OTTAWA, ON (October 3, 2019): In the wake of the 2008 recession, governments embarked on a strategy of unprecedented stimulus spending. This strategy continues to this day, but despite a decade of continuous monetary and fiscal stimulus, Canada’s economy has little to show for it.

OTTAWA, ON (October 3, 2019): In the wake of the 2008 recession, governments embarked on a strategy of unprecedented stimulus spending. This strategy continues to this day, but despite a decade of continuous monetary and fiscal stimulus, Canada’s economy has little to show for it.

In MLI’s latest Quarterly Economic Report, Munk Senior Fellow Philip Cross examines the modest economy, finding that its performance bodes poorly given the amount of resources and effort poured into trying to spur long-term growth. At best, Cross finds that Canada is poised for moderate growth in the near future, building on the meager economic growth that has persisted for a decade.

“Government actions in recent years did not materially increase long-term growth,” explains Cross. He says that this stands in stark contrast to “the promise that stimulus would not just cushion the downturn but also speed up the recovery.”

While economic growth for the second quarter of 2019 was respectable, rising by 0.9 percent, the overall trend for the past few quarters has only translated to 1.4 percent in real GDP growth. This growth is certainly better than a recession but MLI’s Leading Economic Indicator is pointing to subdued growth for the remainder of the year due to weakness in the global economy and a Canadian economy relying heavily on the success of the housing industry.

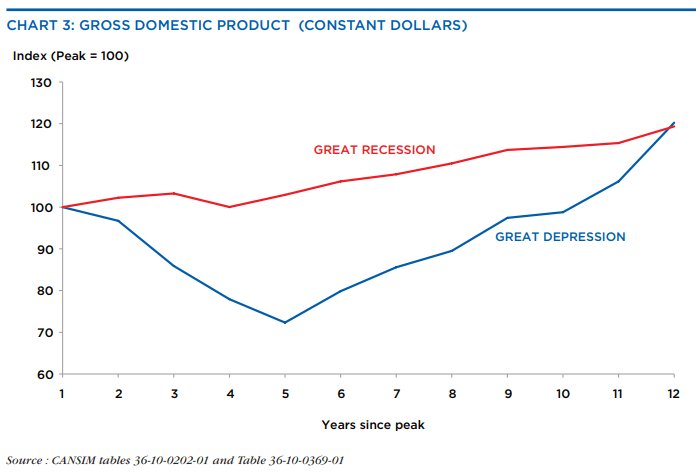

In this context of persistently weak long-term growth, Cross finds parallels between the last ten-year period and the decade following the Great Depression.

“It is remarkable that 11 years after the peak of economic activity (1929 for the Great Depression and 2008 for the Great Recession), real GDP has arrived at exactly the same point with a net gain of 20 percent over the 11 years of recession and recovery in both cycles,” explains Cross.

However, the notable difference is that the recovery since 2008 has been fuelled by unprecedented stimulus efforts that dwarf the monetary and fiscal stimulus experienced in the wake of the Great Depression. While stimulus has perhaps helped avoid the deep and damaging loss of GDP experienced in the late ‘20s, the recovery following the Depression was markedly faster than what our economy has experienced since 2008.

This is to say that the Depression was characterized by a steep loss of income followed by a quick recovery, whereas the Recession was characterized by a milder loss but several years of much slower growth. In terms of which is preferable, Cross says that it is a value judgment beyond the scope of statisticians or economists. That said, he argues that “the persistence of mediocre growth for over a decade is a sobering reminder of the failure of extraordinary monetary and fiscal stimulus to boost faster growth.”

To learn more, read Cross’ full quarterly economic report, Unprecedented Stimulus has Failed to Spur Long-Term Growth.

***

Philip Cross is a Munk Senior Fellow at the Macdonald-Laurier Institute. Prior to joining MLI, Mr. Cross spent 36 years at Statistics Canada specializing in macroeconomics. He was appointed Chief Economic Analyst in 2008 and was responsible for ensuring quality and coherency of all major economic statistics.

Cross’s Quarterly Economic Reports provide analysis of the latest economic data and results of the Macdonald-Laurier Institute’s Leading Economic Indicator, designed to signal an upcoming turn in the business cycle, either from growth to recession or from recession to recovery, six months in advance.

For more information please contact:

Brett Byers-Lane

Communications and Digital Media Manager

613-482-8327 x105

brett.byers-lane@macdonaldlaurier.ca