In late 2022, Canada finds itself staring down the barrel of a looming recession. While many of the warning signs on our country’s economic horizon are a result of factors outside of any individual policy-maker’s control, the situation that Canada now faces is an entirely predictable consequence of poor long-term policy choices.

We know this because Canada’s own history of fiscal discipline (or, more accurately, its absence) paints a clear and startling picture of what happens when governments allow deficits and debt to spiral out of control. Yet our history also provides cause for some hope, with a precedent that shows there is indeed a way for the federal government to course correct and usher in a new era of economic stability and prosperity.

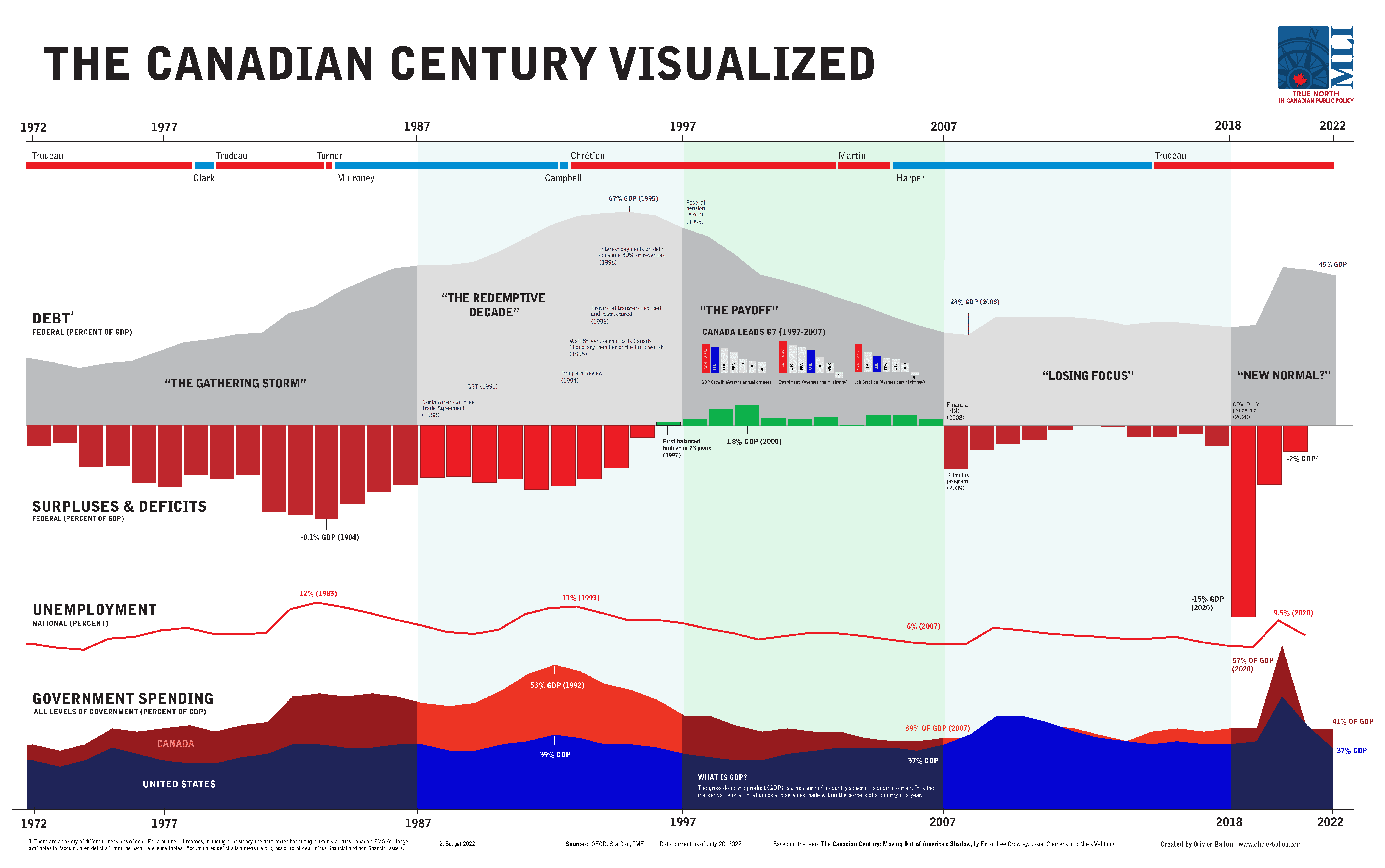

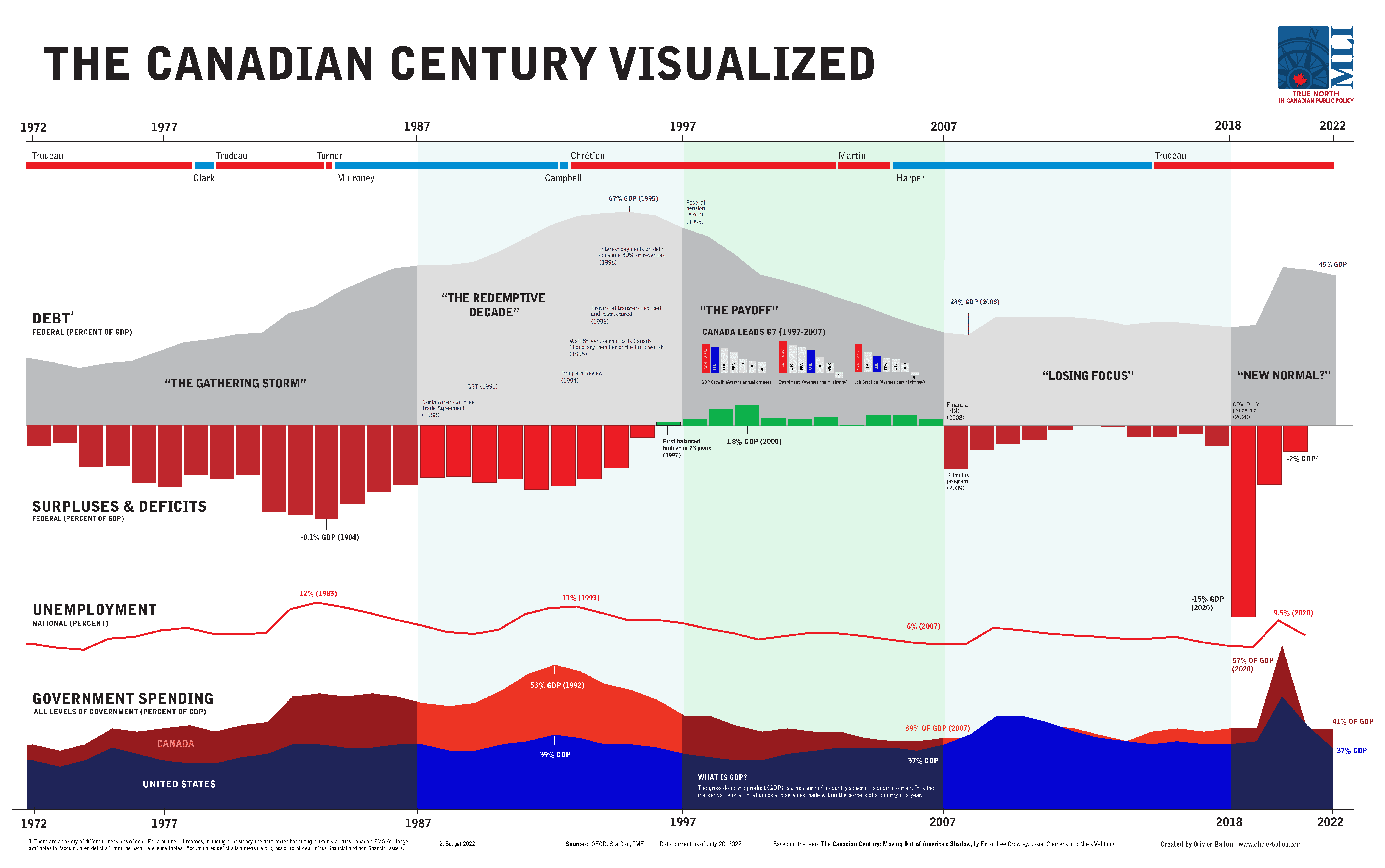

To shine a light on this fiscal history and find what lessons from the past may apply to Canada’s current economic challenges, the Macdonald-Laurier Institute has updated an infographic and project that the Institute first undertook more than a decade ago.

