This article originally appeared in the Hub.

By David Clinton, October 8, 2024

Last week saw reports that Ottawa is set to make a major announcement regarding the future of the CBC in an attempt to “modernize” the public broadcaster. Senior government officials were reported as saying that alongside major legislative and regulatory changes, a new CEO is expected to be named.

This new CEO will have a difficult task ahead of them, as these expected changes come against the backdrop of contentious debate surrounding the CBC’s ongoing purpose and perceptions of its impartiality.

Is the CBC fair and objective—or ideologically driven? Is its programming world-class? Does it deliver products that are useful, widely enjoyed, and worthy of such a huge investment of taxpayers’ dollars?

To intelligently assess the CBC’s value, we need to understand three things: how it spends its funding; to what degree private sector broadcasters are already doing the work covered by CBC’s parliamentary mandate; and the CBC’s impacts—both positive and negative—on Canadians.

The data suggests that the CBC’s value ultimately depends on which Canadians we’re discussing. For instance, a typical young suburban family in Toronto is probably only vaguely aware there is a CBC. But private broadcasters and other media know it all too well—and view it as an existential threat to the industry.

CBC’s financial structure

According to the CBC’s 2023–24 projections in its most recent corporate plan strategy, the company will receive $1.17 billion from Parliament; $292 million from advertising; and $209 million from subscriber fees, financing, and other income. Company filings note that revenue from both advertising and legacy subscription pools is dropping. Advertising is trending downwards because of ongoing changes in industry ad models, and the decline in subscriptions can be blamed on competition from “cord-cutting” internet services. The “Financing and other income category” includes revenue from rent and lease-generating use of CBC’s many real estate assets.

The projected combined television, radio, and digital services spending is $1.68 billion. For context, 2022–23 data from the most recent annual report break that down to $996 million for English services, and $816 million for French services. That same year also saw $60 million in costs for transmission, distribution, and collection. Corporate management and finance costs came to around $33 million. Overall, the company reported a net loss of $125 million in 2022–23.

The report estimates that their English-language digital platforms attract 17.4 million unique visitors each month and that the average visitor engages with content for 28 minutes a month. In terms of market relevance, those are pretty good numbers. But, among Canadian internet users, cbc.ca still ranked only 43rd for total web destinations (which include sites like google.com and amazon.ca). For context, CBC’s web services are far more popular than any of its news-based competitors, like CTV or the Globe and Mail. French-language Radio-Canada’s numbers were 5.2 million unique visitors who each hung around for 50 minutes a month.

Monthly engagement with digital English-language news and regional services was 20 minutes. The report does not give visitor numbers but does admit that “interest in news was lower than expected.”

CBC content production

Next, we need to explore how the corporation divides its spending between programming categories and what’s driving the revenue. This should help us understand the corporation’s internal priorities or, in other words, which programming is consuming the largest portions of its funding.

