By Andrew Evans

January 3, 2024

Canada’s nuclear industry has been in a renaissance. This renaissance has been led by major announcements in Ontario to expand the Bruce Nuclear site and create four Small Modular Reactors (SMRs) in Darlington. SMRs are challenging a nuclear industry that has been inwardly focused in recent decades by offering a smaller, more cost effective, and safe option for clean, reliable electricity. Canada cannot afford to sit on the sidelines in this effort.

At stake is the possibility of not only reducing Canada’s share of global emissions lower than the current 1.5% and creating well-paying export-based Canadian jobs, but also of confronting and deterring nuclear proliferation by the world’s rising authoritarian regimes. Canada can be a meaningful part of the solution, bolstering our own security and securing our economic future in a high-tech space.

Global nuclear geopolitics has not been so important since the end of the Cold War, particularly with respect to Russia’s war in Ukraine and China’s growing desire to challenge the US-led world order. Civil nuclear technology is a multi-faceted policy file, with wide-ranging impacts, including clean electricity generation, nuclear non-proliferation, and advanced technology and manufacturing.

For much of the 20th century, the United States was the leader in civil nuclear technology, viewing it not only as influential in the Cold War but also as a means to decrease global nuclear arms proliferation. Having been the first to develop nuclear weapons, the US immediately recognized the significance of more countries seeking to develop their own nuclear weapons. While it was impossible to remain the only power with the atomic bomb, US leadership decided to tamp down wider nuclear proliferation, making the world safer for everyone.

In 1953 President Eisenhower spoke at the United Nations, outlining that: “the United States would be more than willing – it would be proud to take up with others the development of plans whereby such peaceful use of atomic energy would be expedited.” American foreign policy viewed the export of US civilian nuclear power reactors as a way of discouraging other countries from developing their own nuclear arms programs while still enjoying the benefits of mass electrification, as long as the importing country agreed to a bilateral ‘123 Agreement’, prohibiting them from developing nuclear weapons. Nuclear civilian exports served the envisioned dual policy purpose of providing safe and reliable electricity, while also tamping down nuclear proliferation by prohibiting importing countries from developing nuclear weapons.

America’s global leadership position began to wane in the late 1970s, as domestic electrical utilities began to defer their investments in nuclear power plants amid rising costs, cheaper substitutes, and misplaced safety concerns. As it worked out, there were no new nuclear construction starts between 1978 and 2013, although 47 reactors approved before then came online in the late 1970s and 1980s. American reactors continue to age, with the average for a US plant being 42 years old (Energy Information Agency 2023a). Today, the American civil nuclear fleet has the same generating capacity as in 1988 (EIA 2023b). As the American civil nuclear industry has languished, Russia and China have maximized their influence at the expense of the United States.

Canadian interests in nuclear energy have always been on the cutting edge and resolutely aligned with the United States. From the first self-sustained nuclear reaction outside the United States in 1945, Ottawa moved in 1952 to establish the Atomic Energy of Canada Ltd (AECL) (Atomic Energy of Canada Ltd 2006). AECL would subsequently develop the CANDU-model reactor, which was exported to Pakistan (in operation as of 1971), Argentina (1984), South Korea (1983), Romania (1977), and China (1998), demonstrating the reach and influence Canada was able to exert. By exporting to those countries, Canada was able to negate Soviet influence that otherwise could have drawn several nations closer to the Soviet bloc.

Since the end of the Cold War, due to a lack of geopolitical competition, Canada’s nuclear policy withered and there has not been a new build in Canadian nuclear capability since 1993. Activity that has occurred since has largely been oriented around refurbishments of the Bruce and Pickering sites in Ontario, and Point Lepreau in New Brunswick. In 2018, the Ministry of Energy and Natural Resources of Canada (NRCAN) released an “SMR Roadmap” broadly outlining what would have to happen for SMRs to be successful in Canada. This was a good first move to build momentum and support for a new era of nuclear power generation (Natural Resources Canada 2018).

