By Andrew Evans

March 7, 2024

Speaking in December 2023, Minister François-Philippe Champagne brought the upcoming deficit of Canada’s clean power supply into critical focus, stating that companies were reticent to invest “because some jurisdictions are getting strained with respect to the capacity of energy generation.” Ensuring a stable source of electricity has historically not been an issue in Canada, and the minister’s comments served to demonstrate the urgency of finding new generation sources.

To solve the constraints on energy generation as the minister outlined, and to meet net-zero 2050 targets, the federal government projects that grid demand will be twice that of today. To meet that demand, the capacity of the grid, which we have accumulated since we have had electricity – roughly the past 140 years – will have to double in the next 21 years (Canada Energy Regulator 2023).

If we don’t solve this looming power supply shortage, we will be forced to miss out on private sector investment, make hard decisions about electricity access, or pay higher prices, causing avoidable social pain and unnecessary economic hardship.

Across the country, provinces recognize this imperative and are hastily working on solutions. Ontario is racing to safely build new nuclear plants in order to meet expected demand by 2029 while filling interim demand with new gas plants and a new call for renewables (Ontario Power Generation 2022). Quebec is spending up to $185 billion to solidify provincial supply amidst rising demand both in- and out-of-province (Blais, Stéphane 2023). Meanwhile, British Columbia is filling a projected 15 percent increase in demand by 2030 with the first acquisition of new generation sources in 15 years (Global News 2023). Even Manitoba, a province with abundant and previously boundless supplies of cheap hydroelectricity, is now projecting a deficit by 2029 (Froese, Ian 2024) and is being forced to restrict access for potential new businesses due to supply shortages (Kives, Bartley 2023).

Why is this happening at the same time all across the country?

In short, the electricity systems of today are not going to be sufficient for tomorrow’s demands. The soaring demand stems from a rapidly rising population, increasingly electrified lives, and depletion of existing legacy stocks of supply. Electricity used to simply be a question of ensuring sufficient supply to meet demand while being affordable to the end consumer. This created a relatively simple balancing act for policymakers. Today, Canadian consumers and businesses are also interested in clean or low-emissions generation, creating a threelegged economic, social, and environmental problem that policy must resolve.

Where once most provinces relied on large-scale hydro dams for cheap, abundant power, the demands of our grids have outgrown the methods of the past. Largescale hydro dams flood massive amounts of land to create sufficient reservoirs to power their turbines reliably, and have challenges to assembling social licence, especially in the context of reconciliation. The Site C dam in British Columbia is set to flood 5550 hectares of land and be 83 kilometres long (BC Hydro 2018). Muskrat Falls in Labrador took 14 years from commencement of environmental assessment in 2006 to first generation in 2020, all while costing at least $6 billion overbudget (Global News 2023). The Keeyask project flooded 45 square kilometres of Manitoba in a 40-kilometre-long reservoir(Keeyask Hydropower Limited 2024) and ran at least 33 percent overbudget (Keeyask Hydropower Limited 2024). Public appetite for massive construction projects has faded in the face of rising costs and growing opposition from environmentalist groups. Hydroelectricity has also seen disconcerting trends in decreasing amounts of snow and rain, which it relies on for water in reservoirs during the year (Griffiths, Nathan 2023). The increased frequency of droughts is forcing governments to make extremely difficult decisions, and according to Agriculture Canada, as of December 31, 70 percent of the country is in abnormally dry or drought conditions (Agriculture Canada 2023). If these conditions persist, not only will they strain public water demands, but hydroelectricity production will also suffer from smaller reservoirs.

To help fill the historical electricity supply gaps, we used to burn coal in abundance to create steam to generate electricity. Like large-scale hydro, coal has lost social licence, and is today only used in three provinces (Alberta, Saskatchewan, and Nova Scotia), all of whom have plans to phase out its use (Alberta is going to have all coal generation phased out by early this year) (Alberta Ministry of Environment and Protected Areas 2024). While it remains cheap in itself, regulatory measures, like the carbon tax, increase the price of its use, and it is generally considered by the public as a “dirty” fuel that isn’t worth the environmental costs. Key concerns include its high CO2 emissions, as well as the particulates created if the coal is not all burned, which can cause smog and increased negative health impacts. While it is possible to eliminate coal plant emissions using carbon-capture and storage technology, natural gas is a cleaner and often more economic option.

