This article originally appeared in the Hub.

By Trevor Tombe, October 31, 2024

Canada is stuck in a growth rut. Our economy is not just trailing the United States; it’s falling behind many other advanced economies. The size of Canada’s economy per person will fall below the OECD average for the first time in over 50 years this year, a troubling milestone for a once-leading nation.

What can we do to change course?

We should look abroad for answers. One country in particular has been leading the world on growth and productivity: Ireland.

By looking at what policies they have in place, especially on taxes, we might find ways to get Canada back on track.

Ireland leads the world

It’s hard to overstate how impressive Ireland’s economy and productivity have performed in recent years.

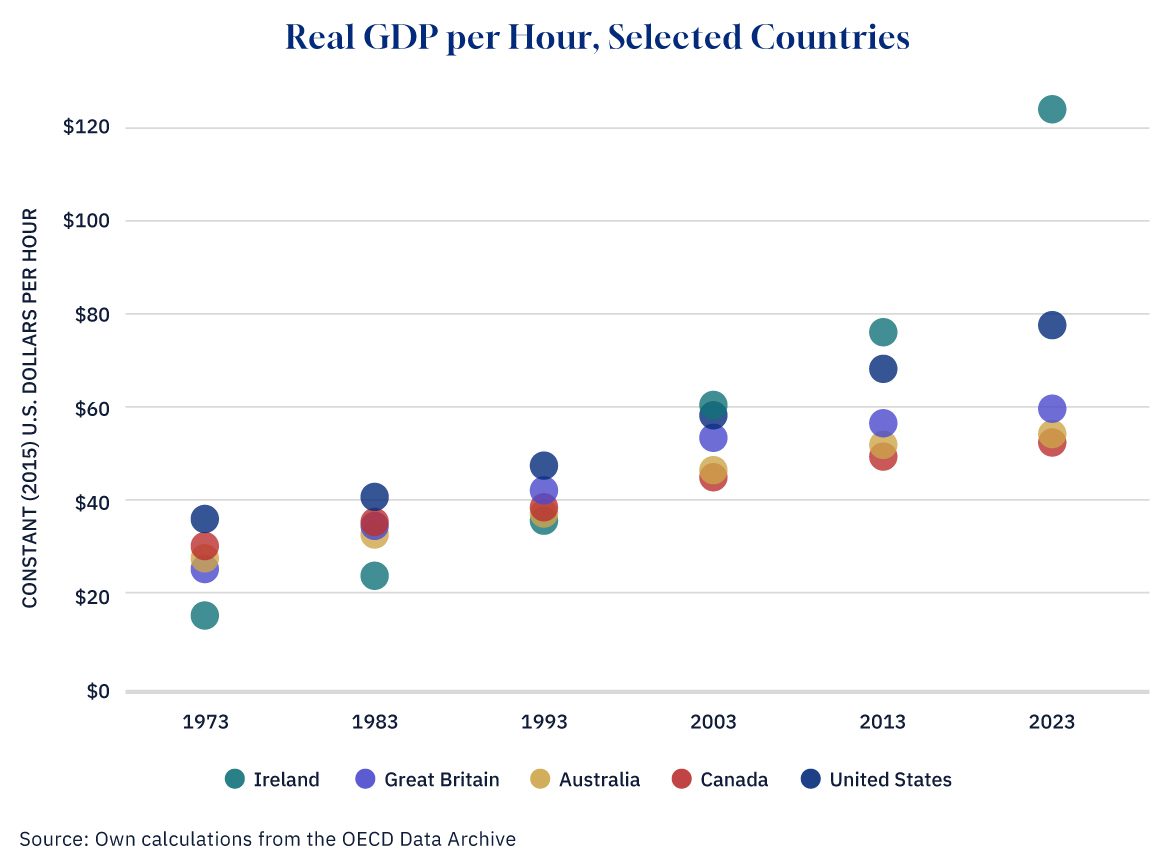

To get a sense, consider the following plot of how much each country produces in goods and services per hour worked (adjusted for inflation). In 1973, for example, the average American worker produced close to $40 per hour, a figure that has doubled today.