Much has changed since the end of the Cold War and our lukewarm nuclear policy is clearly opposed to our national security. If the West’s civilian nuclear industry is overtaken by China and Russia, nuclear weapons proliferation will become more likely due to a lack of safeguards placed on exports from those countries.

Canada has a role to play in preventing this outcome and Canadian owned companies, Ontario Power Generation (OPG) and Cameco, could lead the way.

OPG has taken a major step in undertaking to build of an SMR at Darlington, Ontario, in cooperation with GE Hitachi and the Tennessee Valley Authority (NewsWire 2023). This new build will be a test case for the leadership of Canada’s nuclear industry in the SMR sector, while bringing in partnerships that will maximize the chances of a successful deployment.

OPG has also signed deals with Poland and Czech Republic for construction and development of future SMRs (Larson 2022). Poland has demonstrated significant interest in furthering energy ties; in June 2023 the Prime Minister of Poland came to Canada to discuss OPG’s Polish SMR deal and to visit the Darlington project (Polskie Radio 2023). A foreign leader visiting Darlington should demonstrate how critical Canada is in this space.

Cameco’s recent approval to acquire Westinghouse, in partnership with Brookfield, signals a further interest in a domestically driven nuclear export industry (Nuclear Engineering International Magazine 2023b). This new business allows Cameco to diversify and further expand its business and brings the leading US nuclear company into its supply chain, with economic and strategic benefits.

Cameco has also signed a 12-year deal with Ukraine to provide all of Ukraine’s uranium needs for its nuclear power plants (NEIM 2023a). Prior to the war with Russia, Ukrainian reactors used Russian nuclear fuel, but this is obviously no longer desirable. By stepping in, Cameco secures a long-term agreement that also provides them an inside track for potential future nuclear fuel contracts, as well as new builds using the Westinghouse design. There is significant interest in Ukraine for future nuclear reactors, and building new reactors will be a boon for whichever company wins the contracts (Westinghouse 2023).

As an example of how Canadian-owned companies can cooperate in the future, Westinghouse (partially owned by Cameco) and OPG signed a memorandum of understanding to work together to develop new domestic commercial opportunities (NewsWire, 2023). With Cameco supplying the fuel, and OPG and Westinghouse providing the technical expertise, there are self-reinforcing benefits at play that can help stimulate the Canadian economy.

Helping to further revitalize Canadian exports, Minister of Energy and Natural Resources of Canada, Jonathan Wilkinson, has recently approved the provision of $3B in export financing to Romania for two new CANDU reactors, building on their existing units (Nuclear News Wire 2023).

Nuclear projects in the Western world face consistent issues with cost and time overruns; the latest project completed in the US, Vogtle Units 3 and 4, was $14B overbudget and seven years late (NNW 2022). If the Darlington Ontario project can be even relatively successful in being on-time and on-budget, global prospects for SMRs will improve. With the International Energy Agency (IEA) forecasting anywhere between an 80-150% increase in global demand for electricity by 2050 (2023), the demands for stable, reliable energy, which nuclear power can provide in place of coal and gas, will only continue to grow. Without the growth of nuclear energy (and the corresponding drop in emissions from coal and gas plants that could be taken offline) achieving our climate goals will likely be unfeasible.

China

Chinese civil nuclear development began with the Soviet export of nuclear technology in the 1950s which lacked non-proliferation safeguards, meaning ultimately that the Chinese developed nuclear weapons capability in 1964 (Duffy 1979). Chinese civil nuclear technology, led by the China National Nuclear Corporation (CNNC), has used French, Canadian, Russian, and American reactor designs to create fully independent Chinese designs, and the fleet of nuclear power plants in China is now the third largest in the world (International Atomic Energy Agency 2022).

In addition, the CNNC has planned for 150 reactors to be built by 2035, which would exceed the number built globally in the past 35 years (Murtaugh and Chia 2021). Success in this would endow China with the largest civil reactor fleet in the world. While these plans are unconfirmed beyond statements outlined by Chairman Xi, China already has 25 domestic nuclear reactors under construction, and concrete plans to build another 44 more (World Nuclear Association 2023a). Should these plans see completion, China will surpass the United States in terms of both total number of domestic commercial reactors, as well as total electrical output from their reactors.

