Cross outlines why the oil sands should be classified as part of Canadian manufacturing and how that reveals a strikingly different picture of the Canadian economy

Cross outlines why the oil sands should be classified as part of Canadian manufacturing and how that reveals a strikingly different picture of the Canadian economy

OTTAWA, Sept. 28, 2017 – Critics of the oil sands argue that Canada has been the victim of the so-called “Dutch Disease,” where a booming resource sector hampers manufacturing. In this narrative, growth in the oil sands has a negative impact on Canada’s manufacturing sector. Yet such a narrative ignores how technological change is blurring the delineation between industries.

The oil sands do not follow the “rip and ship” model of extracting that is commonly associated with natural resources and mining. Instead, it involves processing raw oil sand ore into bitumen, and some bitumen is upgraded to produce both intermediary and final products.

Munk Senior Fellow Philip Cross, a respected thought leader on fiscal and economy policy, provides an in-depth examination of why we should treat the oil sands as manufacturing rather than mining in a new paper for the Macdonald-Laurier Institute.

“Classifying the oil sands as manufacturing changes much of Canada’s recent economic history,” writes Cross.

To read the full paper, titled “Producing Black Gold: Understanding the Oil Sands as Part of Manufacturing in Canada,” click here.

Classification isn’t just an issue of interest to accountants and statisticians. Nor is it just a word game. It fundamentally affects how analysts understand and frame how the economy functions and how it is evolving.

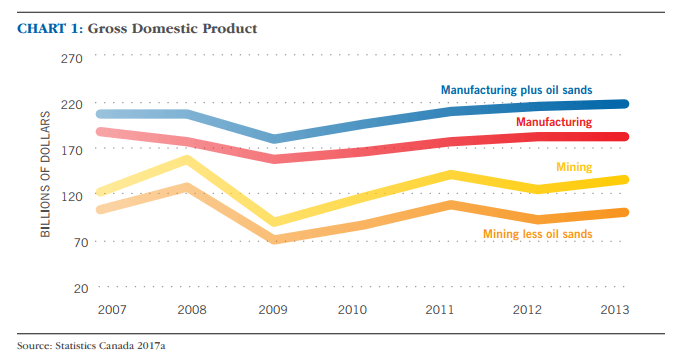

By treating oil sands as manufacturing, the declining trend in mining would be further magnified, shrinking in terms of GDP from over $100 billion before the recession to just $98.9 billion in 2013. It would also make manufacturing more than twice as important as mining, growing from $207 billion before the recession to a new high of $219 billion in 2013.

In such a narrative, the oil sands would not be a drag on Canada’s manufacturing economy, as put forward in the a simplistic (and false) narrative of the “Dutch Disease.” Instead, Canada’s manufacturing sector would actually be expanding and thriving. Indeed, the oil sands would symbolize the successful transition of Canada’s manufacturing sector from traditional industries, such as autos and clothing, and furniture, to those based on natural resources and capital goods.

As Cross concludes, these industries “have proved they can survive a brutal global recession and thrive in an environment where the Canadian and US dollar are at par.”

***

Philip Cross is a Munk Senior Fellow with the Macdonald-Laurier Institute. He previously served as the Chief Economic Analyst for Statistics Canada, part of a 36-year career with the agency.

The Macdonald-Laurier Institute is the only non-partisan, independent national public policy think tank in Ottawa focusing on the full range of issues that fall under the jurisdiction of the federal government.

For more information, please contact David Watson, managing editor and director of communications, at 613-482-8327 x103 or email at david.watson@macdonaldlaurier.ca.