In sum, yesterday’s workhorses of electricity generation are no longer going to be enough as their relative ease-of-use and overall business cases have eroded. We are going to need new sources of electricity to maintain a delicate balance of affordable, reliable, and clean energy.

Canada’s abundant supply of electricity is shrinking

While electricity supply is a delicate balancing act to ensure that the demand exists to pay for new generation assets, the situation in Canada is bordering on dangerous. Cheap, abundant, and reliable electricity has served as the lifeblood of our economic system since the dawn of the twentieth century. Sir Adam Beck, (who created the precursor to Ontario Hydro), spoke in the Ontario Legislature in 1905 about the “very great influence upon the commercial development of the Province [that] will be exercised by the furnishing of cheap power” (Beck, Adam 1905). Since then, the underlying premise that cheap power underlines a prosperous Canadian lifestyle has not changed.

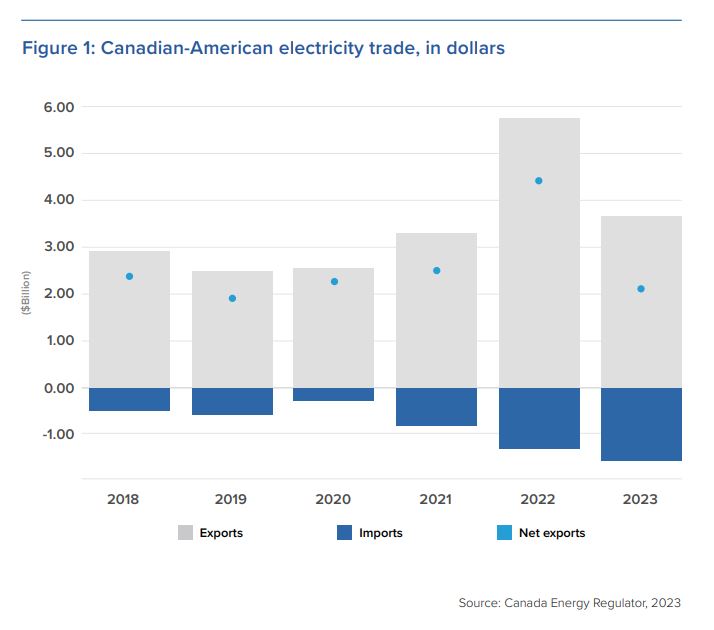

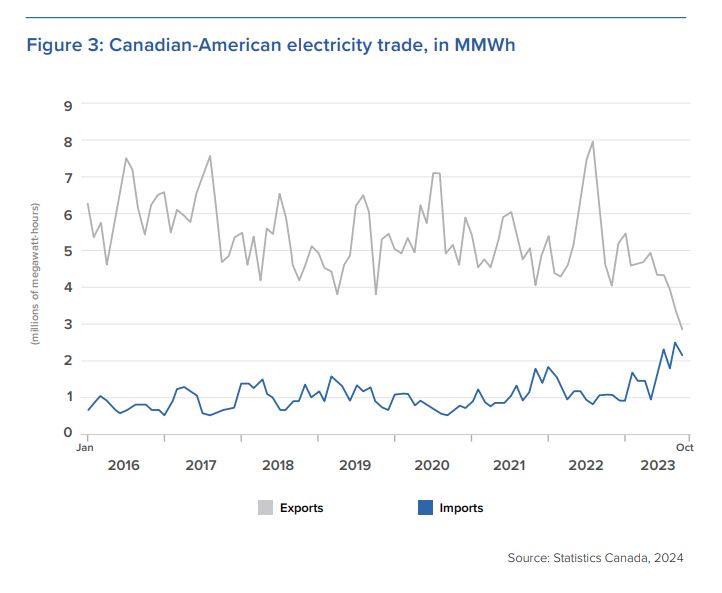

Canada’s electricity has been so abundant that we have grown used to reaping the benefits, including those seen by exporting major amounts of electricity to the United States. From these largely silent exports, we garner billions of dollars annually, and saw record profits in 2022 (Canada Energy Regulator 2023).