With China and the US competing worldwide, China has turned to the Belt-and-Road Initiative (BRI) to seek influence abroad and create markets for Chinese companies, with a strategy of to build 30 overseas reactors to build influence abroad (Bing-Ming 2021). Chinese nuclear plants are already operational in Pakistan, and in July 2023 the two countries signed an agreement to build the largest civilian nuclear plant in Pakistan by 2030 for $3.5B (Gul 2023). Another planned Chinese reactor build in Argentina is stalled pending negotiations regarding the prospect of China bearing even more than the 85% of project financing it is already providing (Bernhard 2022). Saudi Arabia is evaluating a CNNC offer to build a nuclear plant, which Riyadh expressly understands as a way to gain leverage on the United States (Said, Hua, and Nissenbaum 2023). As the map shows (see chart 1), the wide-ranging nature of the BRI means China has plenty of possibilities for export, posing a clear strategic threat to the US-led international order.

Sources: Fanhai International School of Finance 2023, US Department of Energy 2023, Graphic created by author (recreated).

China views an expanded nuclear sector and more Chinese reactors abroad as vital to the long-term, strategic undermining of the US. And as seen in other BRI projects, China is willing to take large commercial losses to achieve geopolitical advantage. This resembles Russia’s strategy before the invasion of Ukraine to use natural gas exports as leverage. The core difference is that China is offering this challenge in the nuclear space, which features sub-issues like nuclear proliferation norms, advanced technology sharing, and longer-term political dependencies. Those dependencies can stretch for decades given the commercial lifespans of nuclear plants, the value of operational and maintenance know-how, supply chain complexity, and the integral role that these facilities have, once installed, in ensuring a smoothly functioning electricity grid.

On China’s civil nuclear expansion, the Pentagon said it is “likely that Beijing intends to use this infrastructure to produce nuclear warhead materials for its military in the near term.” (Department of Defense, 2023). China views an expanded civil nuclear program as a dual-use technology, valuable both for civilian ends like decarbonization, reliable power, and export, but also as key to improving its procurement of nuclear military hardware.

This blatant challenge to US nuclear security is bolstered by cooperation between Russia and China in building two fast breeder reactors (which create more nuclear material than they consume), “each capable of producing enough plutonium for dozens of nuclear warheads” (Department of Defense, 2023). Civil nuclear technology can easily cross into military uses, and Canadian policymakers must be aware of the risks, especially given that Cameco signed an agreement to supply 12.7M metric tons of uranium per year to the China Nuclear International Corporation (Cameco, 2023), which is significantly higher than the 2021 Chinese uranium consumption of 9.56M tons (Statista, 2023). Excess Canadian uranium could end up being refined into fuel for nuclear weapons.

Russia

Russian influence in civil nuclear technology originates from the days of the Soviet Union which, like the Eisenhower Administration, recognized the value of nuclear reactor exports in advancing their geopolitical position. During the Cold War, the USSR required Warsaw Pact members who bought Soviet nuclear reactors (Bulgaria, Poland, Czechoslovakia, East Germany, Hungary, and Romania) to obtain all fuel, technology, construction, and waste disposal from the USSR, and prohibited nuclear weapons development (Duffy 1979). After the fall of the Soviet Union, Russia continued to maintain those links, with the state-controlled nuclear company, ROSATOM, assuming the mantle of Soviet state providers.

Today, ROSATOM is the world’s leading company in new reactor builds, uranium enrichment, and research reactors, and supplies fuel to 17% of the global fuel market, or 78 reactors in 15 countries worldwide (ROSATOM 2023). Like the Kremlin’s use of natural gas as a coercive instrument, nuclear fuel supply could be used as an effective tool of influence. Indeed, the 2022 Russian invasion of Ukraine has caused many of these formerly reliant countries to cancel plans for future Russian construction of domestic nuclear plants, including in Finland and the Czech Republic. Consequently, those countries are now turning to the West for nuclear technology.

