This article originally appeared in the Edmonton Journal.

By Heather Exner-Pirot and Bryan Remillard, November 21, 2024

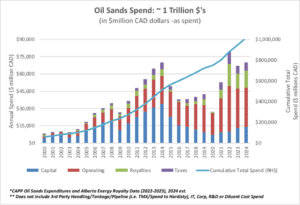

Sometime this financial quarter, the Canadian oilsands will hit a major milestone: one trillion dollars in cumulative spending.

This number does not represent profits or dividends. It is the amount of direct spending – the capital, the operating expenses, the taxes and the royalties – that Canada’s most important industrial activity has injected into the economy over a period of about 25 years. The oilsands are Canada’s winning lottery ticket.

Economists are well aware of the huge outlay of capital that the oilsands attracted in the early 2010s. Many macroeconomic datasets are distorted by them: investment attraction, productivity, GDP per capita: all enjoyed a bump during the oilsands’ most capital-intensive years. What’s less discussed is how those early outlays of capital committed producers to operational and de-bottleneck spending for years to come: the drilling, well pads, gathering pipelines and equipment needed to sustain and optimize operations.

As a result of higher royalties and taxes, oilsands spending actually peaked in 2022, not 2014, the latter of which was the high point for the construction phase of the oilsands’ life cycle. The 2022 oilsands expenditures were equivalent to the GDP of Saskatchewan that same year.

The trillion dollars in spending has bolstered the Canadian economy in hundreds of ways, but a few are worth highlighting. Over $107 billion in royalties and $79 billion in taxes have been paid to Canadian governments, representing more than the last five years of Canadian defense spending.

Billions in goods and services have been procured from Indigenous businesses, and tens of billions from the manufacturing sector in central Canada. Far from just an Alberta success story, the oilsands are a quintessentially Canadian sector. More than 2,300 companies outside of Alberta have had direct business with the oilsands, including over 1,300 in Ontario and almost 600 in Quebec.

If anything, the trillion-dollar figure is conservative. It does not include third-party handling, tankage or pipeline spend (the cost of TMX, for example). And it does not include IT, corporate, research and development, diluent costs or the indirect spend that impacts countless firms across the country. These add tens of billions more to worker paycheques, small business profits, and taxes.

Such a golden goose should surely be cossetted by our political class? Of course not. The oilsands have been consistently undermined by Ottawa. The announcement of an emissions cap is the latest example.

Analysis by S&P Global and the Conference Board of Canada show that, depending on the implementation, the cap could force a reduction in output of well over one million barrels of oil equivalent/day, almost of all of which would have to come out of our exports to the United States. This would lead to a significantly lower balance of trade and an even weaker dollar, affecting all Canadians’ buying power.

Canada has the world’s fourth-largest oil reserves; a democracy alone on a list with authoritarian regimes Venezuela, Saudi Arabia and Iran. Ninety-seven per cent of those reserves are in the Alberta oilsands. That juggernaut could keep Canada’s economy prosperous for many more decades, providing the feedstock for chemicals and carbon-based materials whenever global fuel consumption starts to decline.

In fact, based on the last three years of current expenditures, the oilsands would hit their next trillion-dollar spending milestone in half the time it took to hit the first.

With good planning and collaboration, some of its future expenditures will go toward emissions-reductions activities such as carbon capture and storage, and new technology investment such as carbon fibre production.

But if companies are forced to cut their production, they won’t be able to afford to aggressively cut emissions. Nor will they be able to make other investments to maximize and sustain the value of this resource. Shareholders will put their money elsewhere, and spending will decline.

A trillion-dollar milestone is something to celebrate. Governments and industry need to collaborate so we can reach it again.

Heather Exner-Pirot is the director of energy, natural resources and environment at the Macdonald-Laurier Institute.

Bryan Remillard is senior advisor, policy, at Pathways Alliance and has over 30years of experience in the oilsands sector.