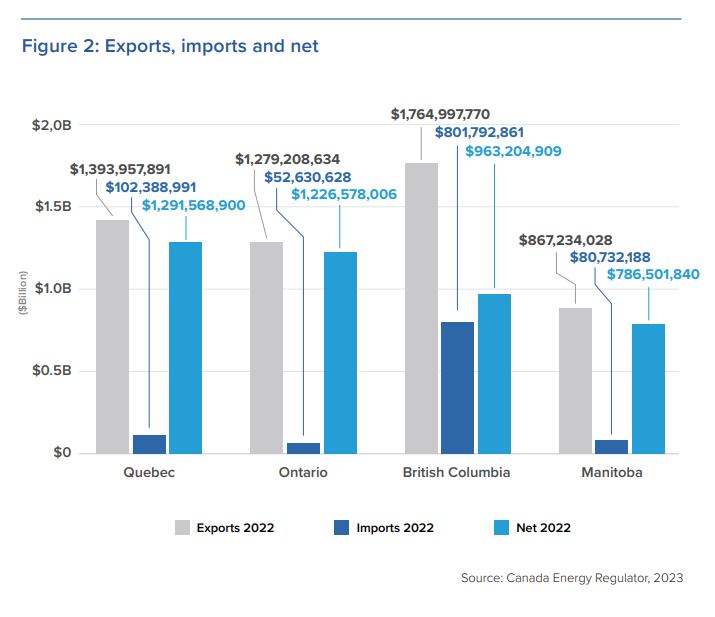

Those profits help to indirectly subsidize large-scale electricity projects in Canada at magnitudes that would otherwise be uneconomic. By sending excess electricity south when the price is higher in the United States, it helps to drive down electricity costs for Canadians. These benefits are especially true in the main four exporting provinces (Figure 2). In 2022 alone, Quebec saw a $1.29 billion net windfall, Ontario $1.22 billion, British Columbia $963 million, and Manitoba $786 million.

These net profits go back to the provinces and can be spent on anything the government deems important, such as the costs of running the electricity systems, social programs, lower taxes, or more services. In each of the respective provinces these high export values act as an indirect subsidy to Canadian ratepayers by enabling lower electricity prices, something that benefits large and small manufacturing, residential users, and midsize commercial customers. Everyone benefits from this across-the-board reduction in prices, and the full benefit is so silent that the final user often has no idea of the extent of the positive impact or where it came from.

Without sufficient surplus to export, these previously reliable financial windfalls will dry up and the provincial ratepayers will face higher costs, while governments who were using these funds to underwrite lower taxes or expanded services may have to re-evaluate. Past yearly trends have shown reductions in total exports, despite continued profits.

The downsides of Ottawa’s ‘electrification’ mandate

Helping to drive this landscape of shrinking supply is the increasing electrification of Canadian life being encouraged by Ottawa. While many of these new innovations will make our lives better and easier, and should be welcomed, the requisite amounts of electricity must be cheaply and readily available, or they will fail to achieve their intended result. For instance, Ottawa’s mandate to have all new vehicle sales be electric by 2035 (Rabson, Mia 2023), and to massively expand heat pump uptake in homes (Canada Energy Regulator 2023), would both be rapidly rendered entirely unworkable due to the increased demands on the grid if the price of electricity skyrocketed due to shortages in supply. Add to this potentially conflicting policy signals from the Clean Electricity Regulations to decarbonize electricity grids in a very short timespan, while obviously still requiring them to be reliable, and the perfect storm brews for Canada’s electricity policies.

Provincial responses and capital planning

Provinces are taking different responses to their capital planning while being wholly aligned on the central policy solution – to build more generation capacity.

For example, the recently released capital plan for BC Hydro outlined $36 billion in spending over the next ten years, a 50 percent increase from the 2014–2024 capital plan, which had a budget of $24 billion (BC Hydro 2024). This is in response to an expected demand increase of 15 percent by 2030, but this is not the only response. For the first time in 15 years, 550 megawatts of additional generation are being sought in the Lower Mainland area by 2029 from private developers (Ezekiel, Ron et al. 2023). Increased private development has the potential to offload risk to the private sector in exchange for compensation in the price obtained when selling into the electricity market. Given that the cost overruns at Site C have made it the most expensive dam in Canadian history, costing at least $16 billion(Eliesen, Marc 2021), maintaining an affordable system will need to be paramount for the success of the British Columbian economy.