The United States

In the 70 years since President Eisenhower spoke at the UN, US nuclear leadership provided benign global stewardship on non-proliferation, and safe electricity generation around the world. We must seek to preserve this US-led stability as, without it, the world would be much more dangerous for all.

Without a clear response to global shifts uncertainty in American civil nuclear policy will leave strategic allies nervous and potentially willing to turn to America’s geopolitical rivals for their energy needs. The world is still undergoing rapid electrification in response to demand for higher living standards across the developing world. Ceding ground to geopolitical adversaries in nuclear power generation should be unthinkable.

Thankfully, American policymakers understand the urgency and have taken steps to help reverse the trends. In the wake of the Russian invasion of Ukraine, the US has secured a number of bilateral nuclear export and cooperation deals with the Czech Republic (Associated Press 2023), Poland (Westinghouse 2022), Bulgaria (Department of State 2020), and Romania (Reed 2022) , as well as the Philippines (DoS 2023). There is still strong global demand for safe and secure American reactors and benign American leadership.

Canada’s Commercial Path Forward

Canada’s ability to be a meaningful partner in this space is evident. Given our historical successes in exporting safe nuclear technology for civilian use abroad, there is no reason we cannot continue to do so. With a new policy emphasis on supporting this sector, we could add even more economic impact to an already high-value producer.

One of the advantages that our rivals, China and Russia, bring to the table in negotiations with other countries is their ability to provide massive amounts of financing, which can prove enticing for cash-strapped countries. Without this advantage, Western nuclear companies will struggle to break into developing economies as the upfront capital costs of developing a new nuclear plant are too high. As Canada’s recent deal with Romania shows, Canadian policymakers have demonstrated they understand the benefits of supporting the nuclear industry with export financing.

In addition to being at the forefront of SMRs, Canada is also at the vanguard of microreactors, with Saskatchewan looking to be the first to deploy a microreactor by 2029, in partnership with Westinghouse (Westinghouse, 2023). Microreactors have about 1/60 of the output of SMRs (at about 5MW) and have the potential to address remote needs that would not be sufficient to justify the use of an SMR. A microreactor would still be enough to power 750 homes, and thus represent another potential commercial market on a smaller scale.

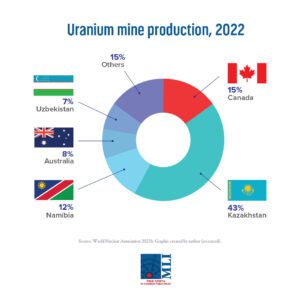

In terms of raw materials, Canada is endowed with very high grade uranium reserves, the third largest in the world (smaller than only Australia and Kazakhstan) (World Nuclear Association 2023b). We also have a robust uranium mining sector, based in northern Saskatchewan’s Athabasca Basin, which allows Canada to be the world’s second largest uranium exporter (see chart 2). Signalling the importance of this sector, Ottawa included uranium as a critical mineral in its Critical Minerals Strategy, making it eligible for the 30% tax credit on exploration for new deposits (MNR and MISI 2023). Several new projects are being advanced in the Athabasca Basin, including the world class Rook I project, which received environmental assessment approval in November 2023.

Source: World Nuclear Association 2023b. Graphic created by author (recreated).

Canada’s Path Forward for Security

From a security perspective, Canada also stands to benefit by seeing its robust nuclear supply chain assume a larger global share in the coming SMR market. Not only will this increase domestic economic development, but it will also offer our friends and allies abroad increased options to avoid Russian or Chinese nuclear technology and services. Utilizing our domestic capacity to provide uranium fuel along with specialized nuclear services can also allow others to pivot from reliance on Russia and China, as we have already seen in Eastern Europe. We should actively seek to deny these gains to Russia and China.

Canada also possesses advantages that America lacks, simply by virtue of being Canadian. As a stalwart member of the Western political community, we can help countries seeking to decouple from China and Russia, but who are otherwise skeptical of over-reliance on the Americans. This advantage could be quite real in countries in Southeast Asia and Eastern Europe.

