This article originally appeared in The Hub.

By Tim Sargent, September 2, 2025

Canadians woke up to rather troubling economic news late this week, with Statistics Canada announcing a larger-than-expected slowdown for the second quarter of 2025. Overall, Canada’s GDP declined 1.6 percent on an annualized basis, largely due to American tariffs squeezing exports.

And so Canada goes, so goes its largest province. The outlook is bleak: Ontario’s economy is in trouble.

While Donald Trump’s tariffs pose a clear and present danger to key sectors in the province, such as autos—StatsCan reported a whopping 24.7 percent decline in international exports of passenger cars and light trucks in Q2 owing to U.S.-imposed tariffs—and steel, the reality is that Ontario’s economy has been stuck in neutral for many years owing to high taxes, overregulation, excessive immigration, and a malfunctioning higher education system.

Decisive action will be required to get Ontario’s economy back on the right track: what is needed is not more government subsidies to favoured sectors, but rather bold reforms that will give the private sector the means and motive to do what it does best: create prosperity.

Ontario’s dismal economic record

Most Canadians are aware of their country’s poor economic performance over the last few years. However, it is perhaps less well appreciated that Ontario—long the economic powerhouse of Confederation—is making a disproportionate contribution to this decline, with living standards and productivity growth that are slipping behind the rest of Canada.

