By Rory Johnston

June 26, 2024

Introduction

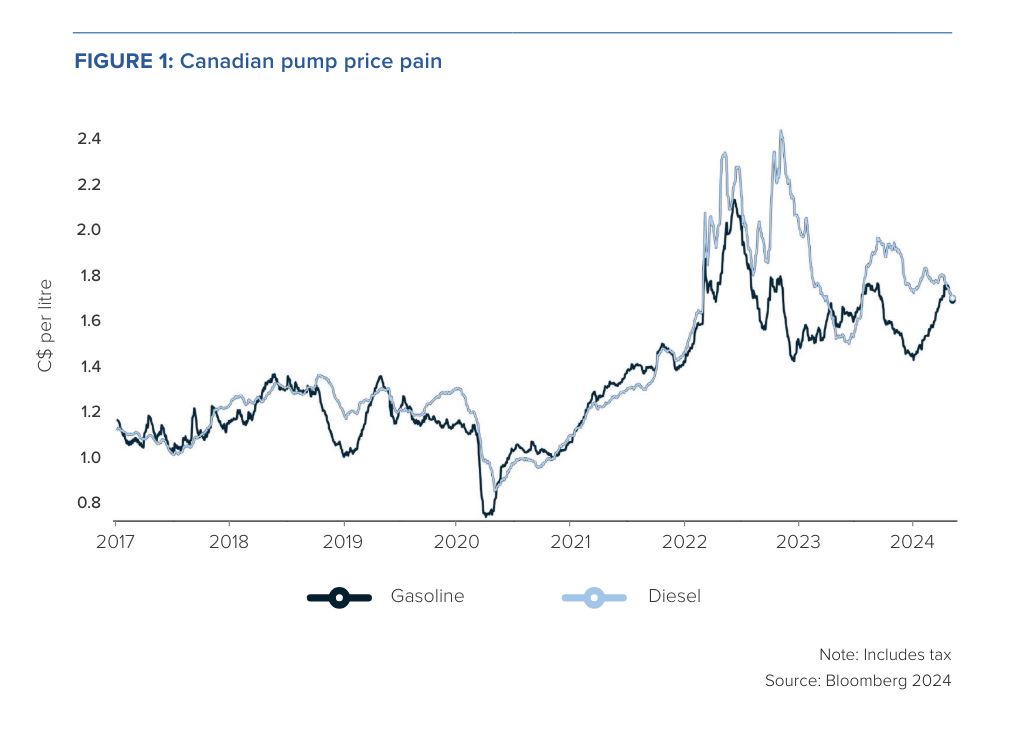

Governments across Canada, and around the world, have announced a suite of policies aimed at reducing the consumption of petroleum products over the coming decade(s). However, these fuels remain a critical piece of Canada’s economy as well as a top-of-mind concern for Canadian motorists today (Figure 1). The importance of oil refining capacity came into sharp focus in the summer of 2022 when a combination of surging crude oil prices, an even steeper run-up in refinery margins, a comparatively weaker Canadian dollar, and the structural uplift of higher consumer carbon taxes pushed average Canadian retail gasoline and diesel prices above $2 per litre for the first time in history and have kept them well above the pre-pandemic norm since.

The path between our current petroleum product reliance and policytargeted lower-emitting future is both uncertain and certain to be bumpy. There is value to Canada’s refining sector as it exists today and into the future. Canadian refineries provide a valuable source of economic activity and high-income employment, a domestic outlet for our prolific crude produc-tion, and act as a hedge against further price gains and volatility in refined product markets. While $2 pump prices were a regressive drag on Canadian consumers, Canadian refineries were able to capture that economic upside and largely prevented that value from leaking outside Canada’s borders. Canadian refineries also provide a crucial domestic outlet for prolific Canadian crude production, which would otherwise require export and, thus, further strain the already-scarce pipeline capacity.

With this backdrop in mind, it’s important to understand the current state of Canada’s refining fleet. The number of Canadian refineries has fallen steadily over the past decades as pre-COVID-19 market pressures, the fleet’s generally advanced age (some of these facilities are more than a century old!), and higher operating costs – both labour and environmental compliance – in advanced economies weighed on operations. Remarkably, Canadian refining capacity has remained relatively stable and, even more, import dependence has been steadily declining and output has been heavily tilted towards high-value consumer fuels, the vast majority of which is consumed domestically. The future of Canada’s refining industry hangs on several critical points, from mounting pressure on its core business from rising electric vehicle adoption to political attacks against key feedstock supply pipelines in Central Canada to the potential for mismanaging the regulation of a volatile and trade-exposed industry.