Filling this gap is important because of the multi-decade commitment that countries make when using foreign nuclear power. The nature of these deals is not limited to the initial design and build, but also extends into fuel supply and ongoing operations and maintenance of the plant. Given the baseload power role that nuclear power plays in national electricity grids, it is not easily replaced, and the costs of the plants themselves mean that they are prohibitively expensive to retire early.

Of course, with uranium and nuclear expertise exported abroad, there is also the need to discuss how to constrain nuclear proliferation. Canadian expansions of nuclear power must come with a recognition that, by expanding global nuclear use, we will also be held responsible for the provision of robust oversight. Beginning in the 1950s, Canada worked with India on developing domestic civilian power plants, whose technology was reverse-engineered by Indian scientists, and directly led to India developing nuclear weapons. In turn, this led to Pakistan developing nuclear weapons of their own. This was a massive geopolitical error on the part of Canada, as safeguards did not exist in a meaningful way to prevent development of weapons. We must be cognizant of this danger. If this happened in the future, there would be serious questions raised about our competence and trustworthiness to keep the worlds’ most dangerous weapons from spreading. Having once erred, we must be doubly certain about the effectiveness of our non-proliferation tools in the future.

Recommendations

Canada has a meaningful role to play in developing nuclear technology and exporting it around the world. The announcement at COP28, from Canada and 21 other countries that committed to triple the global amount of nuclear power by 2050 (Gross, 2023), clearly demonstrates that there is growing interest and investment in nuclear power around the world. There is much to like about this announcement, as it addresses global emissions reductions, improves living standards in the rest of the world, drives a high-value, high-tech industry at home, and helps to deny the expansion of authoritarian influence.

Cameco, Westinghouse and OPG represent “national champion” companies that can help each other grow and develop new business by filing out each other’s expertise in their respective parts of the nuclear value chain. This will assist the Canadian economy by providing greater self-sustaining original economic value. These companies will need a stable domestic business environment to support long-term nuclear projects and new R&D. The government must be cognizant of the unintended consequences of various policies that might impact the plans of Canada’s nuclear industry, and should consult with these companies to build alignment where possible.

Ottawa should also seek to deliver more funds for the development of nuclear projects at home to help bring down the cost curve for new projects and make Canadian builds more competitive abroad. The recent announcement in the 2023 Fall Economic Statement that nuclear energy is eligible under the Green Bond Framework, after its unfortunate exclusion in 2022, is a good step forward.

The Canadian Nuclear Safety Commission (CNSC) is a world class and highly respected regulator, and yet Canada has gotten much wrong in industry regulation in recent years. We must guard against politicization or interference in the mandate of the CNSC and support it to do its work efficiently. An efficient regulator would provide a competitive advantage in developing and piloting new advanced reactor technologies as they emerge.

Canada must also authorize greater amounts for Export Development Canada to provide more attractive long-term financing rates for nuclear energy services and products abroad. Where our financing terms cannot best those of our competitors, we must emphasize Canadian safety standards that are lacking in others’ designs.

Canadian production of uranium and related fuel can also be used strategically. Facilitating long term supply contracts will enhance our allies’ energy security, and Canada’s role in it, while also denying that influence to our adversaries.

Finally, we must also recognize that we do not have to win every bid to be successful in the long-term. Allies like France, South Korea, and the United States all have nuclear companies competing in the same space alongside the Russians and the Chinese. There may be circumstances where the national priorities and political calculations of allies are stronger than ours, and we should recognize that the reverse will also be true. By working together with our allies to forward nuclear energy, we can deny authoritarian advances and foster domestic economic prosperity.

About the author

Andrew Evans is an experienced Canadian policy professional. He is currently studying for a Master of Public Administration in Energy Policy from Columbia University. Prior, he served as the Director of Policy in the Office of Ontario’s Minister of Environment, Conservation and Parks. Other previous roles include time spent as a Senior Policy Advisor in the Office of the Minister of Energy and as a Special Assistant in the Office of the Premier of Ontario. Andrew also contributes regular articles to TheHub.ca on current energy, environmental, and political issues.

