This article originally appeared in The Hub.

By Jack Mintz, November 19, 2025

Listening to some commentators examining the fallout of the 2025 Budget, I am increasingly concerned that Finance Canada’s estimates of corporate tax competitiveness are being swallowed hook, line, and sinker without understanding the limitations of the analysis. The budget claims:

The productivity super-deduction will reduce Canada’s [marginal effective tax rate (METR)] by more than two percentage points, strengthening our competitiveness with the U.S. following measures implemented in the One Big Beautiful Bill Act (OBBBA). Moreover, Canada will have the lowest METR in the G7 and below the OECD average. This means that businesses can invest and scale more easily and that Canada will remain an attractive destination for investment.

As I explain below, we are not as “tax competitive” as we think. The estimates of tax competitiveness are typically biased downwards due to limited information. It also misses an important part of tax competitiveness. It is not just a matter of having a lower effective tax rate internationally, primarily in manufacturing in the Canadian case, but also the misallocation of capital based on economic rather than tax considerations that undermines productivity.

Back in 1984, I was asked to spend two years at the department of finance to guide the development of effective tax rate analysis that appeared in Finance Minister Michael Wilson’s May 1985 budget. The primary concern was with respect to distortions and instability of the corporate tax system that were leading to many companies investing in less profitable activities to reduce tax. In other words, the focus was on the non-neutrality of the corporate tax across business activities. The thrust of reforms was to lower corporate income tax rates and broaden tax bases by eliminating a general investment tax credit and an inventory allowance, as well as reducing accelerated write-offs. The first measures were adopted in the 1985 budget, followed by a second phase in 1987 in a comprehensive package of personal and corporate tax reform.

International tax competitiveness became an important issue when I became the chair of the Technical Committee on Business Taxation in 1996 to advise Finance Minister Paul Martin on corporate tax reform. At that time, Canada had one of the highest statutory tax rates among advanced countries, which not only discouraged investment but also led to base erosion as companies shifted profits out of Canada to other jurisdictions.

Despite earlier reform, many tax preferences remained, including those focused on manufacturing activities. The panel believed that the best response was to pursue “neutrality with internationally competitive tax rates” rather than try to have targeted tax reductions because the U.S. or some other country provided a tax break to a sector. This was akin to the principle of free trade and comparative advantage.

Beginning in 2000, both Liberal and Conservative governments followed through creating a distinctive tax advantage for investment by 2012, with a corporate tax rate of 26 percent that would be 13 points below the U.S. rate and 7 points below the average OECD rate. The general corporate income tax rate was lowered to the manufacturing tax rate, tax depreciation rates were more closely matched to economic depreciation rates, and some remaining investment tax credits were scaled back.

In the 1997 report, we also introduced a new concept by looking at tax competitiveness in terms of production costs rather than taxation of capital returns. Since taxes can increase the cost of doing business, it would be better to have a broader look at taxes on all inputs, like payroll taxes on labour and fuel, and carbon taxes on energy.