Canadian downstream landscape

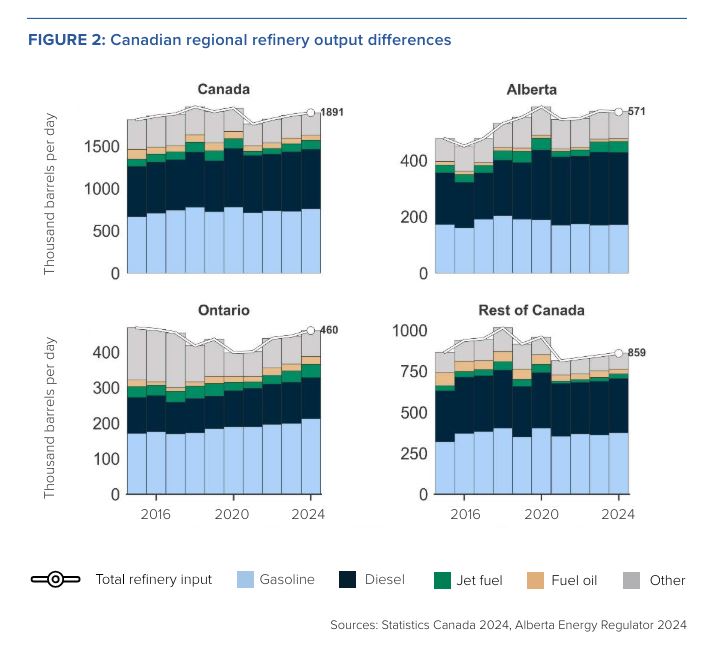

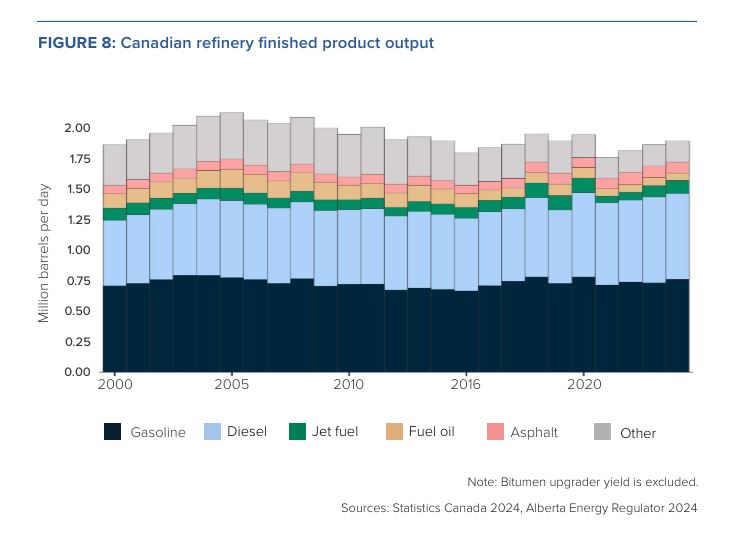

Canada’s refining fleet consists of between 15 and 18 facilities that can process crude into roughly 1.9 million barrels per day (MMbpd) of highervalue finished consumer fuels (Figure 2). Canadian refineries are also relatively sophisticated by global standards and output is heavily geared towards highvalue consumer fuels: more than 80 percent of Canadian refinery yield is a combination of gasoline, diesel, and jet fuel. This leaves a relatively high cut, just north of 10 percent of heavier residual petroleum products like fuel oil, petroleum coke, and asphalt, a ramification of the relatively heavy feedstock processed by Canadian refineries, particularly in Canada’s Western provinces. In addition to the petroleum product output of Canadian oil refineries, there is also roughly 160 thousand barrels per day (kbpd) of petroleum coke that is derived from the processing of raw bitumen in Western Canadian upgraders.

The number of Canadian oil refineries has been steadily shrinking since its peak of 45 facilities in the 1950s, though, remarkably, Canadian refining capacity has remained relatively stable around current levels for decades. In 2023, average petroleum product output fell by a modest 55 kbpd vs. pre-COVID-19 levels in 2019, reflecting the loss of Newfoundland and Labrador’s 135 kbpd Come By Chance (North Atlantic) refinery only partially offset by the startup of Alberta’s 50 kbpd Sturgeon refinery. The Come By Chance refinery was purchased by a private equity firm in 2021 after its COVID-19-era closure and has since been retrofitted into a renewable fuels plant producing primarily renewable diesel from natural fats including cooking oils and other waste products, though at a far reduced 18 kbpd capacity (Khan 2024).

Processing capacity is concentrated in oil-producing Alberta as well as key consuming regions including Southern Ontario and Quebec. However, Canada’s largest refinery, the Irving Oil refinery boasting 320 kbpd of capacity, bucks this trend entirely and is located on Canada’s East Coast in Saint John, New Brunswick; the Irving refinery is also the only major Canadian refinery now not connected to the rest of the country by pipeline and reliant on tankers for both importing crude and exporting its refined product.

Major refining regions(1)

Canada’s refinery fleet may be relatively small in number, but it is spread from coast to coast. Broadly, there are three major refining regions, which can largely be defined by where they primarily source their crude feedstock. While most people associate Canada’s oil industry with the production-rich West, Canadian refineries are most often co-located to major demand centres rather than production hubs – this means that many of Canada’s refineries are located a half-continent away from Alberta and Saskatchewan, and actually have to import a healthy share, if not the entirety, of their feedstock.

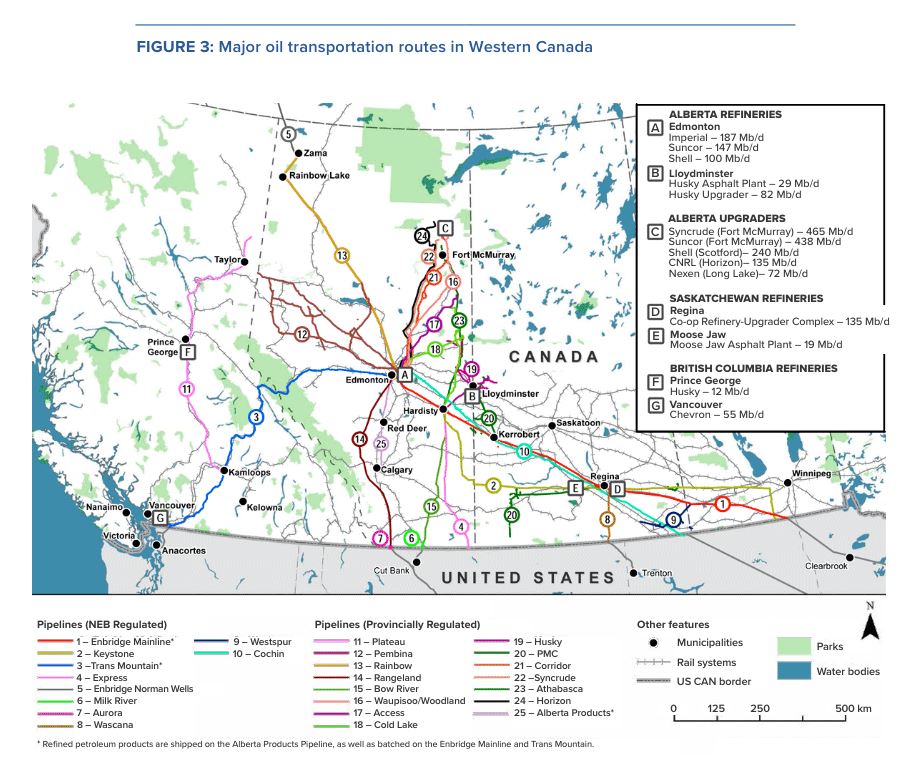

Canada’s West, situated near prolific conventional and oil sands upstream assets in Alberta and Saskatchewan, accounts for roughly 38 percent of presentday operable refining capacity (Figure 3). This collection of large complex refineries across Edmonton (x2), Strathcona, Alberta, and Regina, as well as a smattering of other smaller facilities, processes locally produced crude oils. No other major Canadian refining region can claim the same upstream fortune of often-cheap and always-convenient feedstock.

The Western provinces have even more processing power with so-called upgraders. Upgraders take bitumen and produce synthetic crude but, because output is [typically] another “crude oil” rather than refined products (e.g., gasoline), upgraders aren’t usually included in refining industry aggregates. There are, of course, exceptions, such as the new Sturgeon refinery that processes bitumen into primarily diesel – Sturgeon is also unique in its high concentration of a single end product.

