By Lawrence L. Herman, September 15, 2022

By Lawrence L. Herman, September 15, 2022

We are in the last stages of a consultation process launched by the federal government this past June with the recent release of a government discussion paper titled “Canada’s Critical Mineral’s Strategy.” The paper defines critical minerals as those required for a low-carbon future and “essential to Canada’s economic security” and critical for Canada’s partners and allies. While it lists 31 of these minerals, its focus, at least for starters, is on lithium, graphite, nickel, copper and rare earth elements.

Views are to be sent in by mid-September and will be factored into a much larger policy called the “Canadian Minerals and Metals Plan” under development in consultation with the provinces and industry. Little comment has been made in the media about this plan or about the June discussion paper. Both are important pieces of the federal government’s evolving policy in the critical minerals field.

Among other things, the discussion paper seeks input on how to support Canada’s economic growth and competitiveness in the sector, including strengthening value chains, dealing with climate action and formulating best environmental, social, and governance (ESG) practices. The paper refers briefly to Canada’s trade agreements with several countries, including an almost forgotten Canada-US critical minerals action plan agreed to between Prime Minister Trudeau and President Biden in January 2020.

While including trade relations as part of an overall approach to critical minerals policy, the paper doesn’t discuss broader elements of trade policy or explain what is meant by Canadian security interests in this whole area. It makes no reference to Canada’s system of export controls, which must be considered as a main element in any critical minerals strategy.

Export controls versus sanctions

Before getting to export controls, it’s necessary to point out how these differ from economic sanctions, much in the news as Canada and western allies apply these in ever-widening scope against Russia in response to its invasion of Ukraine. Sanctions have been around for a long time but Russian aggression has taken their use to a significantly higher level.[1]

Sanctions are a responsive economic weapon, employed in reaction to actions of nasty foreign governments like Russia, or their surrogate bad actors. They’re used in lieu of military responses, showing that while the armed forces aren’t being sent in, offending governments will still face consequences for breaching treaties or norms of inter-state conduct. Once broad in nature, modern sanctions are growing increasingly tactical.

When it comes to strategic tools – as opposed to tactical responses – we move to the domain of export controls, a key trade weapon when it comes to any comprehensive critical minerals policy.

Exports of strategic goods

Export controls aren’t much discussed publicly but they are used extensively by most western governments, including Canada. They are meant to prevent or limit goods or technologies being shipped out of the country that could be used to produce nuclear and non-nuclear weapons, or have other uses detrimental to global peace and security. They apply globally, beyond a single targeted country as in the case of sanctions. In distinction to the tactical nature of sanctions, export controls are a strategic trade tool.

Canada’s system is governed by the Export and Import Permits Act (EIPA), prohibiting exports of any item on the Export Control List (ECL) without a permit issued by the Minister of Foreign Affairs.

The ECL is created by order in council (i.e., by the federal cabinet) under section 3 of EIPA. The ECL is contained in full in “A Guide to Canada’s Export Control List,” the most recent version issued in December 2020. More about the ECL and how it is administered is explained on the Global Affairs Canada website, which also includes the Minister’s Annual Report on EIPA submitted to Parliament.[2]

Critical minerals: The China dimension

When considering export controls as a strategic instrument, there’s a connection with China’s aggressive search for critical minerals and recent controversies over Chinese state-owned enterprises (SOEs) investing in Canadian mineral assets. As Nial McGee notes, “For the past two decades, China has built up a powerful position in Canada’s critical minerals and mining sector, with little oversight from Ottawa.” Policy decisions involve Canadian obligations under its 2014 investment treaty with China,[3] and the national security component of investment reviews under the Investment Canada Act, providing a basis for Canada to use export controls as a strategic tool.

All goods and technology on the ECL require an export permit. Permits are up to the Foreign Affairs Minister and can be refused when the Minister, in consultation with other ministers, decides that such exports would not be in the national interest.[4] This discretion could apply – in theory – to exports of critical minerals but for the fact that they are absent from the ECL, a point addressed below.

Missing elements

Section 3 of EIPA allows the ECL to be created, among other things:

(a) to ensure that arms, ammunition, implements or munitions of war, naval, army or air stores or any articles deemed capable of being converted thereinto or made useful in the production thereof or otherwise having a strategic nature or value will not be made available to any destination where their use might be detrimental to the security of Canada.[5] (emphasis added)

Paragraph (a) is the only reference in the statute to Canadian security interests. Moreover, the reference is confined to “arms, ammunition, instruments of war” or items that can be converted into these things, or “otherwise having a strategic nature or value” that can be used for military and war purposes detrimental to Canadian security.