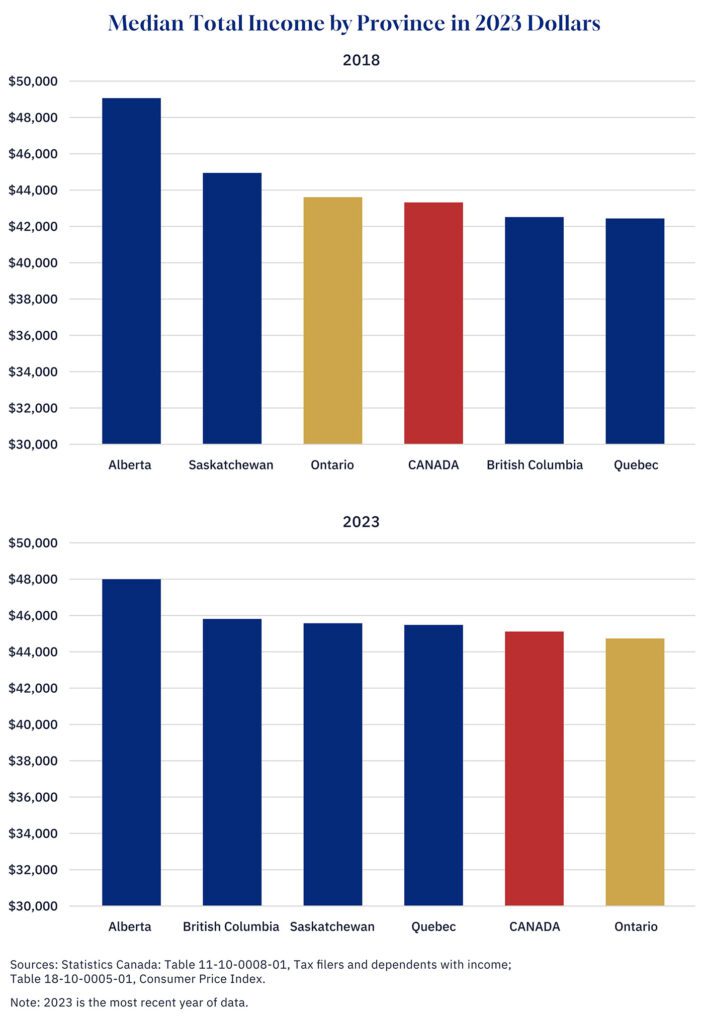

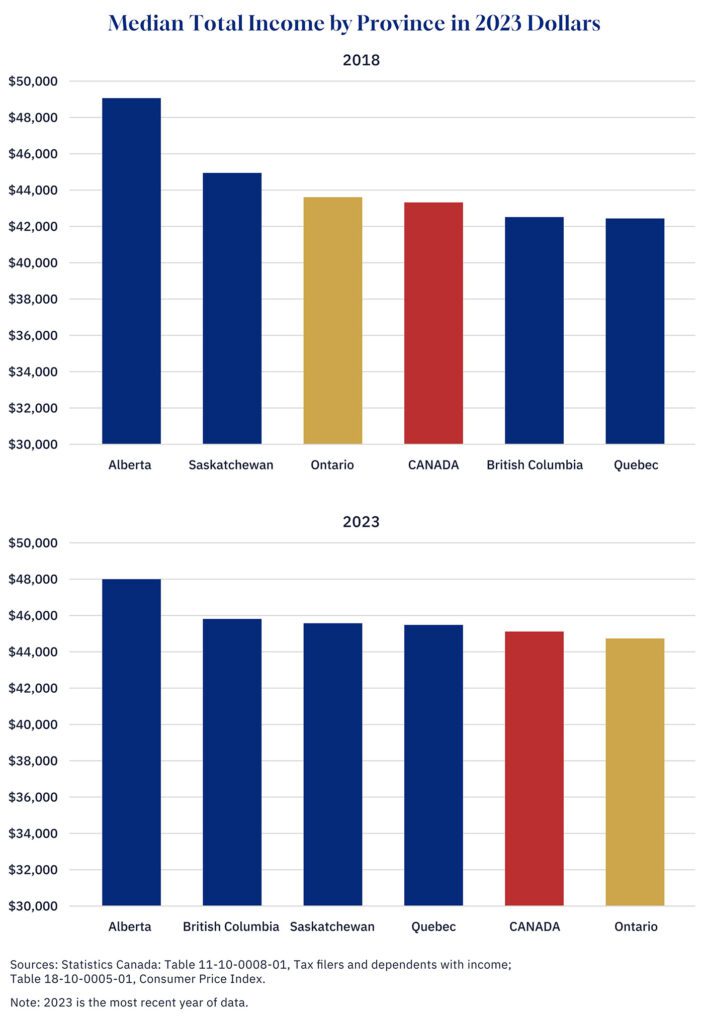

Since 2018, the year that the Ford government came to power, median real incomes in Ontario have grown by only 0.5 per cent a year on average, compared to 0.8 per cent for Canada as a whole and 1.4 per cent for Quebec. As a result, Ontario slipped from having the third-highest median income among the 10 provinces in 2018 (after oil-rich Alberta and Saskatchewan) to fifth-highest in 2023, surpassed by both B.C. and Quebec. Furthermore, median incomes in Ontario are now below the national level (see Chart 1 below).

Ontario’s lagging living standards are a result of stalled productivity, as Chart 2 illustrates. While productivity growth for Canada overall averaged an anemic 0.2 per cent a year between 2019 and 2024, Ontario saw no growth at all, with productivity in 2024 no higher than in 2018. Meanwhile, the U.S. averaged 0.9 per cent annual growth in productivity over the same period.

Ontario’s economic decline is also visible in interprovincial migration statistics, as people leave the province in search of better opportunities. In 2017/2018, more people moved to Ontario than to any other province except for British Columbia. By 2023/24, Ontario had a net outflow, as its residents moved to other provinces, particularly Alberta. Ontario also saw a significant increase in net emigration abroad over the same period.

Fixing the problem: a better tax system

What explains Ontario’s poor economic performance, both in absolute and relative terms, and how can it be improved?

One place to look is the tax system, which affects all economic activity throughout the economy. Unfortunately, Ontario is a high-tax jurisdiction compared to many other jurisdictions. Personal income taxes are particularly high: according to the Fraser Institute, the combined federal/provincial marginal rate in Ontario for someone earning $150,000 is 45 percent, the third-highest combined rate in Canada, and well above nearby American states such as Michigan (28.25 percent) and New York (30 percent), to say nothing of Florida (24 percent) and Texas (24 percent) which have no state income tax at all.

High personal income taxes are an economic drag because they reduce incentives to work, to save, and to invest. They also provide a strong incentive to move to lower tax jurisdictions, particularly for those highly talented individuals who are the biggest contributors to economic growth. It is no coincidence that low-tax jurisdictions in North America are the ones showing the most economic dynamism.

This means that bringing tax rates down, especially for high-income earners, should be a top priority. The good news is that this can be achieved at low fiscal cost. This is because lower taxes—particularly on high-income earners—mean more economic activity, which will then bring in more revenue from both income and sales taxes. High-income earners are also adept at moving their money around to avoid taxes: with lower rates, there will be less incentive for this kind of tax planning and thus more revenue.

Ontario should also have a good look at its corporate income tax system, which is a key driver of business investment decisions. While Ontario’s corporate income tax (CIT) rates are largely competitive, President Trump’s tax legislation is likely to erode this position through various changes designed to make investment more attractive. With the trade uncertainty already making large companies nervous about investing in Canada, Ontario should be looking to a major revamp of its CIT system to increase Ontario’s attractiveness as a place to invest.

One way for Ontario to encourage investment would be to cut its CIT rate from its current 11.5 percent. However, this provides a windfall gain for investments that have already been made. A more effective approach, as suggested by Professor Trevor Tombe of the University of Calgary, is to incent new investments by allowing firms to immediately deduct new capital investments from their taxes, rather than doing so over a long period of time as they depreciate.