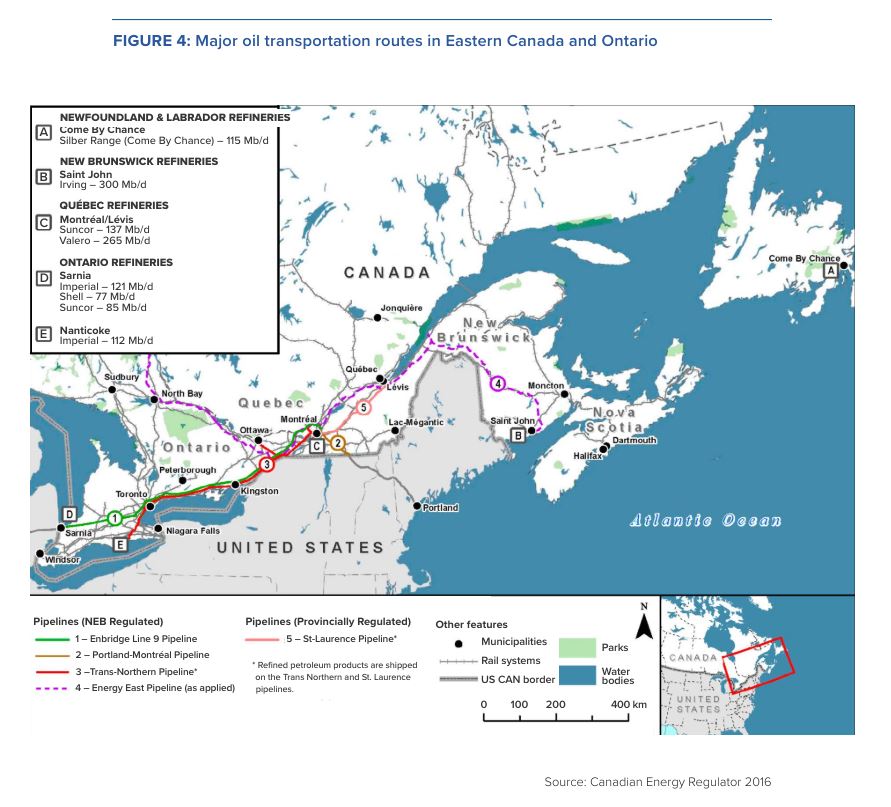

Then we head east to Ontario, which boasts four large refineries that account for roughly a quarter (23 percent) of national refining capacity (Figure 4). Located immediately across the border from the United States, these facilities source feedstock from their two proximate neighbours: the majority is from Western Canada and the balance flows north across the border from the US. Ongoing efforts to shut down Enbridge’s Line 5 pipeline, which transports crude from Western Canada into the US and Central Canada, threaten supply security for these refineries and have become a point of diplomatic friction between Ottawa and Washington (McCarten 2023).

The third major refining region is Quebec and Atlantic Canada, which, together, technically represent the largest share of total current capacity at 39 percent. Situated in the consumption-heavy East rather than the crudeproduction-heavy West, this refining region is largely dependent on imports via tankers across the Atlantic Ocean as well as up the St. Lawrence Seaway (with some Western Canadian supplies making it all the way via the Line 9 pipeline, reversed to flow east a decade ago). Moreover, this eastern tanker import share was even larger, around 45 percent, for much of the decade prior to the closure of the North Atlantic Refinery in Come By Chance, NL, in 2020, which was on a literal island and was thus entirely reliant on tankers – that facility is in the process of being converted into a renewable fuels plant but with a far reduced capacity (from 135 kbpd to 18 kbpd, at least to start). Now, the Irving Oil Refinery in Saint John, NB – Canada’s largest refinery at 300 kbpd capacity – is the only remaining refinery on the east coast.

Source material

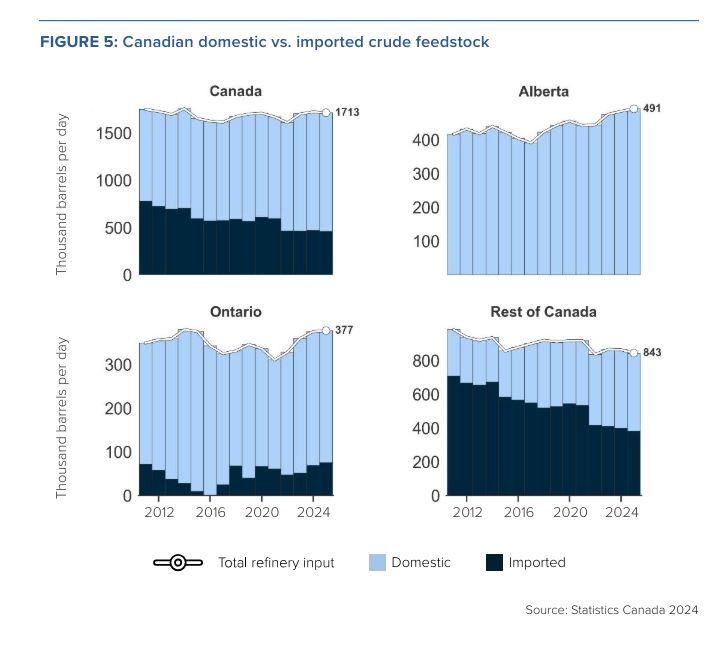

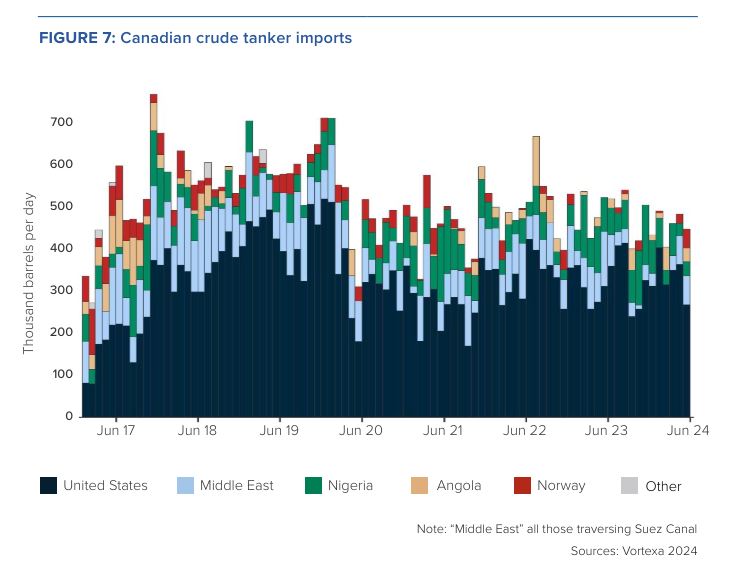

Canadian refineries source the bulk of their crude domestically, though, as one would expect, the proportion of Canadian crude in a given refinery’s feedstock declines as one moves east, away from the center of Canadian oil production in the West – from approximately 100 percent domestic crude in Alberta to nearly 100 percent imports for New Brunswick’s Irving Oil refinery (Figure 5). Canada’s import dependence has been steadily declining, however, as more Western Canadian crude makes its way east and import-intensive facilities close their doors; even more, that import sourcing is shifting closer to home and the US now accounts for more than half of the seaborne total, inadvertently dovetailing with a broader Western government policy tilt toward supply chain “friendshoring.”