Alberta has taken more cautious steps towards a net-zero grid, although it has a provincial net-zero target by 2050. Prior to the pause on renewable approvals, it was a good place to do business in renewables, accounting for 75 percent of the growth of Canadian renewables in 2022, and the third-largest amount of wind electricity generated in the country in 2023 (Canada Energy Regulator 2023). This increase has helped to lower the emissions of the province’s electricity sector from 50 megatonnes in 2005 to 30 megatonnes in 2020 (Alberta Electricity System Operator 2024), a significant drop that has largely been driven by the phase-out of coal generation. In line with the province’s stated commitments, in 2022, the Alberta Electric System Operator published a report that raised concerns with Ottawa’s plans for a 2035 net-zero electricity system, saying such a goal was “highly uncertain and [presented] a significant risk” (Alberta Electric System Operator 2022). Alberta does face legitimate difficulties in decarbonization, with a lack of hydroelectric baseload generation, reliance on natural gas as a baseload generation, limited interconnections to other jurisdictions, and a deregulated private-sector electricity system. Alberta’s unique combination of challenges, both internal and external, will strain political efforts to move too quickly, as a lack of control over stable generation of electricity is not something the province will allow.

Aiming to achieve net-zero electricity by 2050, Saskatchewan strikes a similar path to Alberta, in contrast to the federal government directive for a net-zero grid by 2035. To frame the scale of this issue, in 2021, the electricity sector in Saskatchewan created 14.9 megatonnes of CO2, which is equivalent to about 2 percent of Canada’s 2021 emissions of 670 megatonnes. SaskPower, the publicly owned electricity monopoly, is currently engaged in a process to develop a long-term electricity plan for the province and is actively examining the feasibility of small modular reactors (SMRs) in the province to provide a stable baseload source(SaskPower 2024). The final decision on whether to build any nuclear reactors is not expected to be made until 2029 (SaskPower 2022), which is, perhaps not coincidentally, the same time as when the first SMR in Ontario is set to be completed. With the success or failure of Ontario’s SMR build, Saskatchewan will be in a position to make a confident decision about whether to proceed. Finally, the province is building new transmission inside the province, but is not expanding its interprovincial import/export capacity (SaskPower 2024).

Manitoba Hydro has been hydropower giant, producing 97 percent of the province’s electricity from hydropower in 2019 (Canada Energy Regulator 2020) but the good times at the publicly owned utility are rapidly running out.

Manitoba Hydro’s high debt level requires it to devote 33 cents of every $1 in revenue to paying interest. Meanwhile, the new NDP government effectively vetoed privately owned generation (Da Silva, Danielle 2024), placing the utility (and by extension, the province) into a severe financial crunch. With projections showing a potential near-tripling of demand by the 2040s, and the previous supply fulfillment plan relying on an expansion of private sector generation to meet this demand (Government of Manitoba 2023), a new plan is needed with haste.

Ontario is a true outlier amongst the provinces given the reliance on nuclear for the lion’s share of the provincial electricity (providing 53.7 percent of 2022 electricity) (Independent Electricity System Operator 2024). Despite the extension of the Pickering nuclear power plant announced in January 2024 (Shakil, Ismail 2024), the provincial regulator, the Independent Electricity System Operator, has admitted there is the potential of a shortfall by the late 2020s (Independent Electricity System Operator 2022). To address this, Ontario has begun construction on the first fleet of Small Modular Reactors in the western hemisphere. With four planned, the first is to be commercially operable by 2029, and the ready by the mid-2030s (World Nuclear News 2023). With the history of nuclear builds in the West being one strewn with cost and time overruns, there is an element of risk here that must be addressed. The latest American nuclear plant is $16 billion over budget, and it is still not complete (American Nuclear Society 2022). To try to mitigate the issue of lack of supply from time overruns, the province is seeking to reduce risk by expanding generation capacity in natural gas and renewables. However, left open is the issue of what would happen with the concurrent cost overruns. More transparency around costs is needed today to build public support in case it is needed tomorrow.

Unlike Ontario, Quebec shut down its nuclear power sector in 2012, as abundant hydroelectric generation was sufficient. In the intervening years, Quebec sold itself to companies and US states as a provider of reliable, cheap, and clean power. Now, Hydro-Québec faces supply crunches by 2027 (HydroQuébec 2022). In response, it will spend $185 billion by 2035 to meet the necessary generation needs of at least 8000 megawatts. This is equivalent to the generation capacity of the three largest hydro dams in Quebec, the RobertBourassa, Manic-5, and the Romaine complex (Hydro-Québec 2024). For reference, the Robert-Bourassa dam, which is Canada’s largest hydroelectric development, took seven years to build (1974-1981), and created a reservoir of 2,905 square kilometres (Hydro-Québec 2024) (which according to Hydro-Québec, contains so much water that “each of the habitants could draw 10,000 litres of water from it before it ran dry”) (Hydro-Québec 2024). Quebec’s plans for closing the near-term electricity supply gap hinge on 10,000 megawatts of offshore wind and another 4200 megawatts from hydropower. New sources of hydropower have not been identified and may involve retrofitting existing dams with more efficient turbines. As of writing, there are no offshore wind farms operating or under construction in Canada, so the progress in Quebec is difficult to assess. In the areas off the US eastern seaboard where it is being constructed, offshore wind has been facing headwinds, as projects encounter problems from local opposition (Barnes, Jeanette 2024) and rising costs (Garcia, Eduardo 2024). While some of this may be due to the more populated nature of the area, Quebec must accommodate these issues to ensure supply is in place.