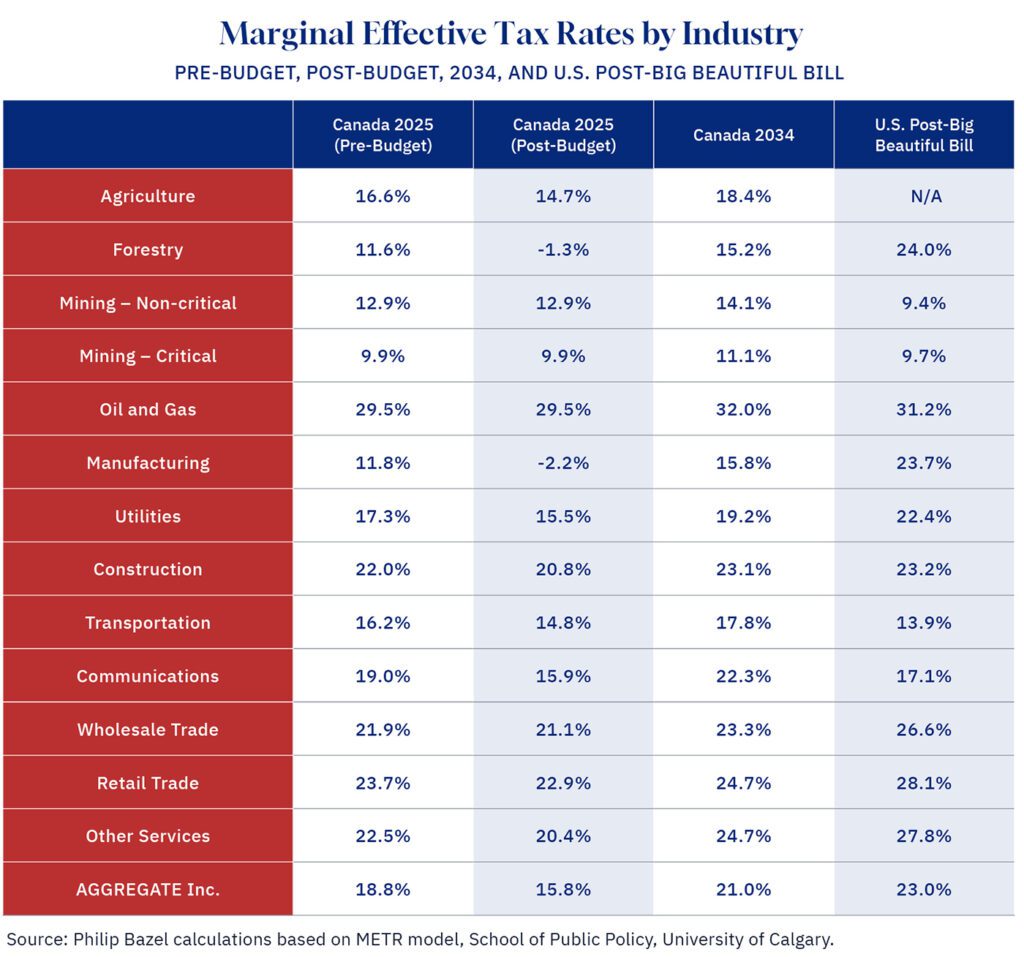

Since 2012, we have generally lost our tax advantages. Our federal-provincial corporate tax rate is now slightly above the U.S. and OECD corporate tax rates. In the Big Beautiful Bill, the U.S. has permanently renewed expensing of short-term capital instead of phasing out accelerated depreciation in Canada by 2034. The budget puts Canada in a more favourable position, but primarily with respect to manufacturing and forestry (the latter due to its lumber, pulp, and paper manufacturing activities). By 2034, when the preferences expire, Canada’s tax advantage largely disappears (some industries will be tax-disadvantaged, including mining, oil/gas, transportation, and communications).

Our tax competitiveness is increasingly non-neutral with the introduction of targeted preferences (see Table 1). We tax more heavily growing resource and service industries than manufacturing, which have been declining as a share of GDP for decades. The 2025 budget has introduced the Productivity Super-Deduction, focused on manufacturing and processing once again. When the super-deduction and accelerated depreciation expire by 2034, much of the corporate tax advantage for marginal investments will disappear except for manufacturing and forestry. Given that investment is a long-term decision, temporary incentives have less appeal to companies.

Further, the METR estimates in the 2025 budget need to be improved with better data and analysis.

- In recent years, economists have focused not only on marginal tax rates but also on the “average” tax rate (total taxes divided by investment or costs). The average rate is relevant to location decisions and intangible investment, with the statutory corporate tax rate playing a much bigger role in measuring tax competitiveness. If investment earns a pre-tax average return that is twice higher than the marginal return used in Table 1, the aggregate-average effective tax rate would be 21 percent instead of 16 percent due to our high statutory corporate income tax rate.

- While the 2025 budget analysis appropriately includes corporate income and sales taxes on capital inputs, it does not include property taxes, resource royalties, real estate and financial transaction levies, and carbon, fuel, and payroll taxes that impact cost competitiveness. Nor is the new global corporate minimum tax included in the analysis, which will claw back some of the incentives, especially for manufacturing. In an earlier paper, I estimated that the METR on capital will almost triple for large companies paying the minimum tax. Obviously, tax competitiveness would be significantly impacted if these taxes were included.

- The current competitiveness analysis reported in the 2025 budget leaves out some significant sectors of the economy. Banks and insurance companies are excluded, yet they are subject to a federal corporate income tax rate of 18 percent rather than 15 percent, as well as a minimum capital tax. While we include mining and oil/gas in our estimates, the 2025 budget does not, leading to an underestimate of the aggregate METR by almost two points.

Given these limitations, the budget underestimates effective tax rates paid by companies by excluding some important sectors (resource and finance) and taxes (e.g., property, carbon, and fuel taxes). In other words, we are not as tax competitive as we think.

Conclusion

We need to get back to the basics. It is not whether we tax one industry—manufacturing—less than elsewhere. Instead, tax competitiveness is harmed by a non-neutral tax system that results in a misallocation of capital and lower productivity. From the perspective of improving corporate tax competitiveness, Budget 2025 deserves an F grade.

Dr. Jack M. Mintz is the President’s Fellow of the School of Public Policy at the University of Calgary and Distinguished Fellow at the Macdonald-Laurier Institute.