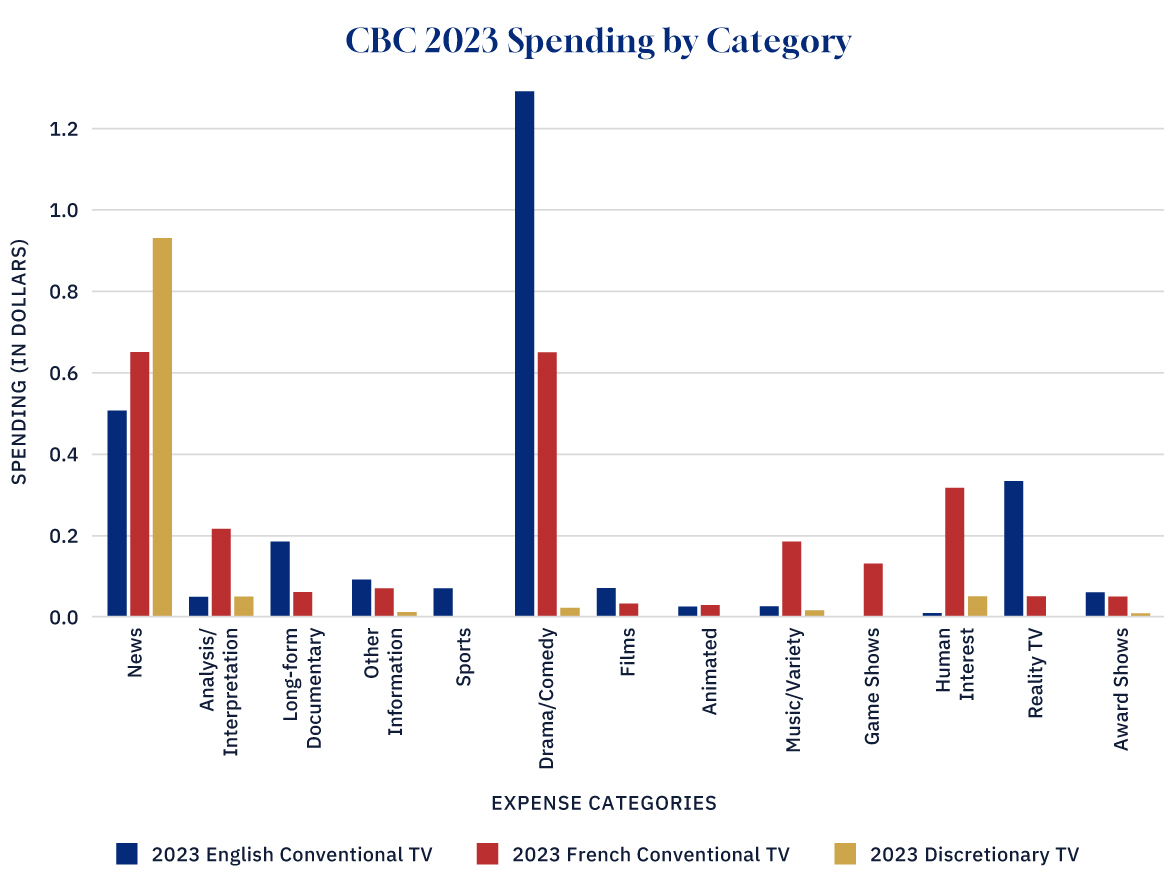

The CRTC provides annual financial filings for all Canadian broadcasters, including the CBC. The full spreadsheet can be viewed here. The most relevant numbers are displayed in the chart below:

CBC spends a large portion of its budget producing news for all three video platforms (CBC and Radio-Canada conventional TV and the cable/VOD platforms they refer to as “discretionary TV”). The two conventional networks also invest significant funds in drama and comedy production.

Radio spending, which is not included in the chart, is also significant: $143 million for English-language production (roughly the equivalent of the costs of English TV drama/comedy), and $94 million for French-language radio production (more or less equal to discretionary TV news production).

CBC content consumption

Who’s watching? The CBC itself reported that viewers of CBC English television represented only 4.4 percent of the total Canadian audience, and only 2.0 percent tuned in to CBC News Network. By “total Canadian audience,” they mean all Canadians viewing all available TV programming at a given time. So, the CBC’s 2.0 percent “share” is actually far less than 2.0 percent of all Canadians.

According to CRTC data, between the 2014–15 and 2022–23 seasons, English language CBC TV weekly viewing hours dropped from 35 million to 16 million. That total would amount to less than six minutes a day per anglophone Canadian. Specifically, news viewing fell by 52 percent, sports by 66 percent, and drama and comedy by 51 percent.

CBC Radio One and CBC Music only managed to attract 14.3 percent of the Canadian market. What does that mean? Estimates suggest that between 15 and 25 percent of all Canadians listen to the radio during the popular daily commute slots. So, at its peak, CBC Radio’s share of that audience is possibly no higher than 3.5 percent of all Canadians.

CBC’s 2024 Perception Survey, conducted last spring, suggested that the corporation still enjoys widespread popularity. In Quebec, 64 percent of respondents strongly agreed with the statement: “CBC/Radio-Canada is a trusted source of information.” That number dropped to just 50 percent in B.C., 48 percent in Ontario, B.C., and 41 percent in the Prairie Provinces. Only 46 percent of Indigenous respondents agreed.

At the same time, a recent survey found that only 41 percent of Canadians agreed the CBC “is important and should continue doing what it’s doing.” The remaining 59 percent were split between thinking the CBC requires “a lot of changes” and was “no longer useful.” Those numbers remained largely consistent across all age groups.

So, many Canadians still support the CBC in principle, but few of them consume its content. The question is, can the CBC fulfill its parliamentary mandate if it is only reaching a small—and shrinking—minority of the country?