What is missing in EIPA is the authority to include items on the ECL that have security implications for Canada beyond explicit military or quasi-military uses. This would include critical minerals which, as already mentioned, is defined in the discussion paper as “essential to Canada’s economic security.”

As it stands, individual items of controlled goods and technology are found in eight different ECL groups, including Group 5 (Miscellaneous Goods and Technology). There are large numbers of non-strategic items in Group 5, like logs, softwood lumber, peanut butter and even on dog and cat food (yes, dog and cat food) but, as stated earlier, no separate listing or category comprising critical minerals.[6]

Finally, there’s the China dimension. With obvious national security concerns regarding China’s weaponized commercial practices, a provision is needed for additional ministerial powers regarding critical minerals, particularly in their jurisdiction over the permit granting process.

Conclusion

The article speaks about how Canada should develop its value chains as global competition for these strategic resources intensifies. Some of these issues inevitably involve Canada’s foreign direct investment policy, with heightened concerns about Chinese companies acquiring Canadian assets in this sector. Export controls are where international trade, foreign investment review and critical minerals strategy converge.

Two specific conclusions flow from this.

First, as an immediate matter, to ensure Canada’s interests are safeguarded pending the enunciation of a comprehensive strategy, the ECL needs to be enlarged to include critical minerals as controlled goods, with amendments to the law to clarify the minster’s authority in this area.

Second, because export controls are a vital strategic tool, any Canadian critical minerals policy that unfolds from these consultations has to include the use of export controls as a major component.

The challenge of economic decoupling amidst an integrated, globalized trading network brings to focus needed updates to Canadian commercial instruments, from sanctions to permits, trade promotion to investment facilitation. Modernizing Canadian legislation requires the urgent attention of the federal government to act with the same ambition as Canadian allies have.

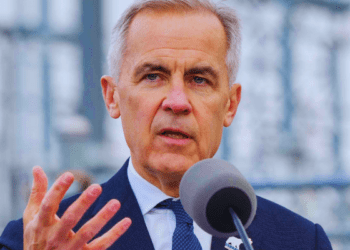

Lawrence L. Herman is international trade counsel at Herman & Associates and Senior Fellow of the C .D. Howe Institute, Toronto.

[1] Sanctions are applied by cabinet order under the Special Economic Measures Act (SEMA). The most recent version, amended in 2022, says (in section 3.1) that the legislation’s purpose, “is to enable the Government of Canada to take economic measures against certain persons in circumstances where . . . a grave breach of international peace and security has occurred, gross and systematic human rights violations have been committed in a foreign state or acts of significant corruption involving a national of a foreign state have been committed.” Canadian sanctions apply in other instances to prevent dealings in places like Iran, Syria, Sudan, Myanmar, etc. In addition to sanctions under SEMA, Canada also applies multilateral UN mandated sanctions under the United Nations Act.

[2] GAC issues regular notices to exporters on the operation of EIPA and the administration of the controlled goods program under the legislation: https://www.international.gc.ca/controls-controles/notices_avis/exp/list_liste/index.aspx?lang=eng#mil

[3] The Foreign Investment Promotion and Protection Agreement (FIPA), signed in 2014 after 20 years of negotiations, is meant to provide access to market and ensure fair treatment to Chinese companies operating in Canada and vice-versa.

[4] In a 2017 case, Turp v. The Minister of Foreign Affairs, an application was made to have the Federal Court quash a permit to export light armoured vehicles to Saudi Arabia. The Court rejected the application, stating that the Minister exercised broad discretion under the statute.

[5] There are other paragraphs in section 3 that authorize the ECL to include things like raw logs, dairy products, guns and ammunition, softwood lumber, clothing, seafood, textiles and apparel so as, (1) to ensure that any action taken to promote the further processing in Canada of a natural resource that is produced in Canada is not rendered ineffective by reason; (2) to implement an intergovernmental arrangement or commitment; or (3) to ensure that there is an adequate supply and distribution of the article in Canada for defence or other needs.

[6] While the list includes chemicals or alloy compounds containing some forms of critical minerals, such as lithium or carbon, there are no items in Group 5 listing any of the minerals themselves in either pure or refined state.