Andrew holds a Bachelor of Arts in Political Science from the University of Waterloo.

References

Associated Press. 2023. “US Westinghouse to supply fuel to both Czech nuclear plants.” March 29. Available at https://apnews.com/article/czech-westinghouse-nuclear-fuel-cez-rosatom-42bd1f8b2be09fa9cb218157bfd122c3.

Atomic Energy of Canada Ltd. 2006. Archived company profile. Available at https://web.archive.org/web/20060116073221/http:/www.aecl.ca/index.asp?layid=3&menuid=20&csid=47.

Bernhard, Isabel. 2022. “Why Argentina’s Nuclear Power Project with China has stalled”. The Diplomat. Available at https://thediplomat.com/2022/12/why-argentinas-nuclear-power-project-with-china-has-stalled/.

Bing-Ming, Chen. 2021. China’s Nuclear Dragon Goes Abroad, Center for International Private Enterprise. Available at https://www.cipe.org/

Canada. 2023. Ministry Natural Resources Canada, and the Ministry of Innovation, Science and Industry, The Canadian Critical Minerals Strategy. Available at https://www.canada.ca/en/campaign/critical-minerals-in-canada/canadian-critical-minerals-strategy.html.

Canada. 2018. Natural Resources Canada. Canada’s SMR Roadmap. Available at https://smrroadmap.ca/

Cameco, 2023. Cameco Marks Uranium Supply Agreement with China Nuclear International Corporation. Available at https://www.cameco.com/media/news/cameco-marks-uranium-supply-agreement-with-china-nuclear-international-corp

Duffy, Gloria. 1979. Soviet Nuclear Energy: Domestic and International Policies. Rand Corporation.

Fanhai International School of Finance, Fudan University, 2023. “Countries of the Belt and Road Initiative (BRI)”. Available at https://greenfdc.org/countries-of-the-belt-and-road-initiative-bri/

Gross, Jenny. 2023. “22 Countries Pledge to Triple Nuclear Capacity in Push to Cut Fossil Fuels”. New York Times. Available at https://www.nytimes.com/2023/12/02/climate/cop28-nuclear-power.html

Gul, Ayaz. 2023. “China Begins Construction of Pakistan’s Largest Nuclear Power Plant”, Voice of America News. Available at https://www.voanews.com/a/china-begins-construction-of-pakistan-s-largest-nuclear-power-plant-/7181016.html

International Atomic Energy Agency, Nuclear Share of Electricity Generation in 2022. Available at https://pris.iaea.org/pris/worldstatistics/nuclearshareofelectricitygeneration.aspx

International Energy Agency. 2023. World Energy Outlook 2023. Available at https://www.iea.org/reports/world-energy-outlook-2023#overview

Larson, Aaron. 2022. “Canada’s OPG and Czech Republic’s ČEZ Partner to Advance SMR and Other Nuclear Technology.” POWER Magazine. Available at https://www.powermag.com/canadas-opg-and-czech-republics-cez-partner-to-advance-smr-and-other-nuclear-technology/

Murtaugh, Dan and Krystal Chia. 2021. “China’s climate goals hinge on a US$440B nuclear buildout.” BNN Bloomberg. Available at https://www.bnnbloomberg.ca/china-s-climate-goals-hinge-on-a-440-billion-nuclear-buildout-1.1675953#.YYHKZ8D765E.twitter

NewsWire, 2023. “OPG joins international group to advance new nuclear.” Available at https://www.newswire.ca/news-releases/opg-joins-international-group-to-advance-new-nuclear-833156041.html

Nuclear Engineering International Magazine. 2023a. “Cameco signs major uranium supply deal with Ukraine.” Available at https://www.neimagazine.com/news/newscameco-signs-major-uranium-supply-deal-with-ukraine-10593236