Tanker imports to Quebec and Atlantic Canada have, historically, come from countries like Saudi Arabia, Nigeria, Azerbaijan, Iraq, and Angola, in addition to other OPEC sources. These imports have featured prominently in political commentary surrounding Canada’s oil industry (“Why are we importing OPEC oil when we’re a leading exporter?!”) and were a driving rhetorical force behind the ultimately abandoned plans for the Energy East pipeline that would have brought more Western Canadian crude all the way to Atlantic Canada.

Looking ahead, there are two notable trends in Canadian refining inputs emerging.

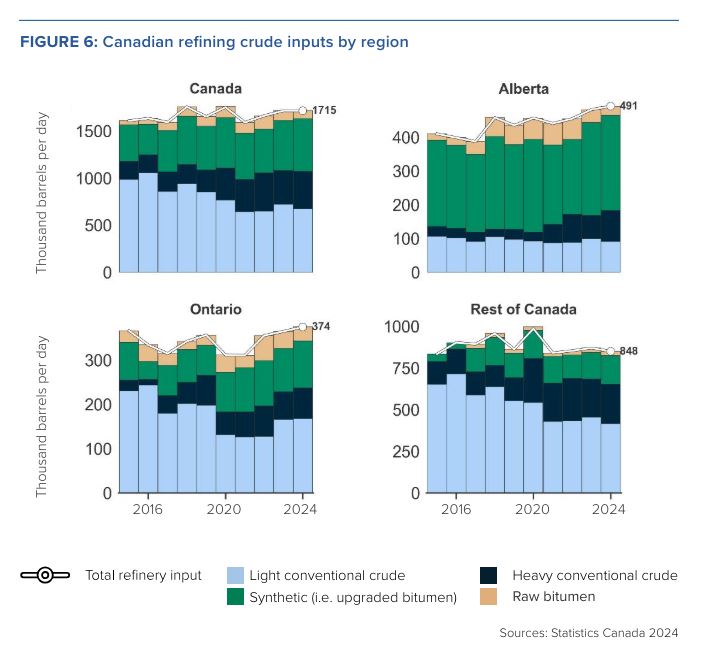

First, Canada’s import dependence is declining as an overall share – but this potential is inherently limited, both by facility equipment and logistical considerations (i.e., tankers are typically easier than pipelines). Unlike highly complex refineries south of the border, most of Canada’s refining capacity – especially capacity further from Canada’s western upstream bounty – is not built to handle the heavier crude streams that have come to dominate Canadian crude production growth. (Figure 6) Indeed, of the 1.7 million barrels processed in Canadian refineries each day, nearly three-quarters (73 percent) is lighter crude oils including conventional (41 percent) and upgraded synthetic (32 percent). The heavier balance consists of conventional heavies (22 percent) and raw bitumen (5 percent). The bulk of Canada’s synthetic crude is consumed in the West, which makes sense: the process of upgrading crude was in large part pursued to create more palatable feedstock for those very refineries. Alberta is indicative here, with synthetic crude making up fully 60 percent of charged feedstock.

Second, the composition of Canadian crude imports is shifting away from OPEC, closer to home: toward the US. As can be seen below, the US now represents more than half of Canadian crude tanker imports, though the total share is far larger, obviously, given pipeline and rail shipments, especially to Ontario (Figure 7). But, somewhat surprisingly, tanker share growth has been a relatively new phenomenon; the US accounted for a negligible share of total tanker imports as recently as 2017. At a headline level, however, tanker imports fell structurally in 2020 with the closure of the North Atlantic Refinery in Come By Chance, NL, which, given its literal island status, was a large importer of seaborne barrels. The Irving Oil refinery in Saint John, NB, while not on a literal island, is the other major source of seaborne crude imports given that facility’s lack of major crude pipeline connections with the rest of the continent, let alone Western Canadian feedstock.

High value outputs

Canadian refineries prioritize the output of high-value consumer fuels, and the vast majority of Canadian refined product production is consumed domestically (Figure 8). Together, gasoline, diesel, and jet fuel output account for more than 80 percent of total Canadian refinery yield. This can be roughly divided between diesel-heavy Alberta (44 percent diesel and 30 percent gasoline) and gasoline-heavy Ontario (45 percent gasoline and 25 percent diesel) – the rest of the country averages 43 percent gasoline and 38 percent diesel. What’s more, both Alberta’s diesel dominance and Ontario’s gasoline dominance are only going up, each by 7–8 percentage points in the past decade. Meanwhile, there is one notable exception in terms of domestic consumption, which is, yet again, Atlantic Canada, where refineries often supply the US Northeast and, to a lesser extent, Europe.

Atrophying assets

Refining isn’t Canada’s – or most other advanced economies’ – most attractive industry for new investment. The industry is capital intensive, highly emitting and, thus, heavily regulated, not to mention that it requires decades for investments to break even in a time when governments around the world are talking about banning the internal combustion engine. No surprise, then, that there are no material planned capacity additions and, frankly, it’s unlikely that we’ll see any materialize. The most recent addition to the fleet is the Sturgeon Refinery (North West Redwater Partnership) in Alberta, a 50 kbpd plant (approximately 80 kbpd bitumen feedstock) that began commercial operations in early 2020; this facility is heavily diesel weighted and co-owned by the Alberta Petroleum Marketing Commission (APMC) alongside Canadian Natural Resources Limited (CNRL). While the project faced considerable complications and cost overruns, the recent diesel shortage and associated strong diesel refining margins have provided an unforeseen lift in the refinery’s fortunes (Morgan 2021).