Ireland, meanwhile, has experienced a tremendous boom, with labour productivity climbing from below USD $20 per hour in 1973 (which was near the bottom, ahead only of Turkey) to over $120 per hour today (the highest productivity in the entire OECD).

In the 1970s and 1980s, Canada was just behind the US, but it has struggled to keep up since. Today, we’re behind Spain and Italy, while the gap with the U.S. has become a chasm.

Learning from the best

What did Ireland do right?

There is no single answer, and what worked in Ireland may not work here. But some aspects of their strategy warrant close attention.

Ireland’s small economy benefits from large, productive foreign firms, especially in software and pharmaceuticals, which significantly boost GDP per hour.

But it’s not only about foreign firms. Domestically, Irish-owned firms also show strong productivity, reaching €62 per hour—around 40 percent above the EU average and comparable to U.S. firms.

Of course, we shouldn’t just ignore foreign firms. They aren’t choosing Ireland on a whim. Policy matters. Ireland boasts a highly skilled workforce, high educational attainment, and strong ties with a large nearby economy (the EU)—all advantages that Canada shares, especially our tight integration with a large market through its free trade agreement with the United States.

However, one area where Ireland has a distinct advantage is its much more favourable tax environment—which Canada could emulate.

Don’t tax work and investment

For an average wage earner, personal income tax rates in Ireland are quite similar to those in Canada. However, as income levels rise, Canada becomes far less competitive.

In Ireland, the top marginal tax rate on personal income is capped at 40 percent, while in Canada, it ranges from 48 percent in Alberta to nearly 55 percent in Newfoundland and Labrador. The federal top rate of 33 percent accounts for most of that burden.

On the corporate side, Ireland also has a much lower tax rate than Canada—just 12.5 percent. This wasn’t always the case. In past decades, Ireland’s business tax rate reached as high as 50 percent in some years, but it dropped sharply over time, falling from 36 percent in 1997 to 12.5 percent by 2003, where it has remained since. In Canada, the combined federal and provincial corporate tax rate is roughly double (or more) the Ireland rate—ranging from 23 percent in Alberta (15 percent federal and 8 percent provincial) to 31 percent in Prince Edward Island (15 percent federal and 16 percent provincial).

Such high tax rates can significantly discourage top professional talent from moving to Canada and encourage our own local talent to leave (often for the U.S.). This makes it harder for highly productive firms to attract the required skilled workers. Similarly high tax rates on business income further discourage investment and growth as the after-tax returns from those investments are lowered.

For Canada to be as competitive internationally as Ireland, personal income taxes would need to fall by 8 to 15 percentage points, and corporate income taxes would need to fall by 10 to 19 percentage points.

There’s no free lunch, though, and such cuts require fiscal room to implement. So how does Ireland do it?

Tax consumption instead

To maintain their competitive tax rates, Ireland relies more heavily on consumption taxes. Its overall value-added tax (VAT)—their version of Canada’s GST—stands at 23 percent. This is significantly higher than Canada’s general sales tax rates, which include a federal rate of 5 percent and provincial rates that range from 0 percent to 10 percent.

If Canada were to increase its federal GST, if provinces raised their harmonized sales taxes, and if jurisdictions like Alberta introduced a harmonized sales tax, it could allow for big reductions in income tax rates. For instance, doubling the GST from 5 percent to 10 percent would generate substantial revenue—enough to cut income taxes by nearly one-fifth.

Big decisions ahead

Canada has big decisions ahead if we want to break free from our growth slump.

While major tax reform is challenging—and raising visible and often unpopular sources of revenue, like consumption taxes, is no fun—it’s a discussion we cannot avoid. Addressing the mounting prosperity and growth challenges we face requires nothing less.

There are also some simple solutions that might pay big dividends. We could, for example, shift our policy focus back to prosperity and competitiveness—making them central to our policy discussions rather than topics for occasional op-eds or academic debate. And on this point, Canada could take another cue from Ireland. There, they have a National Competitiveness and Productivity Council that provides accessible analysis and recommendations that keep these critical issues in the spotlight.

Adopting policies that reward work and investment over consumption and establishing a dedicated pro-productivity institution would be meaningful steps forward.

Hopefully the first of many more to come.

Because without real action, Canada risks settling for continued stagnation while others move ahead.