Proposed regulations would harm middle class users of credit card reward programs the most, finds a new report by Morris, Manne, Lee and Zywicki.

OTTAWA, Nov. 9, 2017 – If you examined the contents of Canadians’ wallets you’d find that nine in 10 carry a credit card. And about 80 percent of those people have at least one card that offers rewards that can be redeemed for trips, merchandise or cash back on purchases. Owners of rewards cards will tell you that the ability to collect rewards is the primary reason they use their rewards cards for purchases.

Which is why it’s odd that in the continuing debate about the credit card “interchange fees” charged to merchants, highlighted by a well-reported spat between Visa and Walmart some months ago and a current private member’s bill that would introduce regulations, little is said about the potential effect on users of rewards programs, which are most Canadians.

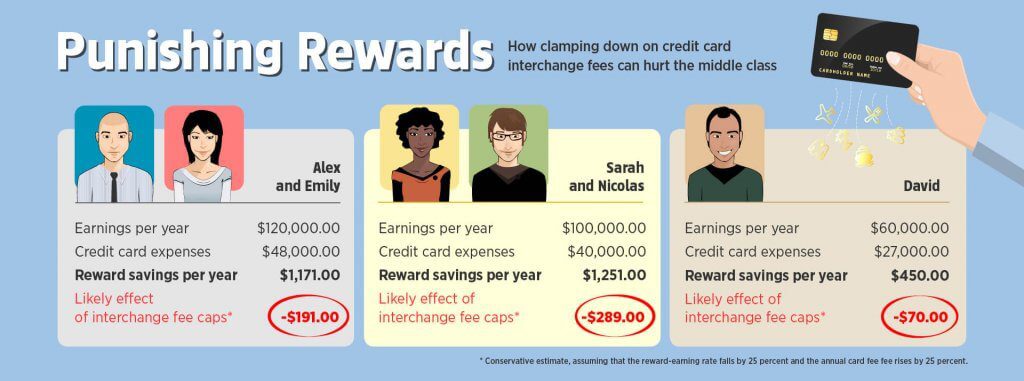

Today MLI releases its latest report by Julian Morris, Geoffrey Manne, Ian Lee and Todd Zywicki. In the report, the authors find that if regulations were introduced to cap interchange fees, average middle class Canadians would lose hundreds of dollars in benefits each year as they pay higher annual fees, and the value of their rewards declines.

This has been the case in Australia, which imposed caps on interchange fees in 2002: “Middle class consumers in Australia now pay vastly more for their rewards credit cards and receive considerably fewer rewards for each dollar they spend,” write the authors.

To read the full paper, titled “ Punishing Rewards: How clamping down on credit card interchange fees can hurt the middle class,” click here.

These rewards are not just for the very wealthy. As the authors explain, a consumer or household earning $40,000 might expect annual rewards valued at $450, while paying fees of $75, providing a net benefit each year of $375. Meanwhile, a consumer or household earning $90,000 might expect benefits of about $1350 while paying $225 in fees, providing a net benefit of around $1125.

The authors of the MLI study estimate that, were an interchange fee cap imposed here, it would have significant negative consequences for Canadian consumers and the Canadian economy as a whole. Specifically, they estimate that if interchange fees were forcibly reduced by 40 percent:

1) On average, each adult Canadian would be worse off to the tune of between $89 and $250 per year due to a loss of rewards and increase in annual card fees:

a) For an individual or household earning $40,000, the net loss would be $66 to $187; and

b) for an individual or household earning $90,000, the net loss would be $199 to $562.

2) Spending at merchants in aggregate would decline by between $1.6 billion and $4.7 billion, resulting in a net loss to merchants of between $1.6 billion and $2.8 billion.

3) GDP would fall by between 0.12 percent and 0.19 percent per year.

4) Federal government revenue would fall by between 0.14 percent and 0.40 percent.

According to co-author Ian Lee, an Associate Professor in the Sprott School of Business at Carleton University: “This study demonstrates that reward cards provide material benefits to consumers which are well understood by consumers who use these cards. The study also reveals that attempts by some merchants to lobby government to impose price controls through caps on credit card fees are the major beneficiary while middle class consumers are the major losers through a sharp reduction in benefits.”

***

About the authors:

Julian Morris is vice-president of research at the Reason Foundation.

Ian Lee is a professor at the Sprott School of Business at Carleton University. Prior to becoming a professor he was employed in the financial services industry for nine years.

Geoffrey A. Manne is founder and executive director of the International Center for Law & Economics.

Todd J. Zywicki is a law professor at George Mason University.

The Macdonald-Laurier Institute is the only non-partisan, independent national public policy think tank in Ottawa focusing on the full range of issues that fall under the jurisdiction of the federal government.

For more information, please contact David Watson, managing editor and director of communications, at 613-482-8327 x103 or email at david.watson@macdonaldlaurier.ca.