Nuclear Engineering International Magazine. 2023b. “Cameco and Brookfield receive regulatory approval to acquire Westinghouse.” Available at https://www.neimagazine.com/news/newscameco-and-brookfield-receive-regulatory-approval-to-acquire-westinghouse-11282477

Nuclear NewsWire. 2022. “Vogtle project update: Cost likely to top $30 billion.” Available at https://www.ans.org/news/article-3949/vogtle-project-update-cost-likely-to-top-30-billion/

Nuclear NewsWire. 2023. “Canada commits to C$3 billion for CANDU project in Romania”, Available at https://www.ans.org/news/article-5409/canada-commits-to-c3-billion-for-candu-project-in-romania/

Nuclear NewsWire, 2023. “Westinghouse, OPG to explore reactor deployment opportunities” Available at https://www.ans.org/news/article-5575/westinghouse-opg-to-explore-reactor-deployment-opportunities/

Polskie Radio. 2023. “PM hails Polish-Canadian cooperation in nuclear energy.” Available at https://www.polskieradio.pl/395/7786/artykul/3181719,pm-hails-polishcanadian-cooperation-in-nuclear-energy

Reed, Stanley. 2022. “U.S. moves toward supplying Romania with a new style of nuclear plant.” New York Times. Available at https://www.nytimes.com/2022/05/23/business/romania-nuclear-power.html

ROSATOM. 2023. “About Us.” Available at https://www.rosatom.ru/en/about-us/

Said, Summer, Sha Hua and Dion Nissenbaum. 2023. “Saudi Arabia Eyes Chinese Bid for Nuclear Plant.” Wall Street Journal. Available at https://www.wsj.com/world/middle-east/saudi-arabia-eyes-chinese-bid-for-nuclear-plant-e4a56f

Statista, 2023. Consumption of uranium in China from 2014 to 2021, Available at https://www.statista.com/statistics/1143485/uranium-consumption-in-china/

US Department of Defense, 2023. Military and Security Developments Involving the People’s Republic of China. Available at https://media.defense.gov/2023/Oct/19/2003323409/-1/-1/1/2023-MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA.PDF

US Department of Energy, 2023. 123 Agreements for Peaceful Cooperation. Available at https://www.energy.gov/nnsa/123-agreements-peaceful-cooperation

US Department of State. 2020. U.S.-Bulgaria Sign Nuclear Cooperation Memorandum of Understanding. Available at https://2017-2021.state.gov/u-s-bulgaria-sign-nuclear-cooperation-memorandum-of-understanding/index.html.

US Department of State. 2023. Secretary Antony J. Blinken At the Philippines 123 Agreement Signing Ceremony. Available at https://www.state.gov/secretary-antony-j-blinken-at-the-philippines-123-agreement-signing-ceremony/.

US Energy Information Agency. 2023a. How old are U.S. nuclear power plants, and when was the newest one built?. Available at https://www.eia.gov/tools/faqs/faq.php?id=228&t=21.

US Energy Information Agency. 2023b. Nuclear Explained. Available at https://www.eia.gov/energyexplained/nuclear/us-nuclear-industry.php.

Westinghouse. 2022. “Westinghouse Selected for Poland’s New Nuclear Power Program.” Available at https://info.westinghousenuclear.com/news/poland-selects-wec-ap1000.

Westinghouse. 2023. “Westinghouse and Ukraine’s Energoatom Pursuing Deployment of AP300™ Small Modular Reactor to Meet Climate, Energy Security Goals.” Available at https://info.westinghousenuclear.com/news/westinghouse-and-ukraines-energoatom-pursuing-deployment-of-ap300-small-modular-reactor-to-meet-climate-energy-security-goals.

Westinghouse, 2023. “First Canadian eVinci™ Microreactor Targeted for Saskatchewan”, Available at https://info.westinghousenuclear.com/news/first-canadian-evinci-microreactor-targeted-for-saskatchewan

World Nuclear Assocation. 2023a. Nuclear Power in China. Available at https://world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-power.aspx.

World Nuclear Association. 2023b. World Uranium Mining Production. Available at https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx#.UZ9-sJynE-0.