In the face of flatlined investments, the future of Canada’s refining industry hangs on several critical points. At the highest level, many in Ottawa are busy planning for a future defined by electric vehicles without adequate recognition of the industry that will fuel Canada’s journey across that energy transition bridge. This lack of attention risks temporary market forces shuttering additional Canadian refining capacity. At a more fundamental level, there are ongoing efforts to shut down Enbridge’s Line 5 pipeline by the state of Michigan, which transports crude from Western Canada into the US and Central Canada. This potential shuttering threatens the supply security of our refineries and shifts the risk calculus from the status quo over the past decade concerning difficulty building new pipeline capacity into the US (see: Keystone XL) to worries about simply maintaining the egress that currently exists. Finally, and relatedly, roughly a quarter of Canadian crude production is processed by the domestic Canadian refining fleet, without which Canadian producers would need to export even more crude abroad, which would further strain scarce pipeline capacity and entrench our reliance on the US market.

Key considerations

For much of the decade preceding the COVID-19 pandemic shock, the downstream oil refining sector wasn’t something that was discussed very often; the world was structurally oversupplied with refining capacity and margins were consistently weak. Then came COVID-19, which prompted one of the most stark – if not the starkest – refined product crises in modern history. Indeed, the importance of Canadian refining capacity came into stark view in the summer of 2022 when the combination of surging crude oil prices, an even steeper run-up in refinery margins, a comparatively weaker Canadian dollar, and the structural uplift of higher consumer carbon taxes pushed average Canadian pump prices above $2 per litre for the first time in history.

Canada’s refineries, especially diesel-rich Albertan facilities, have been enjoying historic premiums available for middle distillates like diesel, and the Canadian economy has been able to capture these historic refining margins because Canadian liquid fuels demand is reasonably well-matched with Canadian domestic refining capacity. Meanwhile, gasoline demand is already clearly under pressure, and Canadian refiners will need to reckon with the declining share of gasoline in the Canadian consumption mix, even in scenarios where Canadian emissions reductions fall well short of current national commitments.

Historical refining crisis

The COVID-19 pandemic shattered the steady status quo of the global refining industry as fuel demand cratered and uncertainty about even the near-term future soared. Many older refineries were already on their last legs, particularly in advanced markets, and some were shuttered instead of facing the alternative: to weather the costly downtime with no real sense of when people would begin driving and flying again. In addition, many of the refineries that were set to begin operations in 2020–21 faced months- or years-long delays stemming from the cornucopia of supply chain and logistical disruptions for everything from steel piping to labour.

This combination of early retirements and delayed start-ups led to a shortfall of fuels like gasoline and especially diesel in the market, exploding the value of those fuels relative to crude oil and kicking off a refining market crisis unparalleled in modern history. In total, more than 2 MMbpd of global refining capacity shuttered in 2020–21 compared to a pre-COVID-19 expectation of only a couple hundred thousand barrels per day. Some relief has already come online, and more is coming: for example, large, delayed refineries in Nigeria, the United Arab Emirates, and Kuwait have finally entered service and will be joined by further expansion of the Indian and Chinese refining fleets over time.

However, this turbulent market proved a boon for Canadian refineries, especially diesel heavy facilities in Western Canada, with the obvious exception of the shuttered Come By Chance refinery that made its decision to close before refinery markets took off. Refineries, in general, became exceptionally profitable in 2022 and 2023, notably above historic norms, as margins remained generally higher than the pre-pandemic norm. Capacity utilization at these facilities has been running hot for the past two years in an effort to capture highly attractive refining margins.

Current crack spreads

Let’s back up a moment. Crack spreads are the difference between the value of crude and a given refined product. The price you pay at the pump includes many different factors (i.e., taxes, currency effects, etc.) but, at its core, reflects the price of crude oil plus whatever the current market value of transforming that crude into a consumable product. The crack spread also reflects the rough margin enjoyed by a refinery for producing that fuel (plus non-crude operational costs).

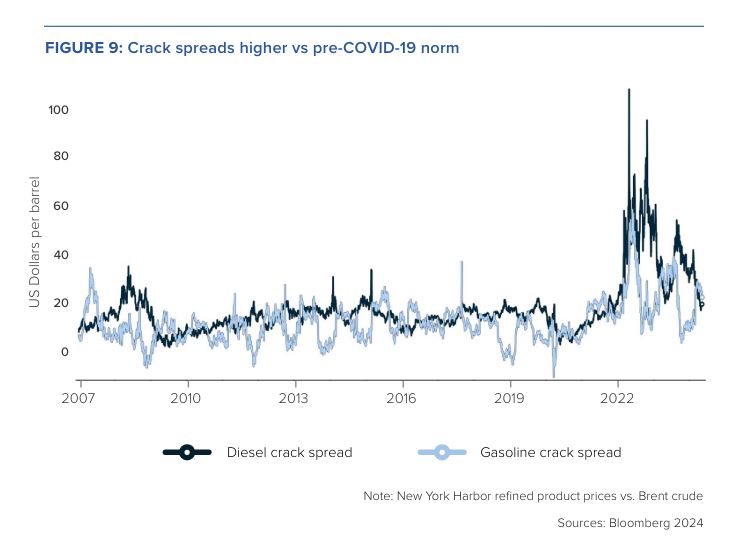

For the past two decades, crack spreads for key consumer fuels have, generally, oscillated between $5–$20/bbl (Figure 9). The pre-COVID-19 high-water mark for gasoline and diesel crack spreads was 2007–2008 when both approached $40/bbl. But then came 2022, and all those prior records suddenly seemed small in comparison. Gasoline cracks reached nearly $60/bbl in the summer of 2022 before falling back and diesel cracks peaked above $100/bbl, ultimately spending the bulk of 2022 bouncing between $40–$60/bbl.

While crack spreads have eased considerably from those 2022 highs, they remain structurally elevated compared to the pre-pandemic norm – and considerably more volatile, too. And now, geopolitical and policy risks are adding insult to injury, from China’s on-again-off-again relationship with issuing refined product export quotas to Russia’s 2022 invasion of Ukraine and all the resultant consequences (e.g., sanctions and import bans, Ukraine’s ongoing attacks on Russian oil refineries, and now Moscow’s decision to ban the export of some fuels).

However, Canadian refineries largely benefit from these extreme crack spreads given premiums available for middle distillates like diesel. So, while this volatility and higher fuel prices is surely unwelcomed by Canadian motorists, the Canadian economy is actually able to capture those supernatural refining margins because Canadian liquid fuels demand is reasonably well-matched with Canadian domestic refining capacity. In a different scenario where Canada depended on importing refined products from abroad, we’d be importing those fuels at higher prices and paying those eye-popping margins and such market episodes would represent an absolute loss for the Canadian economy.

