This article originally appeared in The Walrus on February 18, 2026. Below are two excerpts.

By Heather Exner-Pirot, February 18, 2026

The Defence Industrial Strategy appears when a specific concern is taking hold: Western dependence on China for critical minerals used in defence applications. The Russia–Ukraine war reminded everyone that defence industrial capacity is key to winning wars of attrition, harkening to former president Franklin D. Roosevelt’s concept of US industrial capacity in World War II being the “arsenal of democracy.” In the event of a protracted conflict with China, their superior capacity up and down the manufacturing supply chain would inevitably grant it the upper hand.

What’s more, China has a monopoly on some key materials and components needed for basic military equipment and has already shown its willingness to restrict exports of commodities in the wake of its tariff war with the United States. Such vulnerability is now seen as unacceptable and a matter of national security.

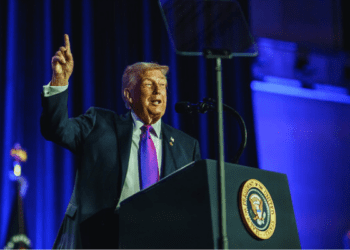

That’s why the Joe Biden administration began more aggressively investing in mines and refining capacity, something which continued under President Donald Trump. Seven projects have been funded in Canada, in commodities such as tungsten, bismuth, and cobalt. Interestingly, Canada matched these US Department of Defense investments through Natural Resources Canada (NRCan), not the Department of National Defence.

For its part, NATO released its priority list of critical minerals in December 2024. As a major resource producer and exporter, Canada has an obvious role to play in ensuring the alliance has some level of independence and sufficiency in raw-materials supply chains. The attraction of meeting some of Canada’s defence spending commitments through investments in mining and processing, which the NATO minerals list helps justify, has further spurred action.

The 2025 budget specifically earmarked $443 million towards the DIS to support the development of processing technologies, joint investments with allies in Canadian critical minerals projects, and the development of a critical minerals stockpiling mechanism.

The DIS does not go much further than what has already been announced but commits to publishing a strategy by the end of the second quarter for producing, processing, stockpiling, and procuring defence-related minerals. It specifically highlights Canadian capacity in aluminum, germanium, gallium, graphite, and tungsten, a good list drawn from NATO priority minerals that Canada could and should lead on. It also commits to helping the tariff-impacted sectors of aluminum and steel to pivot and retool to manufacture the products and grades needed by the defence sector.

The one wild card out of the DIS is a specific reference to developing Canada’s production of nitrocellulose (also known as guncotton), a key ingredient in artillery ammunition derived from forest products. China has been expanding its footprint in the sector, including by buying up Canadian forest-product producers. Keen and dedicated defence supply chain observers have blown the whistle on the dual use of such products, and it is gratifying to see the DIS respond.

This highlights one of Canada’s underutilized latent defence capabilities: the enormous prowess of its mineral, energy, and forest industries. In the event of a conflict that would necessitate a rapid ramp up of Western defence industrial capabilities, Canada is well placed to be an arsenal of democracy on the raw materials front. The DIS makes small steps to better position us for such an eventuality.

Heather Exner-Pirot is a Senior Fellow and Director of Energy, Natural Resources and Environment at the Macdonald-Laurier Institute.