The Canadian Century

As our infographic shows, Canada sleepwalked into staggering deficits between 1973 and 1994, resulting in rising federal debt. Federal spending grew from 15 percent of the economy in 1965 to 23 percent by 1993. Parties of both stripes ran profligate deficits year after year, despite booming economic growth. By the mid-1990s, interest costs were eating up over one-third of federal spending.

But beginning with the federal Liberal Party’s 1995 budget, which subjected all government spending to intense review and cut public sector employment dramatically, the situation began to improve. Federal spending fell to just over 15 percent of the economy by 2008 and starting in 1997, surpluses became an annual event. Importantly, debt fell from over 70 percent of GDP to just under 30 percent by 2007. This allowed cuts to corporate and personal taxes, spurring even greater economic growth and even more revenue. As contentious as parts of this reform were, the results were staggering. In the decade following Canada’s first balanced budget in a generation, the Canadian economy boomed.

In 2015, we asked: what will the next decade bring? Now nearly a decade has passed; the federal government has abandoned fiscal discipline, and fallen into a dangerous new normal that threatens to keep our economy in a slow decline – the type of decline that takes considerable energy and political courage to reverse.

Losing focus

The global recession of 2008-2009 presented a challenge for the Harper government of the day. Stimulus spending promised quick benefits politically and economically. Though the Conservatives made consistent efforts to return to balance, they only did so after increasing Canada’s debt and erasing some of the hard-won gains ushered in by Chrétien and Martin.

Canada was then faced with a stark choice in 2015: would it embrace moderation and fiscal discipline, or would it return to the same spending approach that ushered in the challenges of previous decades?

The election of the Liberals that year settled the question, and armed with a new mandate, Prime Minister Trudeau returned to deficits as a matter of course (despite a campaign promise to return to a balanced budget). Even so, Canada’s debt-to-GDP ratio remained relatively stable, owing mostly to rock-bottom interest rates.

The new normal

When the COVID-19 pandemic hit, the federal government had in many ways already squandered the payoff left to it by the Liberals of the mid-1990s. Historic levels of deficit and a complete abandonment of fiscal discipline took over, fuelling the fires of inflation and radically increasing Canada’s federal debt-to-GDP ratio. This ratio now sits at a 45.5 percent of GDP, its highest level in two decades.

Government spending as a percentage of GDP spiked to its highest levels ever, and though the hit was temporary, the costs incurred are anything but. Future generations can now expect to foot the bill for the profligacy of the current batch of policy-makers.

Worst of all, if things are left to proceed as-is, Canada could find itself in another period of economic turmoil sooner than we might think.

The way out?

A return to fiscal prudence is urgently needed – something now even acknowledged by the current finance minister, Chrystia Freeland. Rising interest rates intended to tame inflation risk consuming already strained government finances, and most Canadians – who are also overleveraged on household debt, struggling to keep up with inflation, and already count taxation as their largest average household expense – have little capacity to absorb another tax hit.

Clearly, Canada must learn from its history: our government once again has a spending problem, not a revenue problem. To course correct, and to unleash the prosperity that comes with well-managed public finances and fiscal economic policy, Canada must return to the tried-and-true strategy of the 1990s. A federal program review of Canada’s finances, undertaken with the express goal of cutting down Canada’s federal debt and normalizing fiscal surpluses, would be a welcome first step.

The difficult choices that must be made will be less painful if taken now rather than deferred. And make no mistake: the cost of inaction would be far greater than the cost of a swift course correction.

For Canada to realize its full potential, we must get our fiscal house in order. Time will tell whether, at this moment of decision, federal policy-makers opted to shrug off the looming danger, or return to the necessary fiscal discipline that holds with it the promise of long-term economic sustainability and prosperity.