In Atlantic Canada, there are widely divergent plans to address to meet tomorrow’s electricity demands. Nova Scotia is making a big bet on wind generation, planning to use it to phase out coal and have 80 percent renewable generation by 2030 (Government of Nova Scotia 2023). In 2022, 67 percent of Nova Scotia’s electricity came from fossil fuels (47 percent coal and 20 percent natural gas)(Government of Canada 2023). But already, plans to develop new wind farms are hitting bumps as local concerns emerge (Withers, Paul 2023). After the failure of the Atlantic Loop – a proposed expansion of the electrical grid between Quebec, New Brunswick, and Nova Scotia – the two Maritime provinces are instead cooperating to develop transmission interconnections between their markets(Rabson, Mia 2023). In so doing, they could build on each other’s comparative advantages, as New Brunswick has bet on SMRs, planning to double generation from nuclear by 2035, alongside five-fold increases in the amount of renewables on-grid (Government of New Brunswick 2023). These sources and partnerships could help fulfill both provinces’ 2035 net-zero grid plans.

Meanwhile, Newfoundland and Labrador has recently finished, and is now recovering from, the Muskrat Falls hydro project. With final costs at least 81 percent overbudget (Smellie, Sarah 2023), a public inquiry launched into the project while it was under construction (Commission of Inquiry Respecting the Muskrat Falls Project, 2020), and continued issues even after commissioning (Butler, Patrick, 2023), it has been nothing short of a catastrophe. Alongside Muskrat Falls, Newfoundland has the Churchill Falls hydro saga, where it has a long-term sales contract until 2041 with Quebec at highly unfavourable rates (Libman, Robert 2023). Overall, Newfoundland has a very clean grid and continued export markets, but it has two mega-sized hydro projects that will cause financial headaches for decades to come.

Facing the challenges ahead

If Ottawa is truly serious about the scale of the challenges we face, it must recognize that a coherent strategy is required, or the entire scheme will fail. Looking for inspiration south of the border could be a good idea, as the Americans decided to use a notably different way to incentivize change in their electricity system. Instead of punitive regulations, the Inflation Reduction Act made the philosophical choice to use carrots instead of sticks, so that at the core, the federal government sacrificed potential future revenues in exchange for positive developments in the nationwide electricity system (United States Environmental Protection Agency 2023). While imperfect, the Inflation Reduction Act has succeeded in that from Q3 2022 to Q3 2023, $225 billion was invested domestically in clean energy, clean vehicles, building electrification, and carbon management technology (Massachusetts Institute of Technology and Rhodium Group 2023). Taking a similar approach in Canada could yield more fruitful results and a more long-lasting political consensus than the fundamentally confrontational approach Ottawa uses now.

Like much of the rest of the world, Canada faces a very challenging road ahead in electricity policy in balancing many different input factors. As illustrated in the case studies above, this story only gets more complex as the individual provinces are examined. Because of this, Ottawa must recognize that the Clean Electricity Regulations are too constricting for unique provincial circumstances. If anything, there is a consensus across Canada on moving to net-zero by 2050, which the federal government wants. However, a heavy-handed regulatory approach threatens the progress Ottawa wants, inciting a negative cycle of retaliatory politics.

If Canada is to meet the moment and come through the challenges ahead, a more cooperative intergovernmental stance is required. This will see increased construction of generation and transmission, greater interprovincial trade of electricity, greater speed in approvals, and more coherent use of policy to clearly signal economic outcomes. Using these practices, Canada can improve growth and productivity, helping to improve living standards, quality of life, and overall direction of the country. Without these necessary changes, missed stated commitments from government will be just another marker on the road to decline.

About the author

Andrew Evans is an experienced Canadian policy professional. He is currently studying for a Master of Public Administration in Energy Policy from Columbia University.