If not here: Refining Canadian barrels abroad

At the same time, Canada produces roughly three times more crude oil and equivalents (i.e., other hydrocarbon liquids that go into a refinery) than our refineries can process, and our market can consume domestically. The vast majority of that balance heads south of the border to satisfy the voracious appetite of American refineries. This symbiotic bilateral relationship has evolved over decades and is somewhat a rarity within the global oil market: almost all of Canada’s crude leaves the country by pipeline, rather than by tanker – not to mention it travels to just one importer.

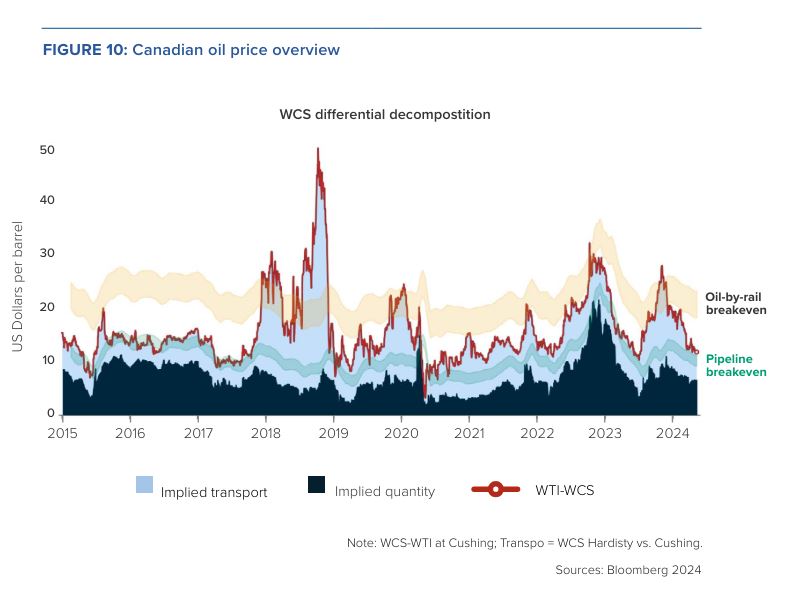

For most other major crude producers, barrels are exported on tankers to sell on the global seaborne market and sales are shuffled between a wide variety of seaborne importers with those decisions driven by a constantly changing set of economic incentives. But for Canada, the reliance on a fixed system of pipelines means that exports always go to the same US markets, which leaves Canadian exporters vulnerable to disruptions in those markets. For example, when US refineries experience heavy maintenance, the lack of alternative accessible market backs up Canadian crude in Alberta and explodes the discount borne by Canadian barrels relative to US benchmark West Texas Intermediate (WTI) crude oil; and while this differential is set by the marginal (i.e., last, sometimes stranded barrel), it is applied across the bulk of Canadian crude pricing contracts (Figure 10).

Therefore, the newly minted Trans Mountain Expansion pipeline is notable not only because of the novelty of pipeline development in this day and age but also the opportunity to diversify Canadian exports away from the US. In total, an additional 590 kbpd of largely heavy sour crude oil is expected to be exported off Canada’s West Coast, with flows to California likely capped by the high sulphur content of Canadian barrels. This means that the lion’s share balance will flow across the Pacific to, largely, Chinese and Indian refineries, which have the technical capacity to process Canadian heavy sour barrels.

The establishment of new export partners outside the US will incrementally contribute to Canadian demand security and modestly lessen Canada’s overwhelming reliance on US markets. However, this dependence on export markets and the constant precarity of export infrastructure capacity highlights another valuable aspect of Canada’s domestic refining fleet: as an outlet for our domestic crude. Without domestic refining capacity roughly matching domestic Canadian fuel consumption, we’d need even more pipelines than we’ve managed to build today – in both directions, outward for crude and inbound for refined products.

Future emissions and transition

Canadian refiners are also grappling with the ongoing energy transition. In the near term, existing government industrial regulations are aimed at reducing the carbon intensity of liquids fuels. In the longer term, there will be an eventual peak in demand for certain fuels, and the value of products will shift accordingly.

Most immediately, energy transition policies are directly affecting Canadian refineries via the recently passed federal Clean Fuel Regulations (CFR). The CFRs “require liquid fossil fuel (gasoline and diesel) suppliers to gradually reduce the carbon intensity – or the amount of pollution – from the fuels they produce and sell for use in Canada over time, leading to a decrease of approximately 15 percent (below 2016 levels) in the carbon intensity of gasoline and diesel used in Canada by 2030” (Government of Canada 2022). One benefit is that the CFRs allow for flexible compliance, rather than requiring a particular emissions reduction path. These regulations allow individual refineries to comply in a way that makes most sense in that regional and market context: companies can earn credits via the installation or integration into carbon capture and sequestration systems, increase the production of low-carbon fuels (like ethanol or biodiesel), or undertake other forms of compliance. The CFRs will take stronger effect over the coming years and naturally bolster biofuels penetration in the Canadian fuels mix (one of more readily available options for most refiners).

However, there’s a reason that these biofuel alternatives aren’t already a larger portion of the fuel mix: they’re more expensive. Indeed, Boeing’s chief sustainability officer, speaking at the 26th World Energy Congress in Rotterdam in April 2024, noted that “SAF [sustainable aviation fuel] is highly unlikely to ever reach price parity with Jet A fuel, so there is a green premium” (Park and Shaw 2024). CFR compliance naturally comes at a cost for refineries, which gives them two choices – accept lower profitability in an industry actively shuttering capacity in Organisation for Economic Cooperation and Development (OECD) markets or pass on higher prices to consumers, both of which will ultimately be required, and each have their drawbacks. Refineries will try to pass some of those costs down the line toward consumers in the form of higher prices, though these markets are competitive and too much of a price increase will prompt imports from the US and the loss of market share. Refiners are, therefore, expected to also face lower overall profit margins, which all else being equal means less of an incentive for these facilities to continue operating.

