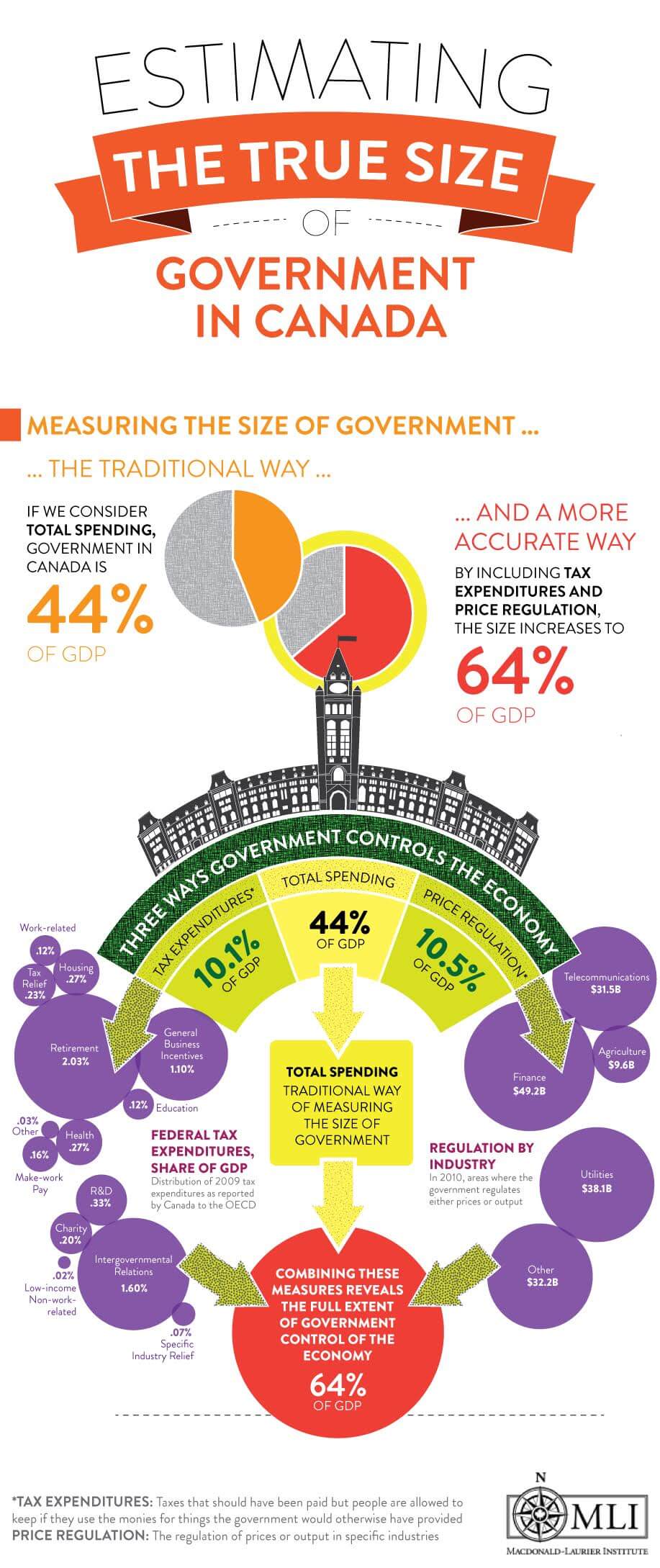

The size of government in Canada is bigger than you think.

And the Macdonald-Laurier Institute is here to explain why.

MLI’ s size of government series, a collection of two papers and a video, explains why current measures of the size of government in Canada are inadequate.

The series pulls back the curtain on a surprising fact: Government in Canada controls way more of the economy than traditional measures suggest.

Why?

Because most measures fail to account for important factors that radically increase government’s reach.

Why this matters

Properly measuring the size of government is essential for holding the government to account. How can Canadians properly evaluate what their tax dollars are being used for if they don’t even know what the government is spending it on?

“We’ve been fighting taxation without representation since Magna Carta”, says Brian Lee Crowley, MLI’s Managing Director, in the size of government video.

Current measures are falling short

Ask how big the size of government is in Canada and the response will likely be straightforward: Simply count how much the government is spending. Then express this as a percentage of the total amount that the country produces on a yearly basis – gross domestic product (GDP) – to give an idea of how big government is.

Ask how big the size of government is in Canada and the response will likely be straightforward: Simply count how much the government is spending. Then express this as a percentage of the total amount that the country produces on a yearly basis – gross domestic product (GDP) – to give an idea of how big government is.

This is useful. But it’s also incomplete. There are other, less visible forms of government intervention in the economy.

Accounting for tax expenditures

Tax expenditures don’t register as government spending in these estimates. Voters see a tax expenditure for volunteer firefighters, for example, as a tax break.

But since they perform the same function – essentially serving as spending to encourage the government’s desired outcome – they add significantly to the size of government.

“We’ve been fighting taxation without representation since Magna Carta”

That’s what Munir Sheikh, former Chief Statistician at Statistics Canada, found in his paper for the series. He calculates that, in the period he studied, tax expenditures increased the size of government by 10.1 per cent of GDP.

Measuring regulation

But the long reach of government is even more insidious than that.

Government regulation may not show up on many balance sheets (or on the front page of many newspapers), but its impact on intervention in the Canadian economy is no less present.

Regulation adds to the size of government because it allows the state to manipulate prices or production in particular industries, says Philip Cross in his contribution to the size of government series.

Take supply management, the system that guarantees certain agricultural producers a price for their products, as an example.

Because it prevents consumers from reaping the benefits of markets and competition, these measures cost the average Canadian family $600 a year. But since this doesn’t count as government spending, it doesn’t show up in many calculations of the size of government.

Because it prevents consumers from reaping the benefits of markets and competition, these measures cost the average Canadian family $600 a year. But since this doesn’t count as government spending, it doesn’t show up in many calculations of the size of government.

Cross’ report finds regulation adds another 10.5 per cent to the size of government as a percentage of gross domestic product.

Totaling it all up

So how big, exactly, is government in Canada?

The common measurement of spending as a percentage of GDP puts the size of government at 44 per cent of the economy. Add in measures for tax expenditures (10.1 per cent) and regulation (10.5 per cent) and you end up with the size of government as 64 per cent of GDP.

Government in Canada, it turns out, is much bigger than you think.