References

Agriculture Canada. 2023. “Current drought conditions.” December 31, 2023. Available at https://agriculture.canada.ca/en/agricultural-production/ weather/canadian-drought-monitor/current-drought-conditions.

Alberta Electricity System Operator. 2022. “AESO Net-Zero Emissions Pathways,” June 2022. Page 6. Available at https://www.aeso.ca/assets/ Uploads/net-zero/AESO-Net-Zero-Emissions-Pathways-Report.pdf.

Alberta Electricity System Operator. 2024. “Alberta’s Power System in Transition.” Accessed 2024. Available at https://www.aeso.ca/assets/Uploads/ net-zero/AESO-Net-Zero-Emissions-Pathways-Report.pdf.

Alberta Ministry of Environment and Protected Areas. 2024. “Phasing out emissions from coal.” 2024. Available at https://www.alberta.ca/climatecoal-electricity#:~:text=In%202015%20the%20Government%20of,coal%20 generation%20by%20early%202024.

American Nuclear Society. 2022. “Vogtle project update: Cost likely to top $30 billion.” NuclearNewswire, May 9, 2022. Available at https://www.ans. org/news/article-3949/vogtle-project-update-cost-likely-to-top-30-billion/.

Barnes, Jeanette. 2024. “Cape Cod residents air objections to current plans for offshore wind.” New England Public Media, January 31, 2024. Available at https://www.nepm.org/2024-01-30/ cape-residents-air-objections-to-current-plans-for-offshore-wind.

BC Hydro. 2024. “Power Pathway – Building B.C.’s energy future.” January 2024. Page 3. Available at https://news.gov.bc.ca/files/CS-4307-CapitalPlan_LTR.pdf.

BC Hydro. 2018. “Site C Clean Energy Project: Site C Reservoir.” February 2018. Available at https://www.sitecproject.com/sites/default/files/infosheet-site-c-reservoir-feb-2018_0.pdf.

Beck, Adam. 1905. “The Public Interest in the Niagara Falls Power Supply.” Brock University Digital Repository, May 1905. Page 11. Available at https://www.sitecproject.com/sites/default/files/info-sheet-site-c-reservoirfeb-2018_0.pdf.

Blais, Stéphane. 2023. “Hydro-Québec to spend up to $185 billion to increase capacity, reliability.” Global News, November 2, 2023. Available at https:// globalnews.ca/news/10066309/hydro-quebec-plan/.

Butler, Patrick. 2023. “Muskrat Falls generating unit must be fully dismantled, says report.” CBC News, July 12, 2023. Available at https:// www.cbc.ca/news/canada/newfoundland-labrador/muskrat-falls-generatingunit-dismantlement-need-1.6903502.

Canada Energy Regulator. 2023. Canada’s Energy Futures 2023. Available at https://globalnews.ca/news/10066309/hydro-quebec-plan/.

Canada Energy Regulator. 2023. “Canada’s Energy Future Data Appendices/ Electricity Generation.” Available at https://apps.cer-rec.gc.ca/ftrppndc/dflt. aspx?GoCTemplateCulture=en-CA.

Canada Energy Regulator. 2023. “Market Snapshot: Heat pumps could significantly reduce GHG emissions from Canada’s buildings.” December 20, 2023. Available at https://apps.cer-rec.gc.ca/ftrppndc/dflt. aspx?GoCTemplateCulture=en-CA.

Canada Energy Regulator. 2023 “Market Snapshot: Record-high Canadian electricity export revenue in 2022.” September 27, 2023. Available at https:// www.cer-rec.gc.ca/en/data-analysis/energy-markets/market-snapshots/2023/market-snapshot-record-high-canadian-electricity-export-revenue-2022. html#:~:text=Electricity%20imported%20to%20Canada&text=For%20 example%2C%20Quebec’s%20average%20electricity,MWh%20to%20 %2457%20per%20MWh.

Canada Energy Regulator. 2020. “Provincial and Territorial Energy Profiles – Manitoba.” 2020. Available at https://www.cer-rec.gc.ca/en/data-analysis/ energy-markets/provincial-territorial-energy-profiles/provincial-territorialenergy-profiles-manitoba.html.

CBC News. 2021. “Manitoba Hydro’s $8.7B Keeyask generating station project now producing electricity.” CBC News, February 18, 2021. Available at https://www.cbc.ca/news/canada/manitoba/ manitoba-hydro-keeyask-generating-station-electricity-1.5918974.

