By Brian Lee Crowley

After the release of today’s StatsCan Daily, you can see why the debate over the “hollowing out” of Corporate Canada by foreign investors continues to rage.

No…wait…actually that debate has almost completely disappeared! I can’t understand why, when StatsCan today says, in a ringing statement that should get the blood boiling in the breast of every true Canadian economic nationalist:

Corporate assets, revenues and profits of Canadian-controlled firms all increased at a faster pace than those under foreign control in 2008. As a result, the share of foreign control in the Canadian economy declined in the case of all three measures.

… Corporate assets under foreign control increased 5.0% from 2007, less than half the growth rate of 13.7% posted by Canadian-controlled firms. Consequently, foreign-controlled firms accounted for 20.3% of assets in 2008, down from 21.6% the year before.

Ohhhhhh, no, I guess that’s not right either. Do you mean to say that foreigners only own a fifth of the assets of the Canadian corporate sector? And that their share is declining?

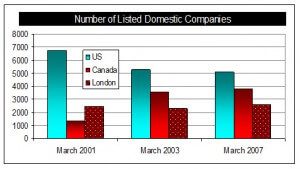

Not only is the answer yes, but these are long term trends. For example, the number of domestic companies listed in Canada has increased, unlike the situation in e.g. the US:

And of course Canadians are also voracious investors in other countries’ companies. We have been a net foreign investors (meaning that our investments in other countries’ companies exceed foreigners’ investment in our companies) since 1997.

As this chart shows, for instance, over time buying and selling by Canadians is fairly balanced, with occasional spikes caused by exceptionally large deals like the one several years ago for INCO.

In other words, most of the anxious hand-wringing about hollowing out is not borne out by the facts, and in fact the situation is getting better, not worse if you think who owns Canada’s corporations matters. But when you consider that the evidence is strong that foreign ownership brings with it higher levels of both innovation and productivity, while employing lots of Canadians, obeying Canadian laws and paying Canadian taxes, it is not at all clear why foreign ownership ought to be considered a bad thing. This is doubly true when we consider the advantages that flow to Canadians through their ability to invest in foreign companies (benefits include, among other things, higher pensions from higher investment returns). If we want to be able to invest abroad, we have to offer reciprocity.

Bottom line: don’t lose any sleep over “hollowing out”. Canada has lots of challenges. Let’s not waste our time on imaginary ones.