korea’s energy imports were hydrocarbons and energy imports accounted for about 22% of total merchandise imports. Korea is the 3rd largest importer of LNG in the world, after China and Japan. Korea’s dependence on energy imports makes it vulnerable to geopolitical shocks and changes in the global energy market, particularly since it depends on unstable regions in the Middle East for much of its energy and resource imports. For S. Korea, energy security is an existential policy concern.

In 2022, Canada exported CAD$3.2 billion of energy products to S. Korea, mostly coal and some oil products and uranium and representing about 25% of total trade with Korea. There is plenty of space for S. Korea to diversify its energy trade with Canada while reducing reliance on the Middle East and Russia and decarbonizing its economy. S. Korea’s plans to expand nuclear power capacity to help meet increased demand and achieve climate commitments. Opportunities could open for an increase in Canadian uranium exports and cooperation on small modular reactors.

Long-term economic security concerns now override immediate economic efficiency considerations; S. Korea views the United States and Canada as potential suppliers of critical raw materials as well as an investment destination that could help it diversify away from over-reliance on China.

Energy is already playing an outsized role in the Canada-Korea relationship. In May, 2022 Canada and S. Korea signed a memorandum of understanding on critical mineral supply chains, clean energy transition and energy security, and committed to position the two countries as “globally competitive players in areas including batteries and zero-emission vehicles”.

Liquid Natural Gas (LNG) will soon play a major role in increasing trade between Canada and Korea. The LNG Canada project – which S. Korea’s KOGAS is an investor in – is expected to start shipping in 2025 and will provide environmentally responsible natural gas to help Korea meet its energy security needs.

S. Korea is already becoming a significant investor in the Canadian energy sector. In the first and second quarters of 2023, Canada ranked third in the world as a destination for South Korean foreign direct investment with a total of CDN$3.2 billion, up about 30% over the previous year. Much of this investment is in the energy sector. Canada and S. Korea have also expanded co-operation in critical mineral supply chains and in other energy-related investments over the past year including in EV battery manufacturing, low-carbon hydrogen production, ammonia production and in Canada’s metallurgical coal business.

S. Korea and Japan recently agreed to work together to build a supply chain for hydrogen and ammonia, and to enhance their ability to negotiate prices and ensure stable procurement of the two fuels. The project, called Hydrogen Ammonia Global Value Chain, aims to develop a seaborne supply chain that transports the fuels from various parts of the world. Government-affiliated financial institutions will provide funds to assist Japanese and South Korean companies to make joint investments in hydrogen and ammonia production projects in supplier countries. This project presents further opportunities for energy cooperation between Canada, S. Korea and Japan.

Deepening partnerships

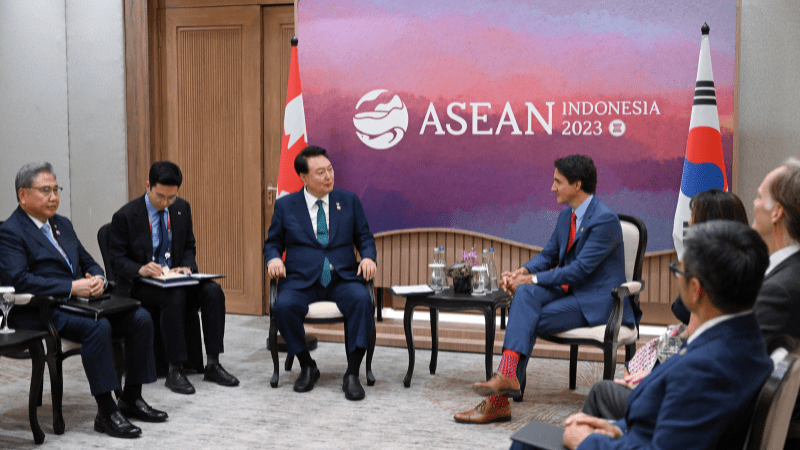

An increasingly inhospitable business environment in China combined with a wariness of China’s future intentions on the global stage has provoked S. Korea to re-evaluate its economic security posture and shift foreign direct investment toward economic integration with North America. Last August, the United States, S. Korea and Japan agreed to form a trilateral partnership at their meeting at Camp David. That agreement arose because of the common need to address geopolitical and geoeconomic competition, climate change, threats of military conflict, nuclear provocations, and other issues. The President of S. Korea and Prime Minister of Japan also announced their intention to strengthen economic security while attending the APEC summit in November of 2023.

Canada faces similar challenges and should also forge closer relations with North Asia given the increasingly difficult relations we have with both China and India. S. Korea and Japan are natural partners, they have similar energy needs and priorities and are implementing similar strategies to develop resilient traditional and clean energy supply chains.

The governments of Canada, S. Korea and Japan should consider a trilateral partnership of their own, focused on strengthening economic security through the further development of energy and resource trade and investment amongst all three countries.

A Canada-Korea-Japan partnership would also help balance against the influence of China, Russia, and North Korea. A deeper partnership with Korea and Japan would help all parties strengthen economic security and resilience and would strengthen the parties collective security in standing up to threats from authoritarian regional actors.

Conclusion

In the development of Canada’s Indo-Pacific strategy, China and India played outsized roles in defining the potential opportunities in the region. However, Canada’s diplomatic relations with both China and India have been complicated by a series of events that put those relations in the deep freeze for an indefinite period.

The success of Canada’s Indo-Pacific strategy now rests heavily on deepening its economic and security partnerships in North Asia. The energy transition presents a window of opportunity for Canada to sustainably develop its vast renewable and traditional energy resources to help ensure energy security and meet climate goals in North Asia while bringing long-term prosperity to Canada. However, this will only happen if some significant barriers within Canada can be effectively addressed.

For Canada, the strength of any partnership will be determined by what it can enact; rhetorical commitments will mean very little without timely and tangible deliverables.

Canada must seize the moment with partners like S. Korea and Japan to deepen its integration within the fast-growing Indo-Pacific economy. Successful long-term partnerships will depend on further institutionalizing our economic and security relations so that they can endure beyond election cycles and political upheavals. A trilateral partnership with S. Korea and Japan could create a path to our collective economic and national security. This will require political will by all parties to commit to the cooperative mechanisms, structural changes and fiscal resources required.

Jeff Kucharski is a Senior Fellow with the Macdonald-Laurier Institute. His current research is focused on energy security, international trade, the geopolitics of energy and the Indo-Pacific.