Commission of Inquiry Respecting the Muskrat Falls Project. 2020. “Muskrat Falls: A Misguided Project.” March 5, 2020. Available at https://www. muskratfallsinquiry.ca/files/Volume-1-Executive-Summary-Key-Findingsand-Recommendations-FINAL.pdf.

Da Silva, Danielle. 2024. “NDP pulls plug on Hydro CEO’s vision to pursue more private power projects.” Winnipeg Free Press, January 31, 2024. Available at https://www.winnipegfreepress.com/breakingnews/2024/01/31/ ndp-pulls-plug-on-hydro-ceos-vision-to-pursue-more-private-power-projects.

Eliesen, Marc. 2021. “Marc Eliesen: Runaway costs on Site C — enough is enough.” Vancouver Sun, March 8, 2021. Available at https://vancouversun. com/opinion/marc-eliesen-runaway-costs-on-site-c-enough-is-enough.

Ezekiel, Ron et al. 2023. “What to expect from BC Hydro’s New Clean Power Call.” Fasken, June 26, 2023. Available at https://www.fasken.com/en/ knowledge/2023/06/what-to-expect-from-bc-hydros-new-clean-power-call.

Froese, Ian. 2024. “Manitoba Hydro may need new sources of power by 2029.” CBC News, January 30, 2024. Available at https://www.cbc.ca/news/canada/ manitoba/manitoba-hydro-grewal-electricity-generation-1.7099055.

Garcia, Eduardo. 2024. “New York lures back offshore wind builders burnt by cost hikes.” Reuters, February 1, 2024. Available at https://www.reuters.com/ business/energy/new-york-lures-back-offshore-wind-builders-burnt-by-costhikes-2024-02-01/.

Global News. 2023. “BC Hydro set to start first hunt in 15 years for new electricity sources.” Global News, June 15, 2023. Available at https://bc.ctvnews.ca/bchydro-set-to-start-first-hunt-in-15-years-for-new-electricity-sources-1.6443116.

Global News. 2023. “Muskrat Falls hydroelectric project in N.L. considered commissioned: CEO.” Global News, April 12, 2023. Available at https://globalnews.ca/news/9619115/ muskrat-falls-hydroelectric-project-in-n-l-considered-commissioned-ceo/.

Government of Canada. 2023. “Nova Scotia: Clean electricity snapshot.” November 16, 2023. Available at https://www.canada.ca/en/services/ environment/weather/climatechange/climate-action/powering-future-cleanenergy/overview-nova-scotia.html.

Government of Manitoba. 2023. “Manitoba’s Energy Roadmap.” July 28, 2023. Available at https://www.gov.mb.ca/jec/files/mb_energy_roadmap.pdf.

Government of New Brunswick. 2023. “Powering our Economy and the World with Clean Energy.” December 12, 2023. Page 6. Available at https:// www2.gnb.ca/content/dam/gnb/Corporate/Promo/energy-energie/GNBCleanEnergy.pdf.

Government of Nova Scotia. 2023. “Nova Scotia’s 2030 Clean Power Plan.” October 14, 2023. Available at https://beta.novascotia.ca/sites/default/files/ documents/1-3582/nova-scotia-clean-power-plan-presentation-en.pdf.

Griffiths, Nathan. 2023. “As energy use grows in B.C., electricity production falls.” Vancouver Sun, October 10, 2023. Available at https://vancouversun. com/news/local-news/climate-change-affecting-b-c-s-hydro-power.

Hydro-Québec. 2023. “Action Plan 2035 – Towards a Decarbonized and Prosperous Québec.” Page 4. November 2023. Available at https://www. hydroquebec.com/data/a-propos/pdf/action-plan-2035.pdf.

Hydro-Québec. 2024. “Reservoirs.” Available at http://www.hydroquebec. com/comprendre/hydroelectricite/gestion-eau.html. Hydro-Québec. 2022. “Strategic Plan 2022-2026.” Page 9. Available at https://www.hydroquebec.com/data/documents-donnees/pdf/strategic-plan. pdf?v=2022-03-24.

Hydro-Québec. 2024. “Visit the Robert-Bourassa generating facility (La Grande-2).” 2024. Available at https://www.hydroquebec.com/facility-tours/ tours-general-public/robert-bourassa-baie-james.html.