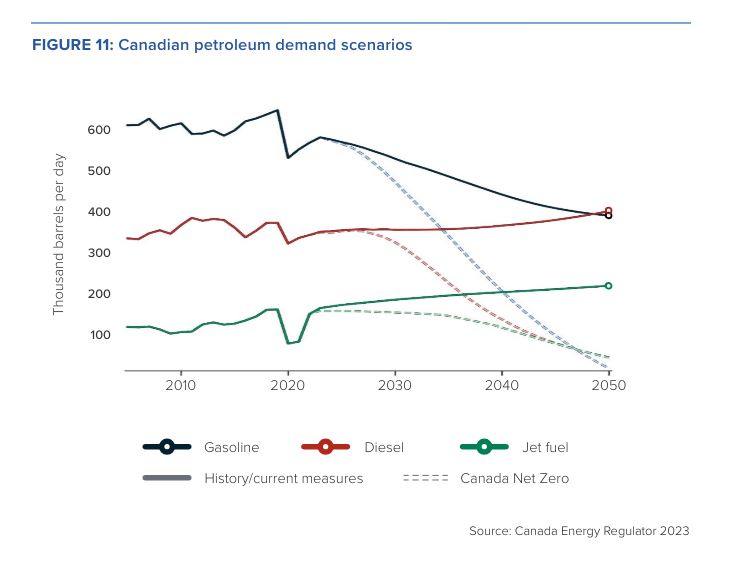

More fundamentally, domestic consumption of refined petroleum products is anticipated to steadily decline as (if?) Canada progresses toward achieving its national emissions reduction targets. The figure below from the Canadian Energy Regulator’s Canada’s Energy Futures report presents two example scenarios for Canadian liquid fuels demand (Canadian Energy Regulator 2023). Under the Canada Net-zero scenario2 above, demand for gasoline begins to fall almost immediately and soon thereafter for all refined petroleum products over the coming decade, with those fossil fuels largely displaced by electric vehicles (EVs), hydrogen, and biofuels (Figure 11). Under the Current Measures scenario, demand for both diesel and jet fuel continue to rise; yet even in this scenario, gasoline demand enters near immediate structural decline.

In other words, gasoline demand is already clearly under pressure today – as rising EV sales are overwhelmingly concentrated in the gasoline-dominant personal transportation sector – and faces an all-but-certain relative decline. Meanwhile, there is a far higher bar for displacing middle distillate fuels like diesel and jet fuel, which remain necessary for commercial shipping and air travel.

So, what does this mean for Canadian refineries?

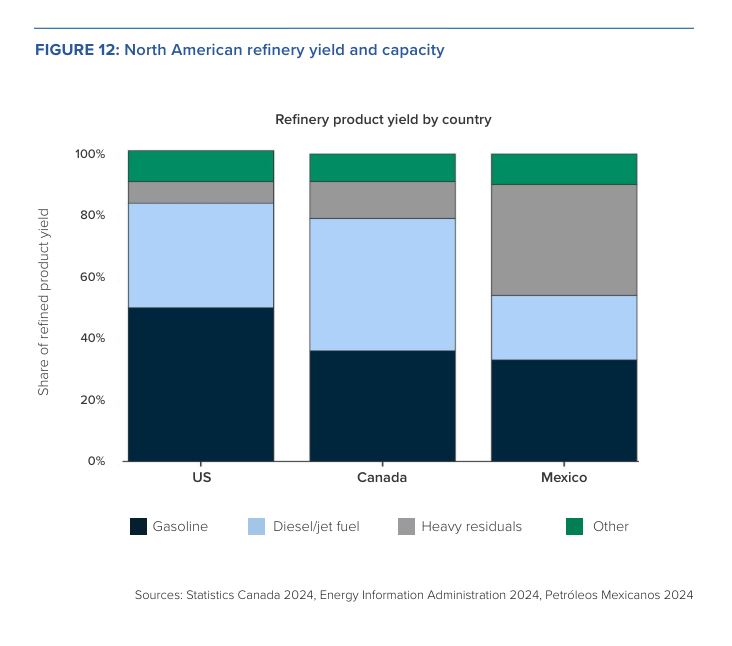

Well, refineries turn a barrel of crude into a wide variety of products; the exact balance of products is determined by (i) the type of crude that goes in and (ii) the equipment available to process that crude into higher value products. Typically, diesel, gasoil, and jet fuel (i.e., middle distillates) are the largest product category by weight, around 40 percent of global refining yield; this is rounded out by gasoline (approximately 25 percent), fuel oil (10 percent), petrochemical feedstocks and LPG (10 percent), and then “other products” like lubricants, asphalt, etc. (approximately 15 percent) (Figure 12). Importantly, Canadian and American refineries produce a greater proportion of higher-value products, like gasoline and diesel, than that global average. This is especially true in the US, where gasoline yield is roughly 50 percent or double the global average. Meanwhile Canadian refineries actually yield a larger share of diesel relative to the US.

In addition, refineries don’t really have that much flexibility in their product slate. Most refineries, for example, can’t produce only jet fuel. Therefore, gasoline crack spreads will inevitably fall as demand wanes – eventually, gasoline crack spreads could go negative if no other use (i.e., petrochemical, etc.) is found to sufficiently offset lost transportation demand and would join the ranks of other loss-making byproducts like high sulphur fuel oil. As discussed above, it’s harder to imagine diesel and jet fuel demand declining as quickly, which means that both those fuels will likely bear the brunt of that crack spread value transfer. In other words, crack spreads on fuels like diesel will be forced to rise to support the overall blended refinery margin, because the refinery still requires enough margin to keep the lights on. This is comparatively good news for Canadian refineries, compared to US refineries, given the higher relative diesel yield, though Canadian refineries, too, have a gasoline yield far above the global average, which will likely be a source of profitability drag over the coming decades.

Conclusion

Canada’s refining sector provides a valuable hedge against ongoing global refined product market volatility as well as serving as a difficult to replace domestic output for prolific Canadian crude production. Canadian refineries have over the past decade friendshored a large portion of their feedstock supplies, reducing imports of OPEC barrels in favour of a higher reliance on domestic and – when imported – US-based crude. However, Canadian oil refiners face several challenges over the coming years including an almost certain reduction in gasoline’s share of the overall Canadian consumption mix given EV sales growth, threats to Central Canadian refinery feedstock supply security given efforts to close down the Line 5 pipeline, and the delicate attempts to regulate the industry along the energy transition, including both plant emission rules and renewable fuels blending mandates.

Further losses of Canadian refining capacity above and beyond the pace of broader Canadian refined product consumption declines will prompt further imports of foreign-refined fuels and increase the vulnerability of Canadian consumers to refined product market shocks. It will also mean that yet more Canadian crude production will need to be exported, further tightening already scarce Canadian pipeline capacity – and given that those exports would almost surely be destined for the US, again increasing our dependence on that handful of US refineries. Business leaders and policy-makers alike need to manage the balance between regulation and preservation carefully so as to not further contribute to secular market pressures on the sector and accelerate potentially premature closures of remaining Canadian facilities.

