The median annual pay growth of workers who moved jobs has exceeded the pay of those who stayed in one place, and the divide between the only be getting wider as the labour market evolves, writes Linda Nazareth.

The median annual pay growth of workers who moved jobs has exceeded the pay of those who stayed in one place, and the divide between the only be getting wider as the labour market evolves, writes Linda Nazareth.

By Linda Nazareth, October 26, 2018

When it comes to your career, are you a “twister” or a “sticker”? One way to tell might be to check your pay stub: If you are a twister, it is likely to be higher than if you are a sticker. That is, it appears that those who are willing to quit their jobs in search of raises end up making more than those who stay put and try for the gold watch. Even more important, the actions of twisters and stickers may tell us something about the broader labour market, and in particular why wages are not rising as quickly as they might be given its state.

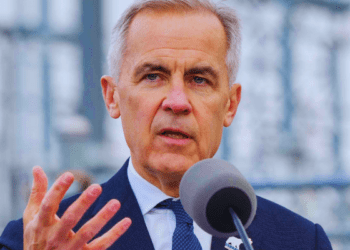

he analysis around twisters and stickers comes from Andy Haldane, deputy governor of the Bank of England, who shared his insights at a London conference last week. Using data from British workers, the BoE found that the median annual pay growth of workers who moved jobs (“twisters”) has exceeded the pay of those who stayed in one place (“stickers”) by four percentage points since 1994.

Historically, twisters tend to affect more than their own pay. The fact that some employees quit for better wages usually wakes up employers to the fact that they could lose more people, which in turn tends to make them give raises to those who stay behind. Clearly then the best scenario, for employers, is a reality in which everyone is happy where they are (or too afraid to leave) and no one has any intention of changing jobs. In that state of affairs, you barely need to give pay raises at all.

Actually, that scenario has characterized the labour force in North America (and in Britain as well) for much of the past decade. In the wake of the financial crisis, with companies thinking very carefully about what staff they needed and how they could cut costs, of course people were reticent about changing jobs. That probably goes a long way toward explaining why wage growth has been so slow in recent years.

But things have changed, have they not? After all, as of September, the unemployment rate in Canada was just 5.9 per cent, while in the United States it was a minuscule 3.7 per cent (the lowest since 1969). Those rates are indicative of pretty tight labour markets, which should be pushing wages higher. That is happening, but just barely. In Canada, annual wage growth in September was just 2.4 per cent, while in the United States it was a bit better than that at 2.8 per cent. However, given that inflation is currently running at 2.8 per cent in Canada and 2.7 per cent in the United States, it does not seem that workers are making a ton of headway.

So back to the idea of twisters and stickers. According to Mr. Haldane, although twisters may still be getting pay raises for themselves, the British evidence suggests that this time around employers do not feel compelled to give raises to the workers they leave behind. In turn, that is holding down wage growth in Britain, even though the unemployment rate there is hovering around 4 per cent. In his view, the reason the stickers are not doing better is that workers in general are now less apt to be permanent employees, but rather to be contractors or part-timers or in some other iteration of the gig economy.

That is likely an issue in North America as well, and presumably goes some way toward explaining why wage growth is so tame. Although clearly being a gig worker is a choice for some, it is foisted on others involuntarily (in Britain, apparently 25 per cent of those who are in temporary work say they cannot find full-time work). In contrast to the precrisis days, employers are apparently now making less investment in employees and are not particularly concerned about a rise in the number of twisters. Being a sticker, in other words, is a luxury even when the unemployment rate is low.

The bigger picture in all this is there has presumably been a break in the relationship between a low unemployment rate and high growth in wages and inflation. In turn, that should mean monetary policy does not have to respond to tight labour markets (which actually might be a lot less tight than meets the eye) as quickly as was true in the past. That is good news if you are worried about how high interest rates may go when unemployment is (officially at least) so low.

As for the workers who want a better paycheque, the answer seems to be that they need to take more risk. Twisters have always made more than stickers, and the divide between the two appears to only be getting wider as the labour market evolves.

Linda Nazareth is a senior fellow at the Macdonald-Laurier Institute. Her book Work Is Not a Place: Our Lives and Our Organizations in the Post Jobs Economy will be published in November.