Independent Electricity System Operator. 2024. “Transmission-Connected Generation.” Accessed 2024. Available at https://www.ieso.ca/en/ Power-Data/Supply-Overview/Transmission-Connected-Generation.

Independent Electricity System Operator. 2022. “2022 Annual Planning Outlook.” December 28, 2022. Available at https://www.ieso.ca/en/ Sector-Participants/Planning-and-Forecasting/Annual-Planning-Outlook.

Keeyask Hydropower Limited. 2024. “Keeysak Project Description.” Available at https://keeyask.com/the-project/project-descriptions/.

Kives, Bartley. 2023. “Confidential briefing note warns Manitoba Hydro can’t service new ‘energy intensive’ customers.” CBC News, September 29, 2023. Available at https://www.cbc.ca/news/canada/manitoba/ hydro-electricity-briefing-note-1.6981719.

Libman, Robert. 2023. “Robert Libman: Getting to win-win on Churchill Falls.” Montreal Gazette, February 24, 2023. Available at https://montrealgazette.com/ opinion/columnists/robert-libman-getting-to-win-win-on-churchill-falls.

Massachusetts Institute of Technology and Rhodium Group. 2023. Clean Investment Monitor. Available at https://www.cleaninvestmentmonitor.org/.

Ontario Power Generation. 2022. “Ontario Power Generation: 2022 Annual Report.” Available at https://www.opg.com/documents/2022-annual-report-pdf/.

Rabson, Mia. 2023. “Canada lays out plan to phase out sales of gas-powered cars, trucks by 2035.” CBC News, December 19, 2023. Available at https:// www.cbc.ca/news/politics/canada-electric-vehicles-2035-1.7063993.

Rabson, Mia. 2023. “Ottawa, two Atlantic premiers agree to ‘modified’ Atlantic Loop project.” CTV News, October 18, 2023. Available at https://atlantic. ctvnews.ca/ottawa-two-atlantic-premiers-agree-to-modified-atlantic-loopproject-1.6604456.

SaskPower. 2024. “Planning and Construction Projects.” Accessed 2024. Available at https://www.saskpower.com/Our-Power-Future/Infrastructure-Projects/ Construction-Projects/Planning-and-Construction-Projects.

SaskPower. 2024. “Planning for nuclear power, our progress and next steps.” Accessed 2024. Available at https://www.saskpower.com/Our-Power-Future/Infrastructure-Projects/Construction-Projects/Planning-and-Construction-Projects/ Planning-for-Nuclear-Power/Our-Progress-and-Next-Steps.

SaskPower. 2022. SMR Project Schedule, September 2022. Available at https:// www.saskpower.com/-/media/SaskPower/Our-Power-Future/ConstructionProjects/SMR/Infographic-SMR-Progress-Timeline.ashx.

Shakil, Ismail. 2024. “Aging Canadian nuclear plant near Toronto to get C$2 bln refurbishment.”

Reuters, January 30, 2024. Available at https://www.reuters.com/business/energy/ontario-announces-c2-bln-refurbishment-pickering-nuclear-plant-2024-01-30/.

Smellie, Sarah. 2023. “Ten years later, Muskrat Falls has left ‘deep wounds’ in Newfoundland and Labrador.” Globe and Mail, December 17, 2023. Available at https://www.theglobeandmail.com/canada/articleten-years-later-muskrat-falls-has-left-deep-wounds-in-newfoundland-and/.

Statistics Canada. 2024. “Canadian electricity imports from and exports to the United States.” January 10, 2024. Available at https://www150.statcan.gc.ca/ n1/daily-quotidien/240110/cg-c002-eng.htm.

United States Environmental Protection Agency. 2023. “Summary of Inflation Reduction Act provisions related to renewable energy.” October 25, 2023. Available at https://www.epa.gov/green-power-markets/summaryinflation-reduction-act-provisions-related-renewable-energy#:~:text=The%20 Inflation%20Reduction%20Act%20of,of%20new%20clean%20electricity%20resources.

Withers, Paul, 2023. “Nova Scotia government retreats on plan to fast-track wind farms in coastal bays.” CBC News, November 23, 2023. Available at https://www.cbc.ca/news/canada/nova-scotia/government-retreats-offshore-wind-bays-1.7036827.

World Nuclear News. 2023. “SMRs would provide economic boost to Ontario, says report.” October 23, 2023. Available at https://www.world-nuclear-news. org/Articles/SMRs-would-provide-economic-boost-to-Ontario,-says.