About the author

Rory Johnston is a Toronto-based oil market researcher, the founder of Commodity Context, and a lecturer at the University of Toronto’s Munk School of Global Affairs and Public Policy. He is a leading voice on oil market analysis, advising institutional investors, global policy makers, and corporate decision-makers. His views are regularly quoted in major international media, and he frequently appears on numerous market and industry podcasts. Prior to founding Commodity Context, Johnston led commodity economics research at Scotiabank where he set the bank’s energy and metals price forecasts, advised the bank’s executives and clients, and sat on the bank’s senior credit committee for commodity-exposed sectors.

References

Alberta Energy Regulator. 2024. ST39: Alberta Mineable Oil Sands Plant Statistics Monthly Supplement. Accessed June 2024. Available at https://www. aer.ca/providing-information/data-and-reports/statistical-reports/st39.

Bloomberg. 2024. Energy. Bloomberg Terminal. Accessed June 2024.

Canada Energy Regulator. 2016. “Market Snapshot: Understanding the Production, Transport, and Refining of Crude Oil in Canada.” [Formerly National Energy Board] April 29, 2016, accessed May 2024. Available at https:// www.cer-rec.gc.ca/en/data-analysis/energy-markets/market-snapshots/2016/ market-snapshot-understanding-production-transport-refining-crude-oil-incanada.html.

Canada Energy Regulator. 2023. “Canada’s Energy Future 2023: Energy Supply and Demand Projections to 2050.” Available at https://www.cer-rec.gc.ca/en/ data-analysis/canada-energy-future/2023/.

Department of Environment, Great Lakes, and Energy – State of Michigan. 2024. “Line 5 in Michigan: Overview.” Accessed May 2024. Available at https:// www.michigan.gov/egle/about/featured/line5/overview.

Enbridge. 2024. “Line 5 and the Great Lakes Tunnel: Fact vs. fiction.” Accessed May 2024. Available at https://www.enbridge.com/projects-and-infrastructure/ public-awareness/line-5-fact-vs-fiction.

Energy Information Administration. 2024. Refinery & Blender Net Production. Accessed June 2024. Available at https://www.eia.gov/dnav/pet/pet_pnp_ refp_dc_nus_mbblpd_m.htm.

Government of Canada. 2022. “What are the Clean Fuel Regulations?” Accessed May 2024. Available at https://www.canada.ca/en/environment-climatechange/services/managing-pollution/energy-production/fuel-regulations/ clean-fuel-regulations/about.html.

Johnston, Rory. 2022a. “Oil Refining in North America.” Commodity Context, December 1, 2022. Available at https://www.commoditycontext.com/p/ oil-refining-in-north-america.

Johnston, Rory. 2022b. “Collapsed Bridge to the Refining Crisis.” Commodity Context, June 29, 2022. Available at https://www.commoditycontext.com/p/ collapsed-bridge-refining-crisis.

Johnston, Rory. 2022c. “Refiners’ Unbalanced Barrel.” Commodity Context, November 23, 2022. Available at https://www.commoditycontext.com/p/ refiners-unbalanced-barrel.

Johnston, Rory. 2023a. “Canadian Refining Regionalism.” Commodity Context, November 14, 2023. Available at https://www.commoditycontext.com/p/ canadian-refining-regionalism.

Johnston, Rory. 2023b. “Cracking Up (Again).” Commodity Context, August 10, 2023. Available at https://www.commoditycontext.com/p/cracking-up-again.

Johnston, Rory. 2024. “Pipeline from Perdition.” Commodity Context, June 17, 2024. Available at https://www.commoditycontext.com/p/ pipeline-from-perdition.

Khan, Shariq. 2024. “Braya starts making renewable diesel at converted Comeby-Chance plant.”

Reuters, February 22, 2024. Available at https://www. reuters.com/business/energy/braya-starts-making-renewable-diesel-convertedcome-by-chance-plant-2024-02-22/.

McCarten, James. 2023. “Undo Line 5 shutdown order, Ottawa’s filing urges U.S. appeals court.” Financial Post, September 18, 2023. Available at https://financialpost.com/commodities/energy/oil-gas/ undo-line-5-shutdown-order-ottawa-us-appeals-court.

Morgan, Geoffrey. 2021. “Alberta takes 50% stake in troubled Sturgeon Refinery, as CNRL, North West Refining see combined $825-million payday.” Financial Post, July 5, 2021. Available at https://financialpost.com/commodities/energy/ oil-gas/alberta-takes-50-stake-in-troubled-sturgeon-refinery-as-cnrl-northwest-refining-see-combined-825-million-payday.

Park, Jackie, and Alfie Shaw. 2024. “Boeing sustainability chief says SAFs are unlikely to fall as low as jet fuel.” Power Technology, April 24, 2024. Available at https://www.power-technology.com/news/ boeing-sustainability-chief-says-safs-are-unlikely-to-fall/.

Petróleos Mexicanos. 2024. Base de Datos Institucional de Petróleos Mexicanos. Accessed June 2024. Available at https://ebdi.pemex.com/bdi/bdiController. do?action=temas&fromCuadros=true.

Statistics Canada. 2024. Table: 25-10-0081-01 Petroleum products by supply and disposition, monthly [Data table] and Table: 25-10-0063-01 Supply and disposition of crude oil and equivalent [Data table]. Accessed June 2024. Available at https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2510008101 and https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2510006301.

Vortexa. 2024. Real-time Energy Cargo Tracking. Accessed June 2024. Available at https://www.vortexa.com/.

Endnotes

- Data Note: Frustratingly, Canadian statistical agencies suppress certain data for commercial confidentiality reasons, which is particularly common in refining and all but eliminates data for the Irving Refining in New Brunswick as well as refining activities in Saskatchewan, British Columbia, and even Quebec. As a result, much of the functional data breaks down to Alberta, Ontario, and the rest of Canada, which unhelpfully lumps Saskatchewan and British Columbia – two Western provinces – in with the east. This helps explain, as just one example, the higher proportion of bitumen, heavy, and synthetic crude than would otherwise be expected.

- The Canadian Energy Regulator’s Canada’s Energy Futures report contains three scenarios: “In the Global Net-zero Scenario, we assume Canada achieves net-zero emissions by 2050. We also assume the rest of the world reduces emissions enough to limit global warming to 1.5 Celsius (°C). In the Canada Net-zero Scenario, Canada also achieves net-zero emissions by 2050, but the rest of the world moves more slowly to reduce GHG emissions… The third scenario, the Current Measures Scenario, assumes limited action in Canada to reduce GHG emissions beyond measures in place today and does not require that Canada achieve net-zero emissions. In this scenario we also assume limited future global climate action.” (Canada Energy Regulator 2023).