CBC revenue sources

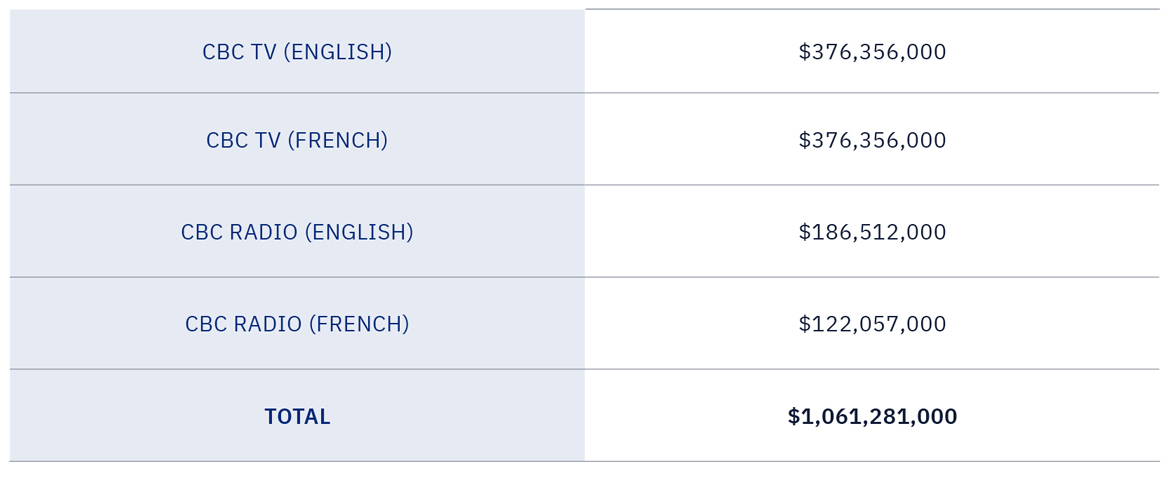

CBC’s primary income is from government funding through parliamentary allocations, broken down in the following manner:

(Graphic Credit, The Hub – Janice Nelson)

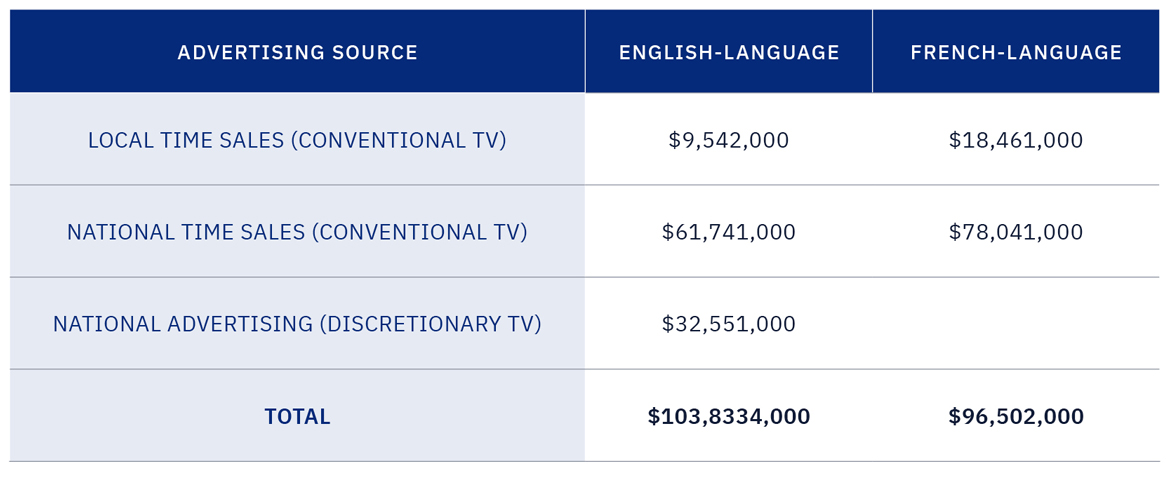

Advertising (or “time sales” as they refer to it) is another major revenue source. That channel brought in more than $200 million in 2023:

CBC’s ad income is especially contentious because Canadian media and content producers are fighting over a steadily shrinking pool of advertising revenue. This, in turn, forces them to seek government funding, which threatens their editorial independence and undermines the public’s confidence in Canadian media.

The issue goes beyond broadcasting to impact private print and online media outlets. CBC competes against private platforms for both users and the click-based ad revenue that comes with them. Web tracking reports suggest that cbc.ca is particularly effective at attracting the valuable 25–54 age segment—it represents 60 percent of CBC’s web audience.

CBC’s critics complain that its digital content too often fails to meet basic standards of objectivity, and is not worthy of its parliamentary mandate.

CBC’s supporters claim that the corporation is vital to rural and underserved audiences that private networks would likely ignore. They argue CBC’s “made-in-Canada” drama and comedy programming is an essential part of Canadian culture. Perhaps. But the CBC spends nearly $200 million a year on drama and comedy programming, and not a lot of people are watching it. And it’s difficult to see how CBC’s programming is measurably better than competing private sector content, much of which receives support from the Canada Media Fund.

The conclusion of this analysis is inescapable: the federal government must launch a full program review of CBC’s parliamentary mandate, with the goal of creating a more finely tuned funding model that’s based on real-world consumption and practical policy priorities. Governments must rethink the CBC’s mandate to ensure it provides unique value not offered by the private sector and fairly represents the array of views of Canadians to rebuild public trust. Otherwise, Canadians will continue to tune out, while private media is robbed of the crucial resources and revenue streams it needs to compete.

David Clinton is the publisher of The Audit (www.theaudit.ca), a journal of data-driven policy analysis, and a contributing writer to the Macdonald-Laurier Institute.