Even more investment-friendly—and simpler—would be to adopt Estonia’s system, which only taxes distributed profits so that any profits that are reinvested in a business are not taxed. Since it was introduced in 2000, investment has risen significantly, while corporate tax receipts are actually higher as a share of GDP than under the old system.

A more investment-friendly tax system would allow the province to dispense with the patchwork quilt of business subsidies, which substitute the judgement of politicians and bureaucrats for that of businesspeople, and which have not prevented Ontario’s economic decline in recent years.

Adopting bold ideas like these to make Ontario’s CIT regime more investor-friendly would require Ontario to break with the federal CIT regime and to set up its own system. While this would lead to additional complexity, it should be noted that Alberta and Quebec already have their own CIT systems, as do U.S. states. Indeed, Ontario’s threat to go it alone on CIT might well prompt the federal government to revamp its system along the same lines to prevent Ontario’s departure.

Fixing the problem: less regulation

Less visible than taxes but perhaps even more deleterious to economic performance are regulations on business. While some regulations are essential in any society, many regulations are outdated, inefficient, and administratively burdensome. According to the latest report by the Canadian Federation of Independent Business, Ontario’s performance is middling, with the province’s regulatory system seen as more burdensome than five other provinces (the Western provinces plus Nova Scotia).

To be fair to the Ford government, reducing the regulatory burden has been a priority, with a series of red tape reduction packages implemented since 2018. Bill 2, which received Royal Assent in June, is a welcome attempt to deal with the longstanding problem of interprovincial trade barriers, and Bill 5, which received Royal Assent on the same day, should help improve the prospects for major resource projects.

However, a more comprehensive approach is required if Ontario is going to improve its relative ranking among Canadian provinces. Following the approach of the Campbell government in B.C. in 2001, the Ontario government needs to compile and make public a comprehensive inventory of all regulatory measures, along with an estimate of compliance costs. They should then commit to a specific target over a specific time frame—perhaps following B.C., which committed to a one-third reduction over three years. Without targets and comprehensive tracking, it will be impossible to know if the government is really making progress.

Fixing the problem: focusing and streamlining immigration and post-secondary education

Having the right mix of skills is essential to a prosperous economy. Unfortunately, both federal and provincial governments have confused quantity with quality when it comes to human capital policy. The federal government massively expanded the temporary foreign worker and foreign student categories, as well as failed to control asylum claims. The result is an excess supply of low-skill workers who earn less than the average wage and who, as Matt Spoke and Alexander Brown have written about in The Hub, are competing for scarce entry-level jobs and pushing up the youth unemployment rate.

Meanwhile, the provincial university system continues to produce graduates in areas such as business studies who do not meet the needs of an economy that needs skilled tradespeople and STEM graduates. In 2022, as many students graduated in business studies in Ontario as in STEM fields and skilled trades put together, something that was not true for any other province. In Alberta, for example, 60 percent more students graduated in STEM and skilled trades than in business studies.

Ontario, therefore, needs a comprehensive recalibration of how it creates and attracts human capital.

On immigration, Ontario should use its discretion under the provincial nominee program to target truly high human capital people who have very well-paying jobs lined up, and skilled tradespeople such as electricians and plumbers with recognized, solid credentials. The province should also be pushing for more provincial autonomy in selecting immigrants—similar to what Quebec achieved under the 1991 Canada-Quebec Accord—so that it can even better tailor immigrants to the needs of the Ontario economy, and avoid the huge immigration surge that we have seen since 2022

The higher education system also needs to be overhauled, with the university sector scaled back—except for STEM and health professions—and the community college sector expanded to produce more of the skilled tradespeople that the economy needs. While universities will no doubt complain about reductions in student numbers and the potential impact on research, the reality is that administrative costs at universities have risen significantly faster than academic costs, and much faster than inflation. Like much of the rest of the public sector, universities need to become leaner and more productive.

Success is possible!

Ontario has many strengths: geographic proximity to the U.S. economy and tariff-free access for most goods (at least for now); world-leading universities; significant strength in financial services and IT; huge potential in mining and agriculture; and one of the world’s most vibrant cities (according to my Toronto friends).

Building on these strengths will require a conscious decision to implement an economic model that emphasizes private sector leadership and that makes Ontario a welcoming place for businesses and businesspeople, with policies that foster innovation, risk-taking, and the right skill sets.

There is no reason Ontario can not make this shift. While some levers are held by the federal government, provinces have significant room to shape their economic destinies, particularly a province as big and important as Ontario. Alberta is a good example of a province that has worked hard and successfully to foster a business-friendly environment.

Ontario can do the same.

Tim Sargent is a contributor to Project Ontario and the director of the Domestic Policy Program at